Coterie Insurance Profile

Last Updated: By TRUiC Team

Coterie Insurance is an insurtech startup providing small businesses with the insurance they need for compliance and the overall success of their business.

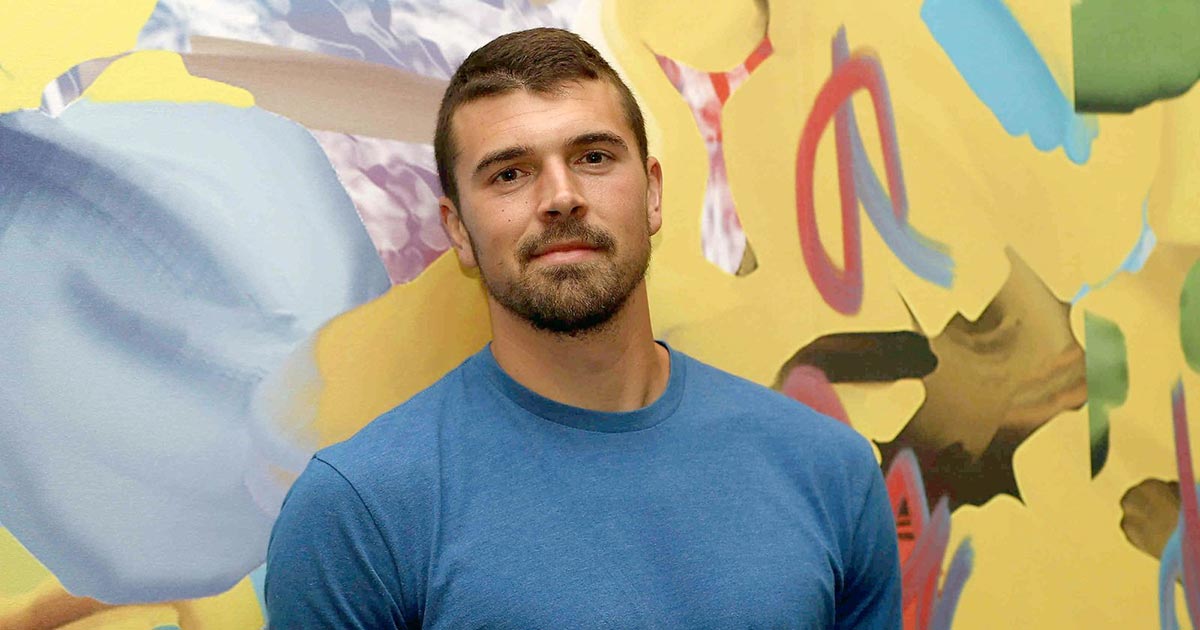

Interview With David McFarland

Describe your product or service:

“Small business insurance — we manufacture, service and distribute small business insurance.”

Describe your company values and mission:

“Our mission is to build and foster a world-class team to bring speed, simplicity, and service to commercial insurance.

Values:

Intelligence

- Always be learning.

- Fight bias. Stay curious. Seek understanding.

- Passion

- Make your work your craft.

- Know and pursue your personal ‘why.’ Put your heart into your work. Pursue excellence. Relentless pursuit with pure intentions. Go above and beyond. Get fired up and smile about your work.

Integrity

- Do the right thing, even when it’s hard.

- Don’t do anything you wouldn’t want to see on the front page of your hometown newspaper. Listen to your conscience. Make your mother proud. Practice the Golden rule.

Humility

- Not thinking less of yourself, but thinking of yourself less.

- Be quick to take responsibility and assign credit. Prop up others. Do what’s best for the team, not just for you. Put others before self.”

How are you funded? I.e. type of funding, number of funding rounds, total funding amount.

“Through investors. We are through our Series C funding round and have raised around $75 million.”

How big is your team? Tell us a little about them!

“We have around 140 full-time employees who are spread across the country. We are fully remote but maintain an office in Cincinnati. This has allowed us to hire an incredible team.”

How did you come up with your startup's name? Did you have other names you considered?

“‘Coterie’ means an intimate and often exclusive group of persons with a unifying common interest or purpose. That explains what we set out to do, and we settled on the name early and pushed forward.

That said, one of his biggest lessons learned was not paying for the coterie.com domain early on. It seemed expensive, but it was later snatched up by a diaper company who we now have to compete with in SEO.”

Did you always want to start your own business? What made you want to become an entrepreneur?

“I saw starting a business as a means to an end. The most effective and efficient way to change the insurance space in the way that I envisioned was to start my own business.”

What was the biggest obstacle you encountered while launching your company? How did you overcome it?

“The biggest obstacle was the mental one to just do it. External obstacles are always there, but many can be overcome if we have the will. That isn't an absolute truth. There are plenty of obstacles that cannot be overcome. I can't will myself to be taller, which is an obstacle if my goal were to play in the NBA. However, I can will myself to work hard to become a better basketball player. Success, in that sense, is not necessarily about overcoming a specific obstacle, but understanding how what you have control over can help you unlock what you're looking to do from a first principles standpoint. Going back to the previous example, a lot of people will say they couldn't play in the NBA because of their height. They provide an obstacle that can't be overcome by the resources under their control. Whereas others will redefine the obstacle, so they have a chance of achieving their goal.

I overcame this obstacle by getting up each day and just moving forward, even when people thought I was nuts. Even when investors backed out. Even when I couldn't pay people. Even when we ran out of money. Even when it all was doomed to fail. You just wake up and keep going.”

Feeling inspired? Learn how to launch your company with our guide on how to start a startup.

Who is your target market? How did you establish the right market for your startup?

“Right now, our target market is partners, including agents and brokers, as small business insurance is primarily sold through agents and brokers. We are a partnership-focused company.”

What's your primary marketing strategy?

“We 100% market to agents and brokers, seeking to educate them about how easy writing small commercial policies is with Coterie. Many insurtechs leave agents and brokers out of purchasing, but we understand the value that an insurance expert has to small businesses. Insurance is complicated; no one should feel they have to go it alone.”

How did you acquire your first 100 customers?

“Through our first partnership, which was a fully integrated, micro-insurance offering through a gig-econ mobile app. They could bind insurance with the click of a button on a per-job basis. It was pretty cool.”

What are the key customer metrics / unit economics / KPIs you pay attention to to monitor the health of your business?

“Direct written premium, logins, approved quotes.”

What's your favorite startup book and podcast?

“‘High Output Management’”

What is a song or artist that you listen to for motivation?

“MitiS.”

Is there a tool, app, or resource that you swear by to help run your startup?

“Would recommend Zoom because all investors use it — anyone can use it. I use Signal (NFX) to find connections to various investors who like the insurtech space.”

What is something that surprised you about entrepreneurship?

“How much ideas don't matter — it's all about execution.”

How do you achieve work/life balance as a founder?

“I don't look at the two as separate. I don't recommend this for everyone, but [what] I do is a part of my life, and I enjoy my life. If you come to work with the mentality that this is your life, then it's not a different part of your life. It is your life, and you enjoy that. Not separate things. If you incorporate everything into our lives, things are more unified and go better.

I've thought this way since school. Not something I had to do — I saw it as something I do and choose to do.”

When did you know it was time to quit your day job to focus on your startup?

“I've always been focused on my start-up. From the beginning, I wanted to start an insurance company because I saw what tech could do to improve the space.

When it became time, it was when I was afraid to do it. If I was afraid to do it, it meant it was probably the right time because there was a realistic opportunity. It was pulling me in, and when something big happens like that, we tend to get afraid. If there is something potentially beneficial and I'm afraid, I should just do it.”

What was your first job and what did it teach you?

“Learned my work ethic from working at a restaurant when I was in fourth grade. The school partnered with a family-chain restaurant, and we had to do various jobs in the restaurant to learn what working was about. I got to do everything from cleaning to hanging out in the kitchen and waiting tables. The manager liked me so much that he offered me a paying job for kitchen work. I took him up on it, but it didn't work out. [I’ve] always been a hard worker; [it] taught me that if you do work hard, people value that regardless of your age.”

Tell Us Your Startup Story

Are you a startup founder and want to share your entrepreneurial journey with our readers? Click below to contact us today!

More on Coterie Insurance

Founder of Insurtech Startup Coterie Insurance Shares Their Top Insights

David McFarland, founder of insurtech startup Coterie Insurance, shared valuable insights during our interview that will inspire and motivate aspiring entrepreneurs.

Simplifying Small Business Insurance

Coterie is an insurance manufacturer that’s making it much faster and easier to apply for business insurance.

Here’s How You Can Support Insurtech Startup Coterie Insurance

We asked David McFarland, founder of Coterie Insurance, to share the most impactful ways to support their startup, and this is what they had to say.