FlyFin Aims to Make Tax Prep Easier for Freelancers With AI

The Origin Story of FlyFin

Last Updated: By TRUiC Team

Freelancing is an increasingly popular career choice, with about 70 million freelancers and counting just in the US. Almost any freelancer will tell you they love the flexibility, including working from home. Most of them will also say they hate preparing their taxes. Jaideep Singh’s startup FlyFin provides freelancers with artificial intelligence (AI)-based software that simplifies tax prep.

This is FlyFin’s origin story.

Saving Freelancers Time and Money

Jaideep points out that preparing taxes can be hard on freelancers because their returns are usually much more involved than filing a simple W-2-based return.

“Lots of us have simple tax returns because we have W-2 incomes, and there is no complexity,” he says. However, “a huge segment of our population today is freelancing, independently employed or self-employed … Suddenly the tax return becomes really complicated because what you are is a small business, and you need to understand what your income is, what your expenses are, what your net income is, and then pay taxes on the net income, not the gross income. A lot of people don't know that.”

Even if you’re a tax guru, filing a return as a freelancer can take an inordinate amount of time. “I personally had this problem myself when we started,” he says. “I realized that, more often than not, I ended up filing an extension and not even dealing with taxes in April, even if it cost me something extra just because I didn’t want to deal with that. I realized that the main problem was the two days that it takes me, a whole weekend, to pull down all my transactions… then pull out my shoebox of receipts and try to put it together, all on a spreadsheet, to hand it off to my CPA in San Jose and have the privilege of paying her 1,500 bucks for filing the tax return.”

FlyFin’s AI Software to the Rescue

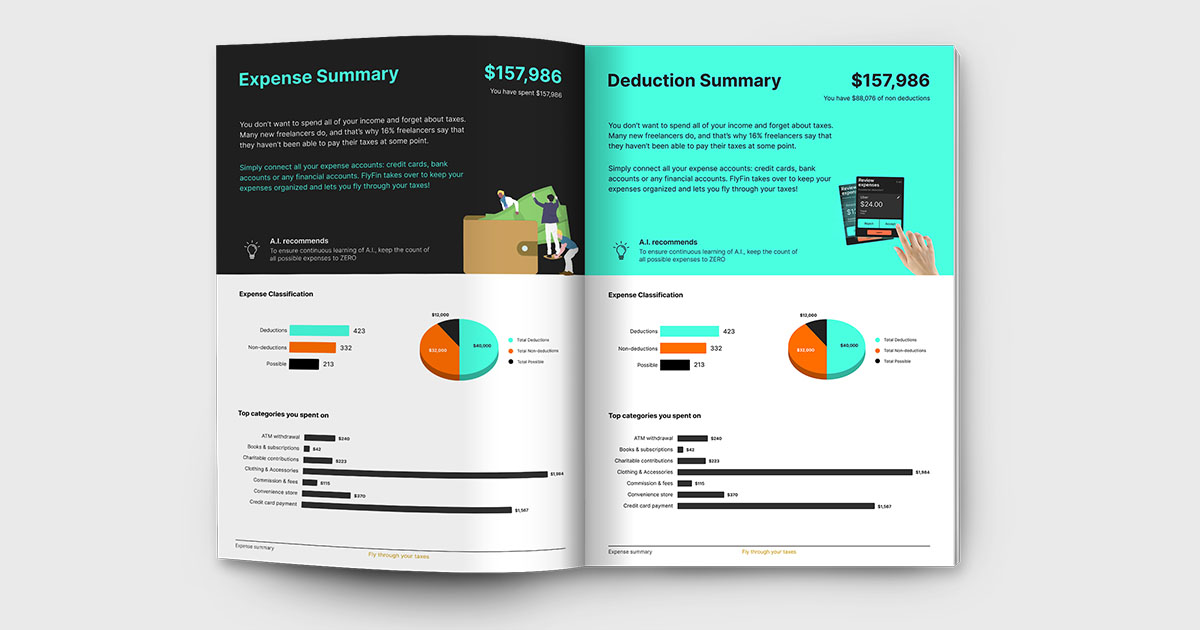

Given recent advances in AI, Jaideep realized that a software solution could automate much of this work. FlyFin’s software securely connects to freelancers’ financial institutions, automatically collects work-related transaction data, and even determines all of the expenses that might be deductible. This saves a lot of time and results in more accurate returns. FlyFin will “learn everything and you can deal with it,” he says. “What normally takes people 15, 20 hours can be dealt with in 20 minutes of review.”

That said, an actual human still needs to file your return. “You can pick a basic plan where you download everything to a spreadsheet [and] get IRS-categorized deductions, and you can take it to your favorite CPA,” Jaideep said. You also can file yourself, or you can have a certified FlyFin tax preparer do it for the relatively low price of $350 for LLCs and S corps. “It's a combination of really using technology to solve a problem that's real pain for you, but doing a high-quality job,” he said. “That's using the best of humans and the best of technology married together in a solution, in a tax service.”

Making Sure You’re a Good Fit

If Jaideep has one piece of advice for early-stage entrepreneurs, it’s to make sure they’re a good fit personality-wise. Not everyone is cut out to work long hours for months or years on end with zero job security and little to no income. That takes a lot of confidence in yourself, as well as a healthy dose of optimism.

“I tend to be a pretty optimistic and positive person, and I didn't even know that about myself when I started,” he said. “I was, I think, pretty dumb when I started. But as I have worked for many years as an entrepreneur and helped other entrepreneurs get started, I find that it's not just IQ and hard work. Those are less important. They're very important, but what's most important is you're going to go through a lot of knocks, and you wake up every morning saying, ‘No problem … I'm going to do it again.’ Eventually, you'll start knocking down those dominoes, but you're going to take a lot of hits. These are emotional hits. Some people just can't sleep, can't deal with stress or unknowns. If you're super smart and have struggled with that stuff, do not be an entrepreneur.”

Tell Us Your Startup Story

Are you a startup founder and want to share your entrepreneurial journey withh our readers? Click below to contact us today!