Ethan: Hey everyone and welcome to the Startup Savant podcast. I’m your host Ethan and this is a show about the stories, challenges, and triumphs of fast-scaling startups and the founders who run them.

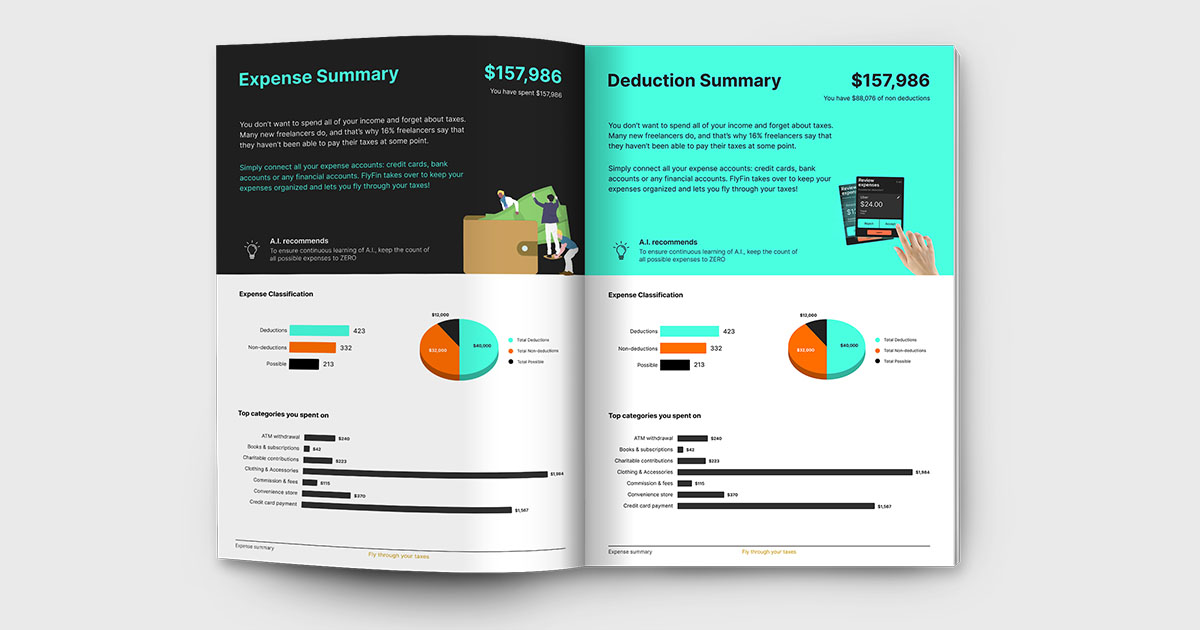

This week we are joined by serial entrepreneur, Jaideep Singh, whose most recent venture, FlyFin, uses AI and machine learning to help members of the gig economy to do their taxes.

We got into a bunch of cool stuff, including his process for brainstorming and testing startup ideas, learnings from the experience of founding three businesses, and last but not least, why there’s a pretty high chance that you’re paying too much in taxes. Like, a lot too much.

But, before we get into my conversation with Jaideep, make sure you’re subscribed to the show on whatever platform you’re listening from. We’ve got to feed the algorithm! And, for more startup content, visit us over at StartupSavant.com.

Now, let’s get to this interview with Jaideep of FlyFin.

Jaideep, welcome! How are you doing today?

Jaideep Singh: Doing great, thanks for asking.

Ethan: All right, let's get right into it. Can you tell us: what is FlyFin?

Jaideep Singh: FlyFin is the leading AI tax service that helps freelancers and self-employed people deal with their taxes. That's the simple explanation.

Ethan: That is a very simple explanation. Can you tell us a little bit about the problem that you're solving with FlyFin?

Jaideep Singh: Sure. Lots of us have simple tax returns because we have W-2 incomes and there is no complexity, don't own a home and stuff like that, especially when you're younger. It was pretty straightforward. I went on TurboTax, it took me 40 minutes, I was done. A huge segment of our population today is freelancing, or is independently employed or self-employed and, when you do that then, suddenly, the tax return becomes really complicated because what you are is a small business and you need to understand what your income is, what your expenses are, what your net income is, and then pay taxes on the net income, not the gross income. A lot of people don't know that, right? Even people like Uber drivers, people on TaskRabbit, freelance marketers, engineers, so on and so forth. There's 70 million people involved in our freelance economy today just in the US alone. Think about it, that's almost 40% of taxpayers.

I personally had this problem myself when we started. We all loathe taxes and hate taxes, there's nothing unique about that, but I realized that, more often than not, I end up filing an extension and not even dealing with taxes in April even if it costs me something extra just because I don't want to deal with that. I realized that the main problem was the two days that it takes me, a whole weekend, to pull down all my transactions from American Express, Capital One and B of A, then pull out my shoebox of receipts and try to put it together, all on a spreadsheet, to hand it off to my CPA in San Jose and have the privilege of paying her 1,500 bucks for filing the tax return.

As awesome as she is, I realized that, as an engineer, as a computer scientist, as a product person, as an entrepreneur, this problem is definitely a great AI ML problem, it can be automated and as much of it that can be automated would be a huge boon to taxpayers. As we started off, that was the pain point we were solving for. That's what made me realize that this is really an interesting problem to solve.

Ethan: It's a pain that I've definitely felt myself. When I started my business in 2016, I realized just how complicated taxes could get. Just like what you said, you go to the CPA and you get the privilege to pay them lots and lots of money to hopefully save you money and a lot of times, even that process is pretty opaque, so it's really cool that you're building this platform that's using AI and machine learning not only to simplify it for the user but to hopefully save people some money. Two questions real quick. Did you really have a shoebox of receipts?

Jaideep Singh: Yeah, because where else do you store them? I know it's a silly thing, but that's a nice, cheap big box.

Ethan: It sure is. That's where I keep all my shred, and it is way overfull right now, it’s in a shoebox. I'm going to have to get a boot box, I guess, and make it a little bigger. Other question is what percentage ... You said that there were ... did you say 70 million people in this contractor market? What percentage of those people do you think are filing their own taxes without using any sort of fancy software or going through a CPA, and are those people generally overpaying their tax bill?

Jaideep Singh: Last year, we did an internal study, and of the users that we were getting, or tax filers we were getting, we found that on average ... This is not a review of the whole market, this is a review of our customers. We found that on average, they were overpaying $3,700 per person, which is a lot of money. It was higher than what I had expected. That's not the industry average because of the 70 million, there's tens of millions of people, maybe 10 million people or so, who make very little freelance income, so it doesn't really change the equation for them. They're only making 500 bucks or 600 bucks, you don't have to report it. Above 600 bucks, you have to report it. They don't matter because it's really not a big problem for them. Then, there's maybe 10 million or so people who have their own CPAs. They're entrepreneurs. They're fully self-employed.

The 50 million people in between ... I think it's a really tough problem for them because many of them don't want to go to a CPA because it costs a lot of money, but do. Some of them try to file themselves, but they don't know what they're doing so they just take their total 1099 income, use that as their income and something like TurboTax [inaudible] and then they end up overpaying. I'm actually surprised by how many people actually blow off their taxes in this space also. Obviously, they'll get into trouble later. Many of them are younger, but once a problem becomes so acute, the mind tends to tune it out. That's the nutshell.

Ethan: I had ideological problems with taxes being taken out of my paychecks and then, once I moved into having that 1099, paying quarterly and writing those big honking checks to the government every quarter ... I think that there are people out there who get it into their mind that taxes suck, taxes are bad or I need to do ... I think this is actually a much worse one and I think there's some CPAs out there that are telling businesses to do this, but they're like, "Spend as much of that money as you can because you'll get to write it off of your taxes." I think that there are people who really truly don't understand write-offs, so they just go on a spending spree of just crap that they don't need.

If we all can do a bit of a rewiring of the brain and say, "The fact that you're paying taxes and the fact that you're paying more taxes means that you're creating more value. You're more successful, you are having more money come in, and that means you're doing the thing that you're supposed to be doing." Having that mindset change really helped me with the wanting to pay the taxes. I never got myself into any issues where I blew them off or anything like that, but hearing you say that there are tons and tons of people out there that are just not filing their taxes or are ignoring certain things, that's scary, and they can get themselves into a lot of trouble that lasts forever.

Jaideep Singh: Correct.

Ethan: Thank you for making this product that should hopefully help these people out and not get into serious, long-term tax issues.

Jaideep Singh: Let me actually ... I want to respond to one of the points you made about making more money. If you're paying more taxes, you're making more money. That is true for salaried people. However, there are some attractive things about being a freelancer, despite the pain of paying taxes five times a year or dealing with it five times a year, four for a quarter and one for your annual: the thing is that you can actually write off a lot of things. As a freelancer, I can write up this home office space that I'm talking from. I can write off the computer, the monitor, my iPhone, my AirPods, a lot of stuff. There's millions and millions of items that can potentially be written off. If you do it right and if you use a smart system that can help you do it all, like in our case, it only takes 5% of the effort that it would've taken you last year.

AI does two things. It solves a huge time thing because you link your accounts, it's going through all your statements and pulling out all the transactions. It does it really fast and you only have to deal with a small bit of it of reviewing which are the possible deductions. Secondly, because you're going through every expense, you don't leave a single penny on the table. There's no chance of you forgetting or those receipts in that shoebox turning ... where the ink fades and you can't even read it anymore a year later ... All that's out of the window. The flip side of this thing is, if you use a tool like FlyFin, you can save a lot of money and pay very little taxes. There are people making like 50-60K a year of self-employed income, of freelance income, paying almost no taxes. That's the chip.

Ethan: It's not dodging taxes. The way that the tax code is written is that there are certain benefits that you have if you are a small business or a freelancer, 1099, whatever. If you're paying a ton of taxes and not taking advantage of those programs or of those different situations, then it's not that you're being a better citizen, or that you're not dodging taxes or whatever, you're just literally not taking advantage of the lawful system that is laid out in front of you.

Let's get into a little bit about how FlyFin actually works. You touched on it a bit, having the AI crawl through your accounts, but tell us a little bit more about the process, from soup to nuts. What is the AI and machine learning actually doing and what is the process that the user will follow through when they're using FlyFin?

Jaideep Singh: It's actually really simple. There's only a few key steps in this whole thing and the whole process of using FlyFin. First of all, you connect your statements by linking your financial institutions. We do this through Plaid, which almost every American uses, so it's highly secure and it's just read-only information. We just get the transaction information, that's it, but by doing that, two things happen once you connect everything. A, we get all the transactions. B, you can take that shoebox of receipts and throw it in the garbage can. You don't need receipts anymore because that digital record is a receipt. There's no difference. Just by doing that one thing that takes a minute, you've saved yourself a ton of time.

Secondly, as I was explaining earlier, AI rummages through everything, we have a huge machine learning system that is learning across the population, but is also learning per user. What that system does is it takes out a whole bunch of expenses that are not really going to be possible deductions. It presents a large number of expenses to you that are possible deductions right out of the box, but it's organized and grouped them in very clever ways. For example, Netflix ... if you're an Uber driver, you can probably deduct Netflix because you're running it in your cab or in your car. Ethan, you here probably cannot deduct Netflix. Those kind of things. You can make one decision on 12 monthly expenses, it'll learn everything and you can deal with it. What normally takes people 15, 20 hours can be dealt with in 20 minutes of review. You link your statements, AI does a thing, then you review.

We're not just an AI only solution. AI has limits. The last bit is we have CPAs, we have an on staff CPA team that'll file the taxes for you. It's a team of tax preparers, enrolled agents with the IRS, CPAs that deal with the tax filing for you. It's up to you. You can pick a basic plan, where you download everything to a spreadsheet where you get IRS categorized deductions and you can take it to your favorite CPA or, if you're super savvy in taxes, file it yourself, or you can go with our standard plan, which includes the tax filing for federal and state. If you're a bit more sophisticated, where you have an LLC or an S corp, then you can take our premium plan as well.

These are very affordable. The basic plan's less than a hundred bucks, the tax filing plan with the CPA is just 200 bucks and the one with LLCs and S corps is just 350 bucks. It's a combination of really using technology to solve a problem that's real pain for you, but doing a high-quality job. That's using the best of humans and the best of technology married together in a solution, in a tax service.

Ethan: I use a software called Xero. It's just a basic accounting software. I have to manually go in and itemize every single transaction that goes through. I set myself some time, go through twice a month and itemize each transaction. I've built myself in some rules there but my guess, and I guess my question is, with this AI, is the AI taking over that part of the job? If I were using FlyFin, would I still need to go in and do anything manually?

Jaideep Singh: Yes, you would, because there's no way AI is going to know that the Starbucks you went to was for a business meeting or you were just grabbing a breakfast sausage and coffee.

Ethan: Well, hopefully, people are keeping their finances separate as well, because if you are paying all your personal bills out of your business account or vice versa, you're going to have a bad time. Don't do that.

Jaideep Singh: That's a great point. Some people have the discipline of doing it separately but what we've seen is even people who do it separately, it's all mixed. What ends up happening is a lot of people have these Amex cards for their business accounts. You go to a place and they say, "Sorry, we don't take Amex," so you're going to put it on your Visa card. You don't have a choice.

Sometimes, you just forget or you hit your credit limit, use different cards. If you have the discipline to do it separately, it's super, super fast. If you have it all mixed, and we assume it's mixed, your personal and your business expenses, you still have to do this review, but this is what I was talking about: AI will find as much as possible and keep learning over time.

The review you do is not a spreadsheet-type review, or a Xero- or a QuickBooks-type review, which is an accounting software. The system groups up cards in the UI in your mobile app. They're like Tinder cards. You can see a bunch of Uber expenses and you can just swipe accept, accept, accept, reject, or you can look at it in a list view form, which is more like a Xero-type implementation that you were talking about, But we find that people flip through these cards, it's super easy, it's fun to do and it's not that arduous because it's coming up really simply and you're only doing a subset of the whole thing. You don't have to go through every expense.

That's why it just flies by so quickly. We notice that people take years ... in this past tax season, we saw people did it with years' worth of expenses, with 2,500 to 3,000 expenses, transactions from different financial institutions, and they blew through it in 20, 25 minutes in terms of the review piece of it.

Ethan: That's quick.

Jaideep Singh: That was for once a year, and our system's ongoing. We send you a weekly emailer and a notification in the app. It just takes five seconds. You can see, "Is AI doing everything correctly? Then I don't need to do anything," accept all, or change a few things around because machines will always make some errors, especially in the absence of perfect information.

Ethan: If I use FlyFin throughout the year, is it strictly for taxes or is this something that's going to be able to spit out a P&L, profit and loss sheet, and a balance sheet as well? Maybe not a balance sheet because that's a little bit different, but does this create an up to date P&L?

Jaideep Singh: That's a great question. You're a sophisticated user and, if you use Xero, then you're expecting accounting software-type output. We don't do that yet. We are focusing mostly on the tax piece of it, the deductions and the filing, but one of the things we're going to be announcing soon, and I can talk about it now, is the income piece of it. That does create a P&L for you.

Ethan: Sweet.

Jaideep Singh: We are launching that. It's not so much to print out a P&L statement in a spreadsheet, it's more for you to review, view it and consume the information. We're very much a consumer application, not a B2B application. It's meant for people to make some actionable decisions and use it the least, not the most.

Ethan: Awesome. Cool. Let's talk a little bit about your entrepreneurial past. Before FlyFin you started two companies, Spock and seeDoc. Could you give us a little bit of primer on each of those companies?

Jaideep Singh: Sure. Spock was my first company as an entrepreneur. Just to give you maybe a 20-second backdrop, I am an engineer, I have a BS and MS and computer science and I've worked many years as an engineer and a product manager, but I'm also an MBA. I went to the University of Arizona in Tucson to study, but I also got my MBA at the Wharton School. Post that, did early-stage venture capital for a few years. I've got this experience of investing in early-stage companies and my first company actually was funded by the VC fund that I worked at.

That was a timeframe when Google had gone public and there was a lot of opportunity in the vertical search space. I realized that searching for people, a people search, was one of the largest categories of searches on Google. It was almost 25-30% at the time. We built a search engine to search for people and it was a hard technology problem because it was an AI NLP problem. I'm talking about the 2006, '07, '08 era, prior to when lots of tools were available for large-scale AI ML. It was a hard, large-scale problem. We hired one of the smartest teams in the industry in terms of PhDs in AI and ML and a strong engineering product team in a space where there were maybe 100 companies in that space.

We raised venture capital and we soon became the number one company in that space because, within under three years, we had indexed over a billion people off the Internet. We had the largest index of people and information indexed about people and, in that duration, we were up to 30, 35 million monthly unique visitors and growing fast. That was the first company that I started.

Ethan: That was Spock, correct?

Jaideep Singh: That was Spock.

Ethan: Got you.

Jaideep Singh: The reason we named it Spock was it was like that Star Trek character with pointy ears: it was half man, half machine. Just as an engineer, I've always believed that AI and ML can solve a lot of large-scale problems, but you always need that human intelligence to make things just right. That's why we named it Spock.

Ethan: Got you. That was Spock. Tell us just a little bit about seeDoc.

Jaideep Singh: seeDoc was a telemedicine company. Spock was a company that started in the Bay Area, seeDoc was a company I started in India. That was a telemedicine play, like Teladoc for India. The quality of medicine in India is not as pervasive as it is in the United States. There's fewer doctors per person and stuff like that. That's what that company aimed to achieve.

Ethan: Got you. These two companies you started were tele-doc and people search. Obviously, the different types of businesses will color the way you see things, but running multiple businesses in multiple different time frames in different locations and all that good stuff will teach you all sorts of different lessons about business, life and everything. Having these two experiences, what do you feel as though was the greatest impact of those two businesses on the way that you operate FlyFin?

Jaideep Singh: Well, I would say putting things in two buckets. One is just understanding what it takes to succeed to build a killer product. My background is software. Any software company, you need a really great software product to start with before you even have a chance but, in order to build this great software product, you need a great team. You cannot do it with just average people and with an average effort because every space is competitive. There's alternatives out there and, if a product doesn't work real well for people, they'll never come back and use it again and they'll never say anything good about it.

I would distill these two things down as our main takeaways about building a company and I would layer on a third thing, which I guess most people know, but it's still worth mentioning: in order to get from a great team to a great product to a great business, it takes a lot of hard work. You have to work harder than anyone else out there, as a team and as an individual. I think those are some of my learnings that are brought into FlyFin based on my prior experiences.

Ethan: All right, moving on from those last two businesses and how they helped you operate FlyFin, while you weren't running those two businesses in your way to FlyFin, you mentioned in the write-up that we did that you spent over a year vetting different business ideas. I really like to get into the process of what is the way that you validate business ideas? What's the mechanism that you run the idea through and see what comes out the other side?

Jaideep Singh: I think that's a great question. It took me two years to vet FlyFin. I really wanted to take my time and I did apply a very stringent process to it. This is my process. By the way, there is no right path. There are people who just had an idea, executed it and turned out to be great companies, but my process really has been to look at four or five things. First, is this a problem that I personally connect with? Do I feel the pain in a certain software area or any kind of service that could be changed with software? Friends give you ideas, people pitch you ideas because I've been a VC as well. If I don't really get it myself as much, cannot viscerally feel it, I'm not going to pick it, even if it sounds to be a great business opportunity. That's the number one thing is picking an idea, a pain point, that you understand and can associate with.

The second thing that I applied a lot of rigor on was, is this market really going to be big or not? That's what excites me. There's lots of businesses to be built. There are two-person businesses that work great, there's 20-person businesses that work great and then there's Googles, Facebooks and stuff like that. That's the thing that has always excited me. I spent a lot of rigor to figure out the actual market size. That's called a TAM. It's very easy to multiply two numbers, get a really big number and get excited about it, but that's usually incorrect. There's only usually a sliver of the market. For us right now, it's the freelancer market, it's not all of tax. That was the second filter that I applied and it takes, I think, a fair amount of research to figure out, what is that TAM?

The third thing that matters to me is more ... The first thing I talked about was a consumer problem, the second thing is a business problem. The third thing that's really important to me as an engineer is a technology problem that is not too easy to solve and not too hard. Spock, our first company, I think we tackled a problem that was really, really hard. One of my lessons was it was too hard a problem to solve. The company did well, we did fine and we did well and everything, but it was excruciating. Having said that, I don't want something too light, either. In picking FlyFin, I realized in doing this, we can build a lot of intellectual property and get the brightest people in the world to work on it to create that intellectual property. That's the third thing.

The fourth thing to me, and this is something I've learned just by doing, is to get investors and talking about them very early on in the process. If you think one, two and three are right but investors don't get it, as much as you may want to do it and it still may make a lot of sense, it'll be hard to raise capital. Without capital, you ain't going anywhere. Those are the four things that I looked at very carefully. That's my process. I do it in a spreadsheet. It's a kind of scuttlebutt, but not really. I'm pretty organized with my documentation, Google Docs, slides, spreadsheets and quantifying everything.

Ethan: I believe that. I believe you're a pretty organized guy. Go ahead.

Jaideep Singh: Once you do that, then what ends up happening is never clear-cut. There's a few ideas. Which one do you pick? That ... it never comes out of a spreadsheet ever. It's an emotional decision. You want to buy a high-performance car that corners really well, you build a whole spreadsheet in terms of what's the best car, you go with your girlfriend and she says, "Hey, why don't you buy this red car, because that's cool?" You end up buying the red car, which had nothing to do with your spreadsheet.

Ethan: That's the girlfriend rule.

Jaideep Singh: Most decisions tend to be emotional at the end of the day, not just logical, but I think having a combination of that analytics and then going with your gut feel, which is what I'm putting in the emotional bucket, is how you'll arrive at the right decision.

Ethan: That actually leads to an interesting question: have you had business ideas that have been marked yes in all of those four areas but that you just didn't feel, that just had some sort of internal feeling where you're like, "I just don't think that that's the one"?

Jaideep Singh: Yes, and I've had that multiple times. Most recently, a year before starting FlyFin, I had a term sheet for an idea from an investor who loved the idea and had my advisors who loved the idea. It made logical sense in the spreadsheet but, at the end of the day, I didn't pull the trigger. It just didn't feel right. I didn't want to spend the next few years doing this to find out that ... and I wasn't that excited when I started. That does happen.

Ethan: Well, I think that shows a lot of knowing yourself, a lot of self-introspection but also, it shows patience because there are people who are like, "I need to do a business, I need to do something. I need to do something because I'm sick of what I am doing," or "I just have all this creative or entrepreneurial energy that I just need to put somewhere," but being able to really just take a step back and say, "Is this the thing? Is there something that's eating at the corners of this idea that, if I ignore it, is going to start to eat at my corners in a year, two years, whatever?" Good on you for being able to just hold off until the right thing came around. I think that's super important.

Jaideep Singh: I think it's a function of your personality and also experience. Perhaps earlier in my career I would've gone for it because that would've been the easiest path to take.

Ethan: I think that, if you are a person who can find the best in any situation or at least find positives in most situations, you can take those things, you can do them, learn from them and take the win as the learnings. Even if the business doesn't work out, then that's still fine. You still got one rep and you can move on to number two. Number two’s gonna be: you're going to come at it with a whole different perspective than number one. That's super awesome advice.

I want to move into the first users, the first 100 users that FlyFin got on board. One of the ways that you mentioned that you got these users in the write-up was that you picked up the phone and you called people.

When I ran an insurance agency way back in the day, that was the idea that I had. They got you hyped up. "You're going to get on the phone, you're just going to sell, sell, sell," and you're like, "Yeah, I'm going to get on the phone, I'm going to sell things. This is the best." Then, you sit down on that first day, you pick up your receiver, you put your finger near the buttons and you're like, "Who am I calling?" So, let me ask you that. Who were you calling and where did you find them?

Jaideep Singh: You go for the lowest-hanging fruit, your buddies. You first call your buddies.

Ethan: All right.

Jaideep Singh: Soon, you find out that you run out of them. Then, you go to your classmates from different institutions, whether it's high school, college or wherever, or coworkers where you may have worked before. That's a good way to do it because they'll pick up the phone. I think the beautiful thing about the stage of the development of the internet today is you don't need to do that. You don't need to be Glengarry Glen Ross cold calling people. There are great platforms like user interviews and just other platforms like that, where you pay someone 50 bucks, 100 bucks and you pay the platform.

These are people who have opted in to be interviewed. They put their profession, what they do and everything. You have a platform where you can reach out and talk to people. We used all our different channels. It wasn't just me, it was a team of people. We all did it. The engineers did it, the product managers did it, I did it, my co-founder, Sachin, did it. We all hustled. It was important to inject that hustle at the beginning in everyone because that's what it takes to get ahead.

Ethan: What was that platform that you used?

Jaideep Singh: User Interviews. It's called User Interviews.

Ethan: User Interviews. Cool.

Jaideep Singh: That's a great platform.

Ethan: Awesome. Sorry, I didn't mean to interrupt you, I just wanted to grab that real quick.

Jaideep Singh: That's how we got to over 100. I think we probably got to 150, 200 people like that, over many, many months. It wasn't just conversations. We actually did our designs of the application in Figma. It was just ... think of it as a Photoshop type of design. Made it interactive, put it in front of people and said, "Go to your phone, we'll send you the link on your phone, open it up." It looked like an app, they would click next and you could see where they're getting confused, where the delight points so, even though they can't say it, you could see when someone's nodding, not asking questions, they're getting it. That's how we got feedback and got the ideas of how to make this application interesting. The AI is a completely different technology set, but it's subservient to the consumer application.

Ethan: You used Figma to build, basically, a working mock-up that users could actually touch, feel, and operate through. Is that something that's pretty easy to set up? Maybe that's a question that's difficult to answer because everyone's different skill level, but do you think that a person who ... they know what apps look like and they're building a new thing but they don't necessarily have money to go and hire out a designer or a back-end team. Do you think that this Figma is something that they could figure out to build out a working model?

Jaideep Singh: Yes, it totally is doable and, if you can't do it, you should not build that product. You're not qualified.

Ethan: Hey, that's awesome advice because, when you get into it, there's a lot of thinking about… you have this picture in your head and then, when you go down to actually sit and sketch it out… Back when I was doing it, I didn't know about Figma, so I was doing it on note cards and writing out on paper, but I like Figma better because you can actually press buttons. Is cold calling still the way that you're getting a majority of your new users or have you moved into new-

Jaideep Singh: No.

Ethan: Tell us how you're getting people now.

Jaideep Singh: That was just to refine the idea, really, and build the first prototype of our application.

Ethan: That wasn't really user acquisition, it was more validation.

Jaideep Singh: Research, correct.

Ethan: Got you.

Jaideep Singh: It turned out that a bunch of those people actually ended up becoming users because we built a rapport with them. Many of them were just straightforward. They're like, "I'll never use this. I don't want to do anything myself. I make enough money, I'll pay three grand to a CPA, so go away." That's fine, too. That was very useful to know also in terms of what's the limits to the market.

Ethan: Well, I like that Trojan horse method of, "Hey, we want to get your opinion on this," you're paying them 50 bucks or whatever, but then they end up becoming customers and you've essentially doubled the investment or doubled your return on the investment because you've gotten their feedback but you're also getting a customer. Heck yeah, do that.

Jaideep Singh: Correct. So yeah, to answer your question, no, that's not how we're growing right now. We're using all the digital channels available to grow a company, but I'm going to point out one thing that's very relevant but may be useful to other entrepreneurs: one of the things we realize is that there is no strong community for freelancer finances and certainly taxes. One of the things, if you go to Instagram and search for FlyFin, you'll find a community approaching 50,000 people where people talk about the tax problems they have, other people answer. FlyFin ends up answering a lot of those questions, we ask our CPAs to go answer those questions.

There's so much interesting stuff in the tax realm. There's someone who's a content creator who just posted that she wrote off her honeymoon to ... I forget which place, I think it was Hawaii or something like that, partly because she was broadcasting it as a content creator. If that's what you're doing then that's your job. It was primarily her job. Then, that is a legit write-off. Not everyone can do that. There's all these interesting situations and people need help. CPAs will only give you one type of help. Learning from other people in the community is a very powerful thing, but that also turns out to be a good customer acquisition tool.

Ethan: We've got one more question for you before you get out of here. What is the one piece of advice that you would give to early-stage entrepreneurs?

Jaideep Singh: I think the one piece of advice I'd give is make sure you have the right personality fit for entrepreneurship. I tend to be a pretty optimistic and positive person, and I didn't even know that about myself when I started. I was, I think, pretty dumb when I started but, as I have worked for many years as an entrepreneur and helped other entrepreneurs get started, I find that it's not just IQ and hard work. Those are less important. They're very important, but what's most important is you're going to go through a lot of knocks and you wake up every morning saying, "No problem and I'm going to do it again." Eventually, you'll start knocking down those dominoes, but you're going to take a lot of hits. These are emotional hits. Some people just can't sleep, can't deal with stress or unknowns. If you're super smart and have struggled with that stuff, do not be an entrepreneur. Not at all. That's the main piece of advice I'd give.

Ethan: Resilience, some important stuff. All right. Thank you so much. This has been a lot of fun. One quick more question before you run: where can people connect with you online and how can our listeners support FlyFin?

Jaideep Singh: Well, there's multiple avenues. They can connect with me on LinkedIn, but you just type Jaideep Singh and FlyFin, and I'm right there. Of course, if they're freelancing and there's a product for them, they should certainly use the product. The best place to connect with the company is on our Instagram profile. Just type FlyFin on Instagram and you'll see it. There's tons of great content, tons of ways to participate and engage.

Ethan: Awesome. Cool. Jaideep, this has been a lot of fun. We're going to put all of those links and everything else in the show notes, and hopefully everybody had as good of a time as I had. This has been a ton of fun. Thank you.

Jaideep Singh: Thanks, Ethan. That was a lot of fun for me, too. You're a smart guy and you ask great questions.

Ethan: Aw, don't butter me up too much.

Jaideep Singh: No, no, no. I do a bunch of interviews, too. It's fun when the host is fun.

Ethan: Sweet. Alright, that’s going to be it for this week’s episode of the Startup Savant podcast and we want to know what you thought! Drop us a line on LinkedIn or YouTube, and leave us a review on Apple Podcasts. It really helps us to grow the show.

Thanks for listening, y’all! We’ll see you next week - same time, same place!