Summary of Episode

#14: Frida Leibowitz and Rachel Lauren join Annaka and Ethan to discuss their startup Debbie, a company working to combat debt cycles by helping borrowers transition to wealth builders. Frida and Rachel walk us through their personal stories dealing with debt, the process of using current psychological research to model product designs, the transition from a side project to a full-time company, and how they leveraged their network to fundraise a $1.2 million pre-seed round.

About the Guests:

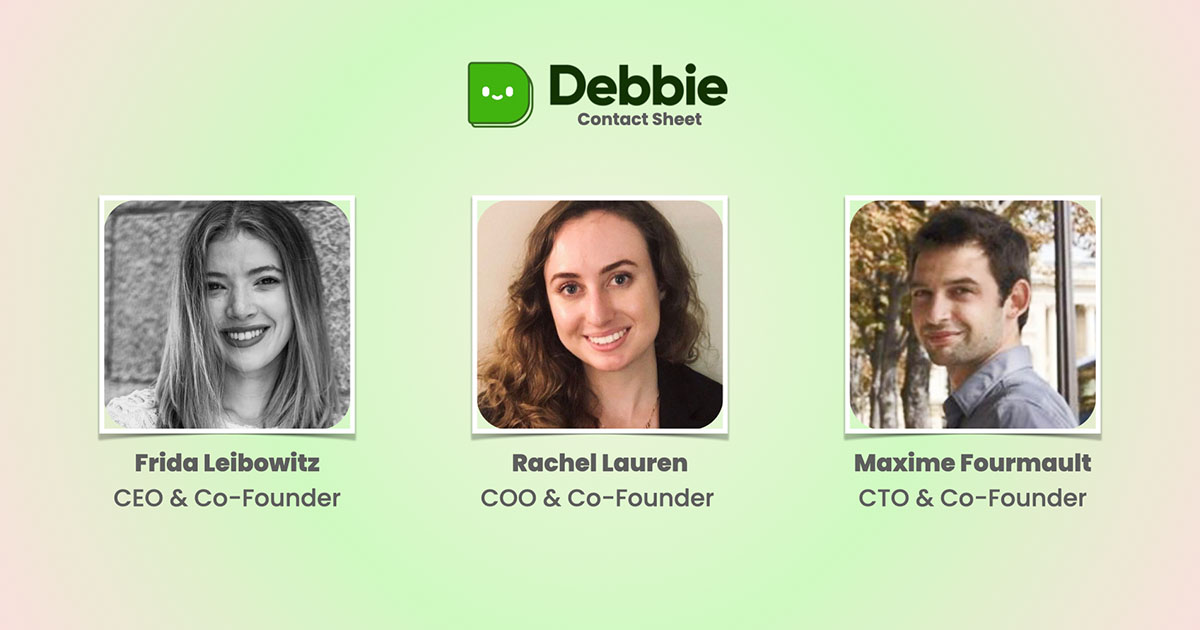

Frida Leibowitz and Rachel Lauren are the founders of Debbie, a platform working to help users create a path towards debt freedom. Frida previously worked in credit risk and product development at Marcus by Goldman Sachs. Rachel formerly worked as a VC at BDMI. Both thought there needed to be better systems in place to help educate consumers about their debt and how to pay off debt. Together, along with their third cofounder Maxime, they have created an entirely remote team striving to fix the debt cycle that plagues far too many people.

Podcast Episode Notes

The American debt cycle affects 40% of families [1:35]

Frida’s experience navigating debt and finding a path towards debt freedom [3:20]

Analyzing the debt payoff market and creating new ways to combat a recurring problem [6:10]

Prioritizing consumers rather than spreadsheet models — we do not always make rational financial choices [9:15]

Observe first then combine observations with your personal experience to get going [13:04]

Focusing on carrots not sticks — how Debbie leverages research in psychology and behavior change to make informed business decisions and product designs backed by data [19:15]

The booming tech scene in Miami [22:45]

Working with a team across the world and creating an identity as an all-remote company [27:10]

Focus on the problem not the solution. If you are enthusiastic about the problem, you can be open to see various ways to tackle it [32:03]

“Find the message that works,” Rachel’s advice for growing from 0 users to 11,000+ [36:20]

Who is Debbie? [41:05]

Building a founding team with a balanced skillset [43:38]

A methodical approach to building an initial concept for Debbie and making the jump from a standard job to working full time at Debbie [50:50]

Raising a $1.2 million pre-seed round of funding and using your own network to win additional support [56:05]

Building a better product to scale Debbie and continue to grow the customer base [1:00:55]

Rachel’s advice for entrepreneurs is to find a great cofounder [1:03:05]

Frida’s advice — “Would you still be doing what you are doing if you were anonymous and got no credit?” Nobody really knows what you are doing, so you need to love it. [1:04:38]

Full Interview Transcript

Annaka: Hello everyone and welcome to Startup Savants. I'm Annaka.

Ethan: And I'm Ethan.

Annaka: If you're a returning listener, welcome back and if you’re new this podcast is about the stories behind startups, the founders who run them and the problems they're solving. Today our guests are Rachel and Frida. Two of the co-founders of Debbie, a FinTech startup on a mission to create a reward based debt repayment platform. Hey guys, thanks for coming on the show. How's it going?

Frida Leibowitz: It's going great. We're really happy to be here. Thank you for having us.

Annaka: Of course. We're very excited. Rachel, how are you doing?

Rachel Lauren: Doing all right. Doing all right.

Annaka: All right. Perfect. Perfect. Perfect.

Rachel Lauren: Can you tell we're neck deep in product development?

Ethan: Oh yeah. All right. Jumping right in. Tell us a little bit about the story behind Debbie, its mission, and how you got started.

Frida Leibowitz: Sure. I can get started on that. As all good founding stories go, this one came directly from personal struggle. For me, that was a theme in my childhood ever since I could remember myself. I grew up in a family that was immigrant, non-college educated, single parent, and that was a perfect recipe for having very little access to financial literacy and falling pretty deep into the American debt cycle that actually affects about 40% of American families.

The reason why I call this American is because I think in the US, there's actually a lot more access to credit than most other places in the world. And while that could be a wonderful thing, it can also really hurt consumers who don't understand how to take on the right kind of debt, how much debt really costs, and all those things, right? So, if every time you walk into Walmart and you're offered 20% off to get the credit card it can be very harmful to consumers who don't understand what that means, what it means to put everything on credit cards.

So, that was my family's story growing up. Always sort of in and out of the debt cycle, paying really, really high costs for basic items like cars, anything needed to sort of sustain a normal life. And because of that we were really barred from financial security. And it's interesting because for me as an adult, even though I was super lucky, I ended up getting a scholarship to go to NYU with Rachel and I watched study finance out of all things. Personal finance was still not something that was talked about outside of the house.

So I was able to build DCF models and banking and do all these things, but I had no idea that I had to pay my statement balance in full at the end of the month. In my family if you paid more than the minimum you were doing amazing, right? And so, I ended up racking up $15,000 in credit card debt by the time I was 20 years old, an average interest of 25% and I was really just drowning in interest at that point. I was a student working a part-time job of making maybe 25k to 30k a year and paying $4,000 in interest.

That's just interest without even dipping into the principal at all. And so at that point, I approached the sort of debt freedom market for the first time as a borrower and I was trying to figure out what solutions exist out of here? How do I get myself out of this situation? And I tried a whole bunch of things. I tried to do balance transfers and a whole bunch of little sort of fixes. And then I ended up going through with debt consolidation. So, that's also very well known as the personal loan market and I think personally did a very good job of targeting me. I started getting all these emails from credit card mail, direct mail telling me, "Hey, you are the perfect candidate for this debt consolidation product. We're going to give you this loan. You're going to pay off all of your credit cards and then you're going to just pay these fixed, very manageable monthly payments for three years, and most importantly, we're going to reduce your APR by half." Right. And that was an amazing pitch to me as a consumer. I was like, "This is wonderful. This is going to really set me on a path to freedom."

And I ended up taking out one of these loans with Lending Club, which was one of the pioneers in the space and I had a really great initial experience. I think everything leading up to origination was really smooth, entirely digital and I've talked to us so eliminated a lot of the shame, really eliminated a lot of the stigma around it. And so, I really loved that experience. And then, shortly after I had that experience, I actually ended up joining Marcus to work on their personal product because I was super excited about it and I thought this product had a lot of potential and I really wanted to go build that. And I think really after going through my own debt consolidation journey and also at the same time sitting in the lender seat, I got to see where the shortcomings of not just this specific product, but just the debt freedom market in general and that really expressed itself in sort of two ways. One, I got to see that more than half of the borrowers were going back into credit card debt within less than a year. So, the success rates were super low for the debt products, and two, the borrowers who were improving, who were getting better, they were having a super hard time getting better treatment from the institutions that they were dealing with.

And so, they just started hopping around and constantly trying to find new rates, new solutions, other things. And yeah, that was really the backstory for Debbie. And that's when I started venting to Rachel who was and still is my roommate. So, we were just sitting together during COVID in our little New York City apartment and I would just mentor her all day about the things that I was seeing, my experience, my family's experience and that's how we started talking about Debbie. Hope I answered all of your questions.

Ethan: Absolutely. Yeah. So, you guys are roommates?

Frida Leibowitz: We are. We are roommates. We've been roommates. Funny we just had to fill out one of our applications for a state lending license and Rachel just copy pasted our address history. She's like, "Oh, there we go." We've been roommates for a while.

Ethan: So Rachel, do you feel she summed up that history pretty well?

Rachel Lauren: I think she summed up the history pretty well. There's more to it though I think in terms of how we started thinking about why Debbie and why us and what does that solution actually look like? And I think that kind of comes from my background. So, I spent the last couple years working in venture capital at BDMI, which is a corporate venture fund, which is fairly generalist, but I was focused more so on FinTech and software. And so, seeing a lot of consumer FinTech across my desk and it's a very, very saturated market. It's very hard to kind of stand out. And when we looked at the debt payoff market specifically, we tried to understand why is this a problem that hasn't been solved yet? And what are the different approaches that people have taken to try to solve it? And we saw one of two. One was throwing a bunch of cash at the problem, which is what sort of the personal lending industry has done. You see that cash advance is doing this now.

It's sort of blowing up. Here are the 300, $400 spot. The problem with that is obviously just cash alone is not really going to solve that habit problem if it is spending related. And so that sort of ties back to what Frida said, what she saw inside Marcus and in the industry as a whole. On the other hand, in terms of the other approaches, we're starting to see companies that are sort of offering this what we call the fancy-schmancy algorithm that's going to determine the best, fastest, cheapest way for you to pay off your credit cards.

So, you plug in all your credit and it kind of automatically kind of decides how to pay it off for you. Now, the issue with that is sort of the same thing. Right. It's making your life easier, but at the same time it's not stopping you or incentivizing you from not spending on your credit cards more. In fact, it's in their best interest for you to continue to spend on your credit cards because then you will continue to need their product. And so, neither approach really targets the underlying root cause of why folks get into credit card debt or spending related debt in the first place. And that's when we realized we needed to take an entirely different approach to the problem that was more sort of incentives focused, more rewards focused. And so that's why we decided to build the rewards platform for debt payoff. We take a Noom style approach. We look to the weight loss industry as a really good example of a place where people maybe have high motivation when they kind of see that trigger of, "Oh, I want to lose weight."

But then they'll rebound after trying a bajillion diets, the same thing happens in the debt payoff and sort of financial wellness space. People will have that high hit of motivation. They'll maybe kind of go out on what we call a financial diet, they'll cut their spending that's not sustainable and they'll sort of bounce back into debt. And so we want to take a Noom approach. We think they've done an amazing job in the weight loss space to actually enact long term sustainable behavioral change. We want to do the same thing for debt payoff.

Ethan: Got you. So, in that story, I heard a lot of words like freedom, journey, shame, habits, what I didn't hear a lot of was spreadsheet and numbers and that sort of thing. So, is it safe to say that you're really taking a more personable approach to solving this issue than to just find the right numbers for somebody that they can slot into?

Frida Leibowitz: Yeah. I'm very happy you said that because that was actually one of our intentions. We like to think of ourselves as a consumer product first, financial product second, because of exactly that thing. And I think one of the things that underlying everything that Rachel was describing, right, what we see today in the FinTech space is a very spreadsheet approach. The issue with that is that completely different guards, all the emotions and all of the human element really in it, right?

And as humans, we're not necessarily rational. We don't necessarily make decisions that are best for us all the time. Everything, especially in the debt space and when it comes to our finances, most of it is driven by emotion. And so, we really decided to focus on that. And the way, again, going back to the weight loss space, I think the reason why Noom did so well is because they speak to that, right? They speak to why we formed the habits that we do and going back to the root causes of it, right? Not just explaining to you, "Oh, this is how much calories a cookie has and that's why you shouldn't eat it." Right. So that's kind, yeah.

Ethan: Yeah. They're very focused on behavior change.

Rachel Lauren: Yeah. I want to build on top of that also and say, I think the reason why most FinTechs or just financial companies in the past have been so kind of numbers focused, because most of the people that have been building these products have never been on the other side of the aisle. Right. They've never actually experienced what life is like for the whatever percentage of people that are in debt. And so, I think that's what makes our story so strong as well is that we have experienced that. We do know what it feels like. And so we understand kind of the journey that folks go through when it comes to debt payoff. And I think our users understand that too. I think that resonates a lot with them.

Ethan: Got you. So, you've mentioned Noom a couple of times. Are they really kind of the model that you're going after or what other kinds of research did you do? How did you find this model and how did you really work to develop this direction to the solution?

Frida Leibowitz: Yeah. I think it started kind of very basic. At the very beginning when I started seeing my own personal experience, the issues that I was facing and the things that I was seeing in the industry, we just decided to talk to other people and see if they had the same issue or what other issues they had. And so, we really started by joining a ton of Facebook communities, Instagram communities, a little bit on TikTok, right. That kind of formed that a lot of them blew up over COVID actually.

Frida Leibowitz: And so there were a lot of communities that were forming around financial wellness, debt payoff, all these things. And people started sharing their stories, talking about it to each other, trying to get help. People are creating Instagram accounts just to track their debt payoff journey. So they'll post every single month like "Here's my current debt. Here's what I'm at. Here's what my goals are for the month." They're like "Oh." They'll post "I slipped up." And then they'll just start to get that support. So, we really ingrained ourselves in those communities.

And we listened first. We didn't come with any solutions. We had some ideas obviously in the back of our head, but we tried to keep as much of that to ourselves and just really understand what are people going through? We also ended up running a series of support groups via Zoom also during the pandemic, which was really good, because people were home and so they had more time for us. And we let that be very natural. We kind of let it go how it went. We participated as participants strictly, not as moderators or anything like that. For every question that we asked, everybody answered, including us. We had it like that. We even had one that was led by a certified financial planner.

And again, the idea was to first be a fly on the wall and really observe. And I think that's what led us to where we got to and the weight loss analogy actually, that just came pretty naturally. I don't remember when it was the first time that we had it, but at some point someone weighed an analogy or one of us saw it and it clicked. And since then, it's actually interesting to see that so many times when we have conversations, we don't even mention it and somebody else will. They'll be like "This sounds exactly like the weight loss process." So yeah. I don't know if you have anything else to add, Rachel.

Rachel Lauren: Yeah. I think what we sort of realized initially when we started the business, we tried to think about how do we reward the people who self-select as better users? We want to help the people who are sort of on the margins, who want to change, but maybe struggle, but we felt maybe we didn't have the skills or the enough knowledge to really enact behavioral change. And that was the thing that investors were like "You're never going to change people. People are who they are and they will never be different." But at the same time we realize the biggest issue is what Frida mentioned, what she pointed out, is that rebound phenomenon. Right.

Of people that have the motivation, that have the intent, but at the end of the day, there's something that stands in their way, whether that's an unexpected expense or just the habits that they've formed over the years. And so, when we looked around to see which companies have actually been able to solve that problem, Noom was really just the one that stood out and to the point where I was on LinkedIn every day trying to find someone from Noom in a product capacity to help us, which eventually we found the director of product and growth at Noom is an advisor of ours and has a PhD in psychology. He's been amazing, Shane Blackman, but he's been helping us build the product and the curriculum and that's been a crazy unlock for us.

Annaka: And looking at kind of user and consumer psychology, I'm almost in disbelief that we're just now getting to this point where studying consumer behavior is influencing business practice and it's like "Wait, why haven't we done this yet?" But, going back to those support groups because I'm a support group junkie. I love them. What impact did that really have not only on the users, but on your business going forward from here?

Frida Leibowitz: Yeah. It's interesting. We came into it with very little expectations of ourselves, of anybody when we kind of was a very chill thing. We're just like "Let's just get together and talk about life and get support from each other." I think for the users, it was some sort of accountability. Definitely the feeling. One of the other important things is feeling like other people are also in the same boat. Like we said, there's a lot of shame associated with debt and people have a really hard time talking about it. Even for myself, it's actually interesting, most of my friends at NYU had no idea that I was in this kind of debt, even when I was already working at Goldman. And I was still in debt, so I was paying it off, most people that I work with had no idea because I was really embarrassed to talk about it. And people are looking for ways to first identify, okay, other people are like me and then they feel comfortable talking. Once they know, okay, this is a safe space, everyone else understands where I'm at and aren't going to judge me for being in this place.

So, I think that was a huge benefit to the users. And what it helped us do is as soon as you create a safe space like that, people feel comfortable really telling you what's going on. Really telling you why they struggled and what can help them most and they're just more honest and that's really what we wanted. We wanted people's honesty. And like Rachel mentioned before, I think the fact that we were built for borrowers by borrowers and that we ourselves have experienced this issue also helps us here, it helps users open up to us in a different way. So I think that part was super strong for us.

Rachel Lauren: Yeah. I think definitely it helped us kind of hone in on some messaging around sort of normalizing talking about debt and sort of financial wellness and health. I think there's been a big movement around mental health that hasn't really trickled into other areas like financial health and a lot of that is people want to show that they're successful. A lot of people's brands are sort of built on spending and very conspicuous spending.

And so going and telling someone, "Hey, talk about your financial struggles." It's very, very challenging. But I do think that there will be a reckoning the same way there was when you had all these people come out and say, "Hey, I want to talk about my mental health today even though normally I make funny videos and kind of entertain you." And I see that in feedback sessions that I have. People will come on the call and they're not there to give me feedback on the app though I try to weed that out of them. They're there to vent to me and tell me about all their problems and their credit score issues and all the collections agencies that are coming half to them. That's what I'm spending half of my user feedback sessions on, which is kind of funny that's not really the point of them, but I wouldn't say it's fun, but it's really heartwarming to me that people are so willing to kind of sit down and open up to us, to total strangers.

Annaka: Yeah. Well, and you said kind of a magic word for me associated with finances and debt, and that word is shame. And there's a lot of shame and guilt connected to debt especially when it comes to credit cards. And it sounds like that's an issue and a perspective that you're really looking to change. Is that a part of your overall strategy? Is there some of that, what words am I looking for, are those mantras that are getting built into the product?

Frida Leibowitz: Yeah. So we built a manifesto with five key principles that drive our business. And the very first principle is carrots not sticks. I think that when you look at the debt space, right, it's full of sticks. If you don't make your payments on time, if your utilization is too high, you're going to get hit. If you do everything that you're supposed to do, it takes a very long time. There's no immediate gratification, right? It takes a very long time to feel the benefit. And that's exactly why we decided we're going to be in the rewards business, right?

Frida Leibowitz: We are going to be the ones providing those carrots, right? Positivity. So we're going to celebrate good behaviors rather than, right, kind of keep on punishing bad ones, which eventually if you look at this, again, going back to the behavioral psychology, punishments only work for so long. Right. Eventually people just build up a tolerance for it and they're just like "Whatever, I'll just keep getting fees. I'm already used to this. Who cares?" Whereas positive rewards, right, if you do it in the right way, that sort of instant gratification, the feeling well I'm doing good things that tends to have a much more effective impact over time.

Rachel Lauren: Yeah. And we are building that directly into the curriculum. So when you look at the first couple modules that we're building in, one of the first ones is called Positive Vibes Only. And then it sort of walks you through what is the actual, tangible, financial impact of shame, right?Shame leads to things like avoidance, which means I'm going to stop looking at my balances. It's sort of this never ending cycle of, "Oh, I don't know how much I'm spending. I don't want to know how much I'm spending. I'm going to go keep spending because I don't know what's happening." And it's this never ending kind of loop.

Annaka: I know that listeners can't see me just nodding along to everything you all have been saying like "Oh yeah. I've had days where I just haven't looked at my bank account and I know it's not good, but if I don't look at it can't get me. Right?"

Rachel Lauren: Yeah. Yeah.

Annaka: And, I read the manifesto and I loved it. Listeners, please go read it. But carrots not sticks, how does that set you apart from kind of the rest of the debt industry?

Frida Leibowitz: Yeah. I mean, I think kind of like what I mentioned before, if you look today at the space, the only rewards that exist in the debt world are credit card rewards. And those reward you for spending more. There are very few companies that are creating real, tangible, immediate rewards that are directly tied to an action that you do, right, for positive behavior. There's things over time. Like I said, there's company, eventually you'll feel good because your credit score will improve. You'll eventually get a higher credit line, but it's very different.

When you miss a payment you immediately see the late fee. The late fee is tied to the missed payment. Right. It's very clear. This X leads to Y. With rewards it's very hard, right? You don't even know what affects your credit score. You don't even know why the bank decides to give you a higher credit line. You just kind of do everything that you need to be doing kind of. You sort of know what you need to do, but you sort of don't and then you hope for the best. Right. And with us, we want to make that same very clear connection. Right there the task is this reward is this in a very, very distinct way. And I think that really sets us apart for the rest of the debt space.

Ethan: All right. We're going to jump around a little bit. I want to go back to-

Annaka: (

We got in deep there pretty quick which is good. We love it.

Ethan: Back to something that we haven't talked about yet. So it's not back to anything. You guys are based in Miami. Can you tell us what the tech scene is like there right now?

Frida Leibowitz: Yeah, Miami has been really cool for us. As you may have heard, there's been a huge exodus from New York, from San Francisco to Miami. And the interesting thing is during the pandemic at least people are coming there because of freedom because literally you didn't need to wear masks. The pandemic didn't exist there. You could do whatever you wanted, but I think people stayed because of this amazing community that formed and the type of people that came there.

So I think the cool thing is that you're getting the best of both worlds in a way because you're getting the ambition and the work ethic that you have in the New York and the SFs of the world, but people are self-selecting who are more freethinking and want to sort of try something new and move somewhere and start a new thing. So I think that's been really cool. And it's interesting because the tech scene initially felt like it was very dominated by web3. So every other company is doing NFTs, cryptos, very, very cool things, very first world problems, which is very cool. And then I think after a little bit of time though, we were able to find other companies like us that are working on standard web2 problems that we still need to solve for the rest of folks who they can't even get to investing. They can't get to regular things. Right. We need to sort of help them first out of that debt cycle. So that's been really cool. And then the other part of it is I think now Miami's sort of at a perfect place where there is a critical mass so there's enough companies, enough things to go around, but it's still tight-knit.

So after spending a little bit of time there, you start to get to know everybody or at least you have a connection to anybody there and the environment is very collaborative. Anybody that you meet will be willing to connect you with whoever, help you with their network, offer you their office space, offer events to go to, all these things. So overall a super positive experience. And I think something very special that we're happy to be part of.

Ethan: So, you were both in New York and you chose Miami. You could have chosen anywhere in the world. You could have chosen Silicon Valley. You could have chosen SF. Is it over in SF? Is everything just moving to Austin and Miami now? Is that what we're seeing?

Rachel Lauren: So I think the movement from SF has been more harsh than the movement from New York and I think that's for a few reasons. One is, and we talk to people in the Bay Area all the time. And what they tell us is that it's just gotten more dangerous. They're kind of scared. One of our service providers, they're a good friend, literally had a violent attack in broad daylight and we didn't have... Yeah. And so he had to help her for a week and we weren't able to kind of get in contact with him. It was not good. And so, it's not a good situation right now from a safety perspective and in certain areas in SF and I think that's a big reason why people have left.

And then the other thing is going back to sort of the way that the Miami tech scene has sort of evolved is the kind of people that are looking for startup jobs. I think in the Bay Area, it's very much like "Okay, let me find a Series A company that's going to give me significant equity and still pay me really well." Because there's so many companies, there's so many companies getting funded. And so it's not even that much of a risk that you're taking. Right. As soon as a company that just got funding, even if it dies there's a dime a dozen and you're getting great equity.

So, you're really not taking that much of a risk. It's really more of a question of which one do I think will be the rocket ship. Whereas I think in Miami it is a risk, right? There aren't sort of a dime a dozen companies that you can sort of join if one of them fails in Miami. And so the people here are really looking for something that they're more aligned with from a mission perspective that they're excited about in terms of the product rather than who can offer them the best comp package and benefits and lunch every day for the rest of the year or whatever it is.

Ethan: Got you. So, you and you two are both in Miami, but you've got team in several other places on this globe. Tell us about that.

Frida Leibowitz: Yeah. So, our third co-founder, Rick, he lives in Austin. He did the other classic move. He moved from SF. He was in the valley for a couple years. And then he ended up moving to Austin during the pandemic. And then we have Matt. He's in LA and then we have our engineering team in Argentina. Our designer is somewhere else in Florida and our awesome intern is actually in Charleston. So, it's been really cool to kind of have this very spread out team, but I actually think we started off as an all remote company to begin with. So that's how we built our identity. And we really had to get creative and find ways to get to know each other. And little things, I think. It's things like every time we have a meeting most of the time you will spend at least the first 5 to 10 minutes talking about non-work related things.

So, all the things that you would be talking about at the coffee machine to somebody else or during your lunch or things like that, we definitely try to do that. And then we also do create a good amount of meetings that are just meant for hanging out. So we have happy hours, we have things like that. And I know it's really tough because I remember also being an employee before and sometimes you're like, "Ugh, I have to go to this happy hour. I'd rather have my own time." So, we really try to make it relevant and find ways to engage the team. And I think at the end of the day we just like each other also, I think that's important. I hope I get to say that. Matt you'll tell me later if you agree, but yeah, I think that part's important too. I think picking the team and picking people that you actually enjoy hanging out with even remotely, that you would take time out of your day to go to happy hour with on Zoom, that's that's really important.

Ethan: Right. And it sounds like-

Rachel Lauren: And we do have a somewhat larger budget I guess, to travel to each other. So, the money that we spend on the rent in the office space, we would now spend on actually going to meet each other in person, whether that's in Austin, Miami, wherever.

Ethan: That's great. Yeah. I've heard that a bunch of times, that even if you have a fully distributed team, it's important for everyone to get together just every once in a while. And it really helps with just understanding who a person is. We're all on Zoom all day long and I know what Annaka's face looks like, but when we're together in this office, my gosh, it's just the best.

Annaka: Oh, you're such a cute ball. I do love that your team has kind of chosen southern locations, meanwhile or Michigan and it snowed last week.

Ethan: They picked the sun over anything else.

Frida Leibowitz: I remember Michigan in the winter.

Ethan: Yeah. It's something I'm going to try to forget. All right. Jumping around again, what is customer discovery and do you recommend this type of research approach for other founders?

Frida Leibowitz: I think it maybe goes back a little bit to what we were talking about before. Right. The first step that we took before we built the products and I think customer discovery is important for every business. At least from what I've seen, I haven't found one that doesn't need it. And I would actually even say, you should do customer discovery before you have a solution or at the very least keep your solution out of it. First try to figure out, just find the problem, right?

Customer discovery: it's really important to figure out what the actual problem that you're solving is or the set of problems, in our case it's definitely a set of problems. All debt isn't equal at all. And from there figure out slowly, right? Build up your way into what might be a potential solution. And you have to pick the problems you want to deal with. You can't do all of them, not all at once. So yeah, I would say that for us was super important and that's the first thing we did. And that's really how our business started. It was me and Rachel sitting in our apartment without that much else to do, because it was the pandemic and we were just like, "Okay, we have these issues. Let's just for fun sit on Facebook and start just trolling the internet, talking to people, seeing what they're doing." And seeing what's up, talking about our stories, hearing other people's stories. Yeah. And I think that that definitely helped us get to where we got to today.

Rachel Lauren: Yeah. And I tell Frida, I mean, we talk about this all the time that it's important to have a vision for the business, but at the same time I think we're married to the problem, not necessarily the solution. Right. We have ideas of what the solution might be, but as we continue along in the business, if we see that something we've tried isn't working then we try something else, right? Whether that's a change in the business model, a change in the product itself, I think it's important to be open to different solutions within a certain kind of bracket in order to get to that right one, if you really do care about the problem, right?

Annaka: If you really care about the problem. Angels are singing in my brain right now. You can identify a problem and you can be like, "That's the problem, but oops, that sounds, that sounds like a you thing and not a me thing." You see that kind of conversation quite often, unfortunately. So talking about customer discovery, a lot of times in user experience and marketing we talk about personas. And I think based on our conversation so far, we have an idea of who your user is, who your kind of market is, and the way that you want to speak to them. How did you go about designing your user experience and designing your platform with your user in mind?

Rachel Lauren: I'll jump into this one. I think actually it started kind of funny the way that we came into our personas because I think we had an idea of who that might be initially, which was sort of young folks, millennials sort of age 24 to 35, either people just graduated, kind of in their first jobs now finally have spending money or maybe getting themselves into trouble to people who have families looking to buy a home, spending money on their kids and things like that.

And so, we had different kinds of subgroups within that. Now we were thinking about students who were maybe about to graduate as a demographic. So, we had those ideas and then I think we started really, really broad with the messaging. The initial messaging that we went out with to folks was “get paid to pay off your debt.” That was super super broad, it was not specifically targeted at any one person. I think the branding at the time was also pretty vague. Wasn't particularly millennial or Gen Z or kind of in any direction. And then we started seeing who came in. Right. Who were the people that were attracted to the initial messaging and who were sort of shaping up to be our demographic? And I think there was some overlap and then there were some surprises. So the overlap is we definitely got some of that kind of younger folks, 25 to 35. We thought we would get more women given the name as sort of Debbie. Yeah, we thought it would be sort of predominantly women.

In fact, we thought we would get sort of young moms. We thought we might get some students. And actually what we ended up getting was some of that, most of that, but then we also got a lot of men who were looking for side hustles, were looking to pay off debt faster and sort of looking for a motivator, some lower income folks as well. And so, those were demographics that we weren't necessarily expecting that we ended up getting and then we decided to kind of make sure the branding fit within that. So yeah, the branding and sort of the user experience, we sort of tried to make it more gender neutral, at least the color palette, the fonts, all of that, to make it kind of to fit both kind of masculine and feminine.

Annaka: Yeah. Bridging the gap, the gender divide is always a little bit hard. It's like, can you make it soft and masculine at the same time? Yes. Yes you can. But yeah, it's an interesting approach and congratulations on getting kind of a breadth of a market there because that's not easy to do. And speaking of your platform currently as it sits, you have over 11,000 people when I checked kind of ready to join, how did you make that happen? That's a lot of people.

Frida Leibowitz: That's all Rachel. Now Rachel and Matt, but she started it.

Rachel Lauren: So, I have no prior marketing experience. So I kind of just went in, was like "All right, let's throw things at a wall and see if it sticks." And I got a lot of help from a former portfolio company of ours when I was at BDMI which is extra that is done fantastically well. They're building a debit card that builds your credit score. And so, I reached out to Max and was like, "Hey, you guys grew to 100,000 paying subscribers within a year. What's your secret? What did you do?"

And a lot of folks in the FinTech space, particularly investors, were pushing us to find some sort of interesting thing, acquisition channel, some other distribution model, yada yada yada, because it is such a saturated market. And I was like, "What did you do? Did you have some secret special thing that you did?" And his answer boiled down to, “find the message that works, find the message that converts and just push money into that.” And that's what they did and it worked really well for them and that's what we, that strategy we decided to take.

And that's where that messaging that I mentioned before of get paid to pay off your debt sort of came from. We made it very clear, very simple, this is the value prop people, understood it and people came. On top of that I made a lot of silly videos of myself for TikToks and Reels, some of them did better than others. Fixed the branding a little bit, made it more fun, made it more personable going back to the idea of the human approach, right? We wanted to give Debbie a face. We wanted to give the brand a face and so that was really important to me from a brand perspective.

So yeah, I think the combination of all of those things has been super helpful. That, and also building alongside the users. So we built a customer advisory board sort of separate from our general kind of business advisory board. That's made up of influencers in the space and sort of regular users. They’re first eyes on screens, so when we kind of develop a product we show them, we get their feedback, same thing with the messaging, with the branding, advertising, everything. And so they've been pretty instrumental, I think, in getting the message across as well.

Annaka: Fun facts, Ethan and I are also on TikTok now.

Ethan: Oh boy.

Frida Leibowitz: Give us some tips.

Ethan: No, we are the ones that need the tips.

Annaka: We need tips.

Frida Leibowitz: You guys should link up with Matt. Now Matt's our rising TikTok star. His TikTok video that we had over April Fool Day got, I don't know, 36,000 views.

Annaka: I'm like, "Y’all got any tips in there?" I can talk to you and have a conversation, but as soon as you turn the camera on me I’m like”, I'm not funny. I don't know why you're focused on me.” So keep...

Ethan: You keep asking me to dance. I'm like "I'm not on..."

Rachel Lauren: You just got to get into the idea. You just got to shake your butt.

Frida Leibowitz: Oh, you don't even know the kinds of things we did. You don't know what kind of things Rachel made me do. I was like, "I did not know this was part of this job." But at one point, Rachel had commissioned a custom Debbie plushy. So it's a plushy, it looks like Debbie. And then she put it on a mop so that we can do all these animations. And at some point I was holding a mop with Debbie plushy and Rachel was doing some dance video with it. And I was like, "I did not know that this was part of building a startup." But it's fun. You got to just kind of let loose, have fun with it. Just be ready to try anything and hope for the best.

Rachel Lauren: I was definitely inspired by Duolingo. So I think they've done an awesome job. I did not want to spend thousands of dollars on a mascot costume, so I ended up just spending 70 on a little plushy on Etsy, but I think eventually we'll get there. Eventually we'll upgrade to a better mascot, whether that's a costume or something else. But I think that's... Yeah.

Annaka: If you don't have anyone willing to run around in it, give me a call. I will fly down to Miami and be dumb things in the mascot costume.

Ethan: See that that's how we get you on camera. We just have to put you in a suit.

Annaka: Yeah. Anything.

Ethan: Yeah.

Annaka: I'm sure the podcast team is sick of me talking about Duolingo, but their marketing team all deserve awards. They're amazing. So now I just lost… the thought that was there is now gone and there's no getting it back.

Ethan: All right. I've got one. Who's Debbie? We keep hearing that Debbie is a person and you've named your company after her. Who is Debbie?

Frida Leibowitz: Who is Debbie? Think of Debbie like the persona, is your cool young aunt that went through her own wild phases, spent a bunch, gotten to debt, but made her way out of it and is now super successful and kind of gets you and is on your side, but also has some good knowledge and is sort of already familiar and can help you out. In terms of the name, it was really important for us to have a woman's name. For me, it was a little bit like we had Marcus, Dave, Albert. We wanted to have a woman's name. And then it was kind of a little play on words like Debt-Debbie and my sister's name is Debbie. Rachel's mom's name is Dora, which is also like Debbie. So it's kind of approachable. It's kind of cool. It works. And that's it. That's how we chose it. I think, yeah, it was one of those early decisions that we made that kind of just made sense and we stuck with it.

Ethan: Did you ever walk out of a VC meeting where they turned you down and you just said, "We can't help you, you're a Debbie downer."

Frida Leibowitz: That is a great line. I am definitely going to use that.

Ethan: I'm glad.

Frida Leibowitz: I don't know how we didn't think about it, but wow.

Ethan: Because that line is how I lost my job right now.

Frida Leibowitz: Definitely. Oh, no. I love that. I love that. Oh my God. That's going to become my response email to nos from VCs like, "You're a Debbie downer."

Rachel Lauren: I think it's actually so funny because I think about our company all the time we talk about positivity and Debbie downer is such a known thing and so we're just-

Frida Leibowitz: All right. Rachel and Matt, that’s gotta be our next TikTok, is listing all of our Debbie downers. We did one TikTok where we crossed out the names. We showed all of our rejection emails that we went through, we were facing and now we could do one like that with all the Debbie downers. That's funny.

Ethan: Awesome. Glad I can be of assistance. My bill is in the mail.

Frida Leibowitz: You're hired.

Annaka: Great. Ethan and I just got jobs.

Frida Leibowitz: Yeah. You have the mascot. Well, she's got the mascot. She'll do the mascot. You guys are going to be a great team.

Ethan: Fantastic. All right. Michaela, sorry. We're out. That's our producer. All right. Let's get back into real life here. So, you two are two of the three founders of Debbie. Can you tell us about your other founder and tell us how you built your team of founders?

Frida Leibowitz: Yeah. So Rachel and I go way back. Like I mentioned, we went to NYU together and we lived together on and off over the years. So, we knew each other pretty well and we knew we wanted to start this together. We also knew that we were lacking certain skill sets and we wanted to find a technical co-founder. And it was very important for us to bring in a co-founder specifically, not just a head of engineering. I think we'd looked through that option and we realized we wanted someone in it with us and we wanted to have a complete skill set within the co-founding team that it's to sort of de-risk the business and make sure that we're best set up for success.

The journey to finding that third co-founder was very difficult. I think it's even doubly hard when there's two of us so that we have to find a third. So, we both have to really get along with that third person. And it has to be a really, really good fit. And that third person has to like both of us. And it took us months. It took us a long time and we tried lots of things. We were looking for different places. We ended up doing this co-founder matching program that's run by one of the partners at Andreson. We just signed up for it. It's one of the many things we did. And ultimately that's how we found Maxime, who is our third co-founder and is amazing.

And I think there were a couple of things that helped us make that process successful. We did get some really good candidates. And I think because we lead with the mission and we were trying to draw people who are very mission-driven, that was amazing. So I'll just get a really good pool of candidates, but ultimately it really was about finding the two best of both worlds. Right. Which is Maxime also has an amazing background, amazing skill set. He has the experience he's been in Silicon Valley. He worked at Earnest before he spent years there and sort of has really deep level experience, but at the same time, he's someone who's actually fun to hang out with.

A person who we get along with who we could just chit chat about anything. Really brings in a good energy to the team. And one of the things that we ended up doing, as part of the process, we actually put together a list of 40 questions that spanned anywhere from what do you do in your free time? What are your values? And would you sell the company for 100 million, 200 million? What's your price? And each one of us filled it out independently of each other and then we came together. We compared our answers. We talked about it kind of just to really see how aligned we were and all of those things. And that really, really helped. I think that made it very easy to spot. Eventually, Maxime was very easy to spot, how much we were aligned. And then with other other folks, it was very easy to see the folks who were not aligned. So, I think that was sort of the formula, which it's no magic bullet. It was hard work, but it definitely turned out to be amazing.

Ethan: How many people did you put through any sort of a process before you landed on Maxime?

Frida Leibowitz: Wow. Total, total that we had in the pipeline, what was it? I mean, total applications was very high. At some point we were doing applications, but Maxime was a co-founder matching program, so it was different. We had to both select each other. We did LinkedIn job posts. We did all these things. I think across everything we probably had over 300 of those, but it's just a number, so many of them were not necessarily relevant or whatever, of those who probably went through a more in depth process with, I would say, 30 or 40 candidates. And then towards the end it was between probably three.

Ethan: That's a lot of time.

Annaka: Yeah.

Frida Leibowitz: It's a lot of time. Yeah. There's no such thing as a free lunch. That's what they say.

Ethan: Right. Well, and it sounds like you found the right one. That's really great.

Frida Leibowitz: We did. We did. I mean, also for me Maxime, we hit it off right away because I met him first and so then I came to Rachel I'm like "Rachel, I met the one. That's it. We can shut down all the applications. I was praying. I'm like, "Please say yes." But yeah, we really connected. I think he also had that entrepreneurial spirit, because he actually between Ernest and Debbie had started something else with co-founders and he really wanted to be part of something young and he cared about that stuff. And then it also helped that we're both motorcycle riders.

Ethan: Hey.

Frida Leibowitz: And so yeah the next thing is going to be a motorcycle team for Debbie. And we're going to put Rachel in the side car, but also Matt joined us and he's also a motorcycle rider, so we're really going to do it. And then Rachel's going to be in the side car with one of us. Though no one wants to volunteer yet. We're just going to try to convince her to also get a motorcycle license.

Rachel Lauren: Yeah. I do want to drive first. So let's start with that.

Frida Leibowitz: Yeah. We got it. Baby steps.

Rachel Lauren: It's the last adult thing that I don't know how to do. It's very embarrassing. I'm very ashamed of it.

Ethan: Well, I can tell you, if you move from state to state, you can just tell the new state that you have a motorcycle license and they'll be, "Oh, okay." And they don't know how to read the old state's license anyway so they just give it to you.

Annaka: Yeah. It's from experience.

Ethan: So it's a free way to get a motorcycle license. That was a story that has little relevance to anything.

Frida Leibowitz: Have you tried it? How do you know? Sounds sketchy.

Ethan: I moved from Missouri to Michigan and I had a motorcycle license, but the licenses looked different. And so when I went to get my new license they asked me, "What's this M?" And I said, "That's a motorcycle license." And they're like, "Oh do you want to keep that?" And I'm like, "Yeah."

Frida Leibowitz: Yeah. It's the same thing with New York except it is a DM. You have no idea what it means. So you're like, "Yeah, I got it."

Annaka: How important was it that Maxim be specifically a tech co-founder? Is it that it keeps going around?

Frida: (53:09)

Yeah. No, that was important. I mean, that was really the skillset. I think it actually was really good Rachel and I have very different skill sets, so it was perfect. We really complimented each other, but we needed the technical experience. I think that was definitely missing. Otherwise it'll be way too many cooks in the kitchen. Even now it's like we have to set very clear boundaries about who owns what to make it easier for us and to make sure that we run things in a good way. But yeah, we wanted to make sure that we were finding someone with a very complimentary skill set to what we already had.

Annaka: Yeah. That seems to be a recurring theme among founders that are not particularly technical. They're like "We need to find the tech person that is going to watch our back and keep us accountable and get things done." And so yay tech founders. CTOs.

Frida Leibowitz: Yes.

Annaka: Perfect.

Frida Leibowitz: Couldn't do this without them.

Annaka: Alright so, let's get really honest here. What was it actually like getting from launch to now? Because I know it's not all unicorns and rainbows. Give me the nitty gritty. What was it about?

Frida Leibowitz: Yeah. And I think kind of like I mentioned it's sort of to me was always frustrating before when I would hear entrepreneurs talk and there'd be two seconds about all the challenges and then an hour about this is amazing and here's how we out here and we raised money and all this stuff. So, I do want to talk about all the things that went down before we raised money and how we sort of got through that. And it was a long journey. Right. Some of it even before we had an idea before anything it took a long time.

I think for Rachel and I specifically, we were young. We were very early on in our careers at the time. We did not have rich parents or a nest egg or something that we were sort of able to rely on and just say let's just quit our jobs and go try something new. And so we have to be very methodical and really get to a place where we can jump and take a risk. And sort of in the beginning what we did was when we started, after we did the market research and all this stuff, we were like, "All right. Let's get this on paper. Let's put together a deck. Let's just talk to people that we know. Let's see what they say."

We put together a basic deck that if we looked at it today we would probably cry because it was so ugly. And then we just went around to people that we knew, friends initially, whatever like what do you think of this? What do you think of this? And then we started seeing very positive traction and slowly people are like, "Let me introduce you to this person. Let me introduce you to that person. Maybe you should talk to that..." And all that stuff. And that also was a while. And there were definitely days when we worked on it more and there were days when we worked on it less. It wasn't like we were always doing this all the time and we also had our full-time jobs still. And then at some point we realized, okay, we are going to have to make the jump, but how do we do that? Right. And I think this is where it was really important for us at least to each other, because when you have a co-founder, right, you're not doing things alone. And so that actually helps. That gives leverage. So what we ended up deciding is that I would quit my job first. Rachel's going to stay at her job, keep making money, help pay the rent. Right.

She was basically bankrolling the business at the time, helping me out. And then we went from there and I was like, "Okay, I'm going to quit. I'm going to get started. I'm going to start building. I'm going to start figuring this out." And then she was obviously still helping out and doing everything part-time. And I think that jump, that was the most crucial thing. As soon as I said, "That's it. I am now leaving. I don't have a full-time income. I have Rachel to help me, but that's limited." And I had a time limit. That's how much savings I had. I knew it was going to run out eventually. And that sort of lights the fire that you have to just be like "Okay. That's it. Gotta go. Gotta figure out how to do this." And ultimately that really pushed us to fundraise. Right. Because before that we had this phase where we never thought we were ready. Right. Where we were like, "We're not ready. It's not there yet. The product isn't there. The idea isn't there yet. We don't sound good enough. Our deck isn't good enough." Whatever it is.

But all of a sudden when you are like, "Okay. It's either I go out and ask for money or I have to go find a job and stop doing this." That's when you're like, "Okay. That's it. I'm just going to jump." And I think that was sort of the process. And again, it was long. It took time. Everything just happened in one day, but that was really the way, the path to how we ended up making it happen. I don't know if you have anything else to add, Rachel, to that.

Rachel Lauren: Yeah. I want to caveat that we are incredibly lucky that the firm that I was working for decided to support us and kind of give us one of the first checks. Not everybody is given that privilege so I'm very, very appreciative of that and I totally understand that we were in a position that we could do that. At the same time it wasn't a given. For a long time Frida was pushing me like "Rachel, when are we going to talk to BDMI? Rachel, when are we going to talk to BDMI?" And I was like, "I'm not ready yet. They don't know yet. I don't know. I have to soften them up." And this was over the course of months that I spent sort of talking to them about this project, this thing I was working on that I was excited about, until the point where we were already talking to other investors, had gotten some small sort of angel commitments.

And then I went to the fund and was like, "Hey guys, this is a real thing. I'm going to quit to work on this. I should at least pitch you guys and see what we have to say." And I was not expecting a good outcome or I was expecting maybe a small check as a sign of support so that if we went to other investors they wouldn't be like, "Oh, why aren't they investing?" Because that would've killed us, right, to have that negative signal. So I was expecting a very small check and then they pulled through with much more than what I expected.

So like I said, wanted to caveat that for sure, but I will say Frida quitting her full-time job and getting started, we would not have been able to fundraise or get any commitments from anyone had one of us not been full-time on the business. And that's to anyone who asks, whether they can fundraise or start a business while they're part-time. If you're building something that you can monetize easily. Sure. Absolutely. Do it part-time and then quit once it's making enough revenue to support yourself. If that's not a possibility, which for us, it wasn't. We knew we were going to be pre-revenue for a while, we had to jump, we had to take that risk.

Ethan: That's huge. I mean, to know that you're going all in, I mean, it's such a massive decision. All right so on that subject of money, you raised your pre-seed round at $1.2 million. That's pretty respectable for a pre-revenue company. And you've already given us a little bit about the story of that. If there are any other details that you'd love to fill in about your funding journey or anything that you would do differently, we'd love to hear that.

Frida Leibowitz: Yeah. I mean, we weren't just pre-revenue. We were pre-product at the time. We had nothing. We had no wait list. We had no products, but we had put together a pretty strong team. And I think tying it back to the story I think like you said, as a founder you're always like, "I'm not ready. Is this not going to be a home run? How do I do this? And one of our sort of mentors, who is himself in venture, I remember he just gave us one of these pep talks one day. He just got on the phone with us and he's like, "Guys, that's it. You need to go. You need to start raising and you need to first go to people who know you. Go pitch to the people you know from Goldman. Go pitch to the people you know from BDMI because you need to figure it out. Those people are the ones who should be supporting you. If they can't support you then you need to start asking yourself questions about is this viable? And am I the right person to do this?"

And so that was a good wake up call. And so that's when I started. I actually reached out to my former managing director from Goldman. He was [inaudible] who I worked with. I worked under him for a couple years and I was so scared I remember I even told him on the call I'm so nervous suspiciously right now. I'm just going to do it. And I pitched him and he was excited. He ended up actually being our first investor. He was like, "I'm going to commit." And it was initially a small amount which he ended up increasing afterwards. Yes. But that was really it. And then all of a sudden as a founder also, it's pretty cool. Okay, someone who knows me very well, who I worked for believes in me, believes in my work and that's an amazing thing and it's also an amazing signal. And I think from there, we sort of were able to move forward and it started just snowballing really slowly.

And then, I think the other part was, like Rachel mentioned before, we were super lucky to have Rachel and not just because her firm contributed, but because Rachel was sort of a boss and knew so many people in VC and knew how things were run and she knew how to say the right things. And she coached me and she was like, "Well, this is what the VCs need to hear and these are the things we need to have." And that was amazing. I think that was a huge part of it and helped get connections faster.

Ethan: Rachel, do you want to tack onto that?

Rachel Lauren: Yeah. I think it's very easy to see the sea of funds that are out there and want to talk to all of them that want to talk to you, but one of the things that I told Frida early on is we might be getting connections to high flier names, but I know for a fact that they don't invest as early as we were. And so, I wanted to limit the number of conversations we were having with those folks. One, to just limit the number of rejections and two, because it just takes so much freaking time to get on a call with all of these people. And I know that our time was just way better spent building the business.

And so, I tried to focus us very, very, very strongly on who are the people who just do first checks, who do pre-seed rounds, who are open to going that early? Because we could have had a lot more conversations than we did with folks that I knew would've just been phishing or at least wanted to build a relationship early on so that come the next round or Series A or whatever they would've already known us. But I think for me I know that game because I played that game and I was doing that myself. I was trying to meet those companies that were earlier than where BDMI would invest. And it's good for the funds. It's just more time consuming. We still took those calls, but we took way fewer than I think maybe other companies might.

Ethan: Got you. I think we could continue this conversation for another six to seven hours.

Annaka: Yeah. Somewhere around there. We'll be getting dinner later.

Ethan: Because the breadth and depth of your all's experience, I mean, even so far is really just amazing, but unfortunately we are coming up, getting close to time, so I want to move us forward. Hey, maybe we'll have you back some time to check up on everything. So what is next for Debbie?

Frida Leibowitz: Next is nailing product. That is what we need to do. I think our job right now is we did good. We made promises. We got users, we built a community, we built an audience. We have the starting capital and now our job is to make good on that promise. And that making good on that promise is not a month long thing and it's not a three month long thing and it's going to be probably the rest of our journey with Debbie, it's going to be that constantly figuring that out, but I think at least initially, we want to start having that. We want to start being able to say, "Hey, we are actually adding value to people's lives."

And we're close to there. I think we are, but there's a lot of work that we still need to do to get there. And so we are really trying to. Right now our every single day is focusing on figuring out what user issues are and getting feedback from users, trying to help them out, trying to think about what the next set of features will be, analyzing existing features and what we can tweak about them, how we can make them better. And for me, honestly, that's the funnest part. That's what I dreamt building a startup will be. I'm like, "This is it. We're going to build a product." There's all this other stuff which is fun too, to an extent, but this is the funnest. So yeah, I think that's that.

Rachel Lauren: And I would say the thing that really sort of put it over the edge for me was seven days ago was the first day that we took a look at the streaks. So every month basically, our users, they have a goal to hit in terms of their debt. And then sort of we evaluate that as a part of a six month, seven month streak. And so, April first was the first day that we finally had that data because we've only had users for a month or so. And seeing people kind of complete their streaks, us paying them for actually getting that done was just such a good feeling and that's sort of the feeling that I want us to continue, is being able to reward folks for doing the right thing.

Annaka: Yeah. Watching everything kind of come together has to be the premo feeling after all of this work. Okay, so we are dangerously close to time out over here so I'm going to ask you both the same question. My favorite question of the day, and let's start with Rachel, what is your advice for entrepreneurs in general?

Rachel Lauren: My advice for entrepreneurs, if they don't already have a co-founder, get one. If you already have one, cherish them, they are your accountability partner.

Annaka: Buy the presents.

Rachel Lauren: Buy them presents. They're your accountability partner. They are your rock. They will help you think about ideas about ideas, those ideas off each other. A lot of times entrepreneurs will have very high egos and they need to kind of get far as self starters, but it's very humbling to have someone else at the end of the table who compliments you, who has a different skill set, who can add something to that pot. So, that's my number one piece of advice. And I don't necessarily mean technical, I mean, someone who you trust, who you think is a good [inaudible].

Frida Leibowitz: And someone who listens to your venting all the time.

Annaka: Vent partner, you need one.

Frida Leibowitz: But Rachel also listens to my venting all the time. Rachel and Maxim. We have half of our stand ups which are venting which is awesome.

Annaka: You gotta have it. You gotta have it. All right. Rachel, anything else?

Rachel Lauren: Nope. That's my number one thing.

Annaka: All right. Perfect. Frida, the same question to you. What's your advice for entrepreneurs? I don't know how to ask that question differently.

Frida Leibowitz: No. It's a great question. I think my advice is to ask yourself, would you still be doing what you're doing if you were completely anonymous, nobody knew it was you and you got no credit? The reason why I ask it is because there's definitely the part about humility and working on a problem that matters and all of these things, but I think also that helps you figure out are you actually working on something that you enjoy? Do you enjoy doing this? Is this fun for you? Are you loving it? Right. Or are you just doing it for the hype? Are you doing it for another thing?

Because I think the hype part it's very up and down. Right. Sometimes you feel like you're on top of the world and everyone loves what you're doing and you're one of those people who could post on LinkedIn and be like, "Yeah, we raised, we did this, we did that." But a lot of the time it's not. You're sitting there and it's just you and whatever you're working on and you might not get credit for so many things that you're doing. And nobody really knows, right? Maybe co-founders that are the closest to knowing, but nobody really knows how much you really are doing and what you're really doing. And I think that's just for me been one of the most important things to think about.

Ethan: Awesome. This is great. I want to thank you both for coming on to the show today. You've both been very great guests.

Annaka: Lots of fun.

Frida Leibowitz: Thank you so much, guys. This was amazing.

Rachel Lauren: Thank you.

Annaka: It's the most I've laughed in an interview I think yet.

Frida Leibowitz: Woo-hoo.

Ethan: All right.

Rachel Lauren: Wonderful.

Ethan: And that's going to be everything for today's show. Thanks for hanging out. Hey listener, this message goes out to you. Over the past several episodes, I've asked you to leave us a review on Apple podcast. So I went in, I went in to check on your work and you know what? I realized they make it really hard to leave a review.

So here's the plan: in Apple podcast, click on Startup Savants, that's us, then scroll all the way down to the bottom where you'll see a big five point O. We're pretty proud of that. Right there, right there is where you can leave a review of your own. See? It's all about helping people out. Listeners, we love you, and hopefully you love us too. For tools, guides, videos, startup stories, and so much more head over to truic.com. That's truic.com T-R-U-I-C.com. See you.

Annaka: Bye all.

Tell Us Your Startup Story

Are you a startup founder and want to share your entrepreneurial journey with our readers? Click below to contact us today!

More on Debbie

The Startup Changing the Way We See Debt

Fintech startup Debbie was founded with the vision of helping borrowers transition from debt holders to wealth builders as quickly and efficiently as possible.

Founder of Fintech Startup debbie Shares Their Top Insights

Rachel Lauren, founder of fintech startup debbie, shared valuable insights during our interview that will inspire and motivate aspiring entrepreneurs.

Here’s How You Can Support Fintech Startup Debbie

We asked Rachel Lauren, founder of Debbie, to share the most impactful ways to support their startup, and this is what they had to say.

Debbie Company Profile

Paying off debt has never been more enjoyable with Debbie, the fintech startup with a rewards platform geared towards debt payoff.