Schedule K-1

Last Updated: By TRUiC Team

If you already own an S corporation (S corp) or plan to start one, you’ll need to familiarize yourself with Schedule K-1 (Form 1120S).

Schedule K-1 is a tax form used by pass-through organizations, such as partnerships and S corps, to report each shareholder’s allocation of the company’s income, deductions, and credits.

An S corp must create a Schedule K-1 for each of its shareholders. If you’re thinking about starting or investing in an S corporation — or if you recently did so — keep reading to learn more about the following:

- What Is a Schedule K1 Tax Form?

- Do I Need to File Schedule K-1?

- How to File a K1 Tax Form for an S Corp

- Who Receives Schedule K-1?

- What Do Shareholders Do With Schedule K-1?

- Important Dates for Filing Schedule K-1

S corp taxes can be complicated, so we strongly recommend consulting with an accountant or other tax professional for help with filing your Schedule K-1s and various tax forms. Set up a free consultation to get started.

What Is a Schedule K1 Tax Form?

A pass-through entity’s profits and losses pass through the company to its owners. Pass-through entities use Schedule K-1 to report their partners’ or shareholders’ ownership interest in the company to the Internal Revenue Service (IRS). This tax form also reports on how the company allocates its income, deductions, and credits to each partner or shareholder.

Pass-through entities that must file Schedule K-1 include:

- Partnerships

- Limited Partnerships

- S Corporations

- Trusts and Estates

- Certain Exchange-Traded Funds (ETFs)

Schedule K-1s differ based on the type of business entity filing them and come in three types. However, all three versions detail a business owner’s or beneficiary’s basis of ownership and share of income, deductions, and credits so they can accurately report this information on their personal tax returns.

- Partnerships, limited partnerships, and certain ETFs use Schedule K-1 (Form 1065), Partner’s Share of Income, Deductions, Credits, etc.

- Trusts and estates use Schedule K-1 (Form 1041), Beneficiary’s Share of Income, Deductions, Credits, etc.

- S corporations use Schedule K-1 (Form 1120S), Shareholder’s Share of Income, Deductions, Credits, etc.

For help with your S corp tax return, you can schedule an appointment with an accountant to get started today.

Do I Need to File Schedule K-1?

The IRS requires S corporations to file Schedule K-1 for each of their shareholders along with their S corp tax return (Form 1120S) every year. S corps also must send their shareholders a corresponding copy of their individual Schedule K-1 by the due date of the company’s Form 1120S.

All S corps must file Form 1120S and the corresponding Schedule K-1s regardless of whether they have any income in a given tax year.

According to the IRS’s Instructions for Form 1120S, “A corporation or other entity must file Form 1120S if (a) it elected to be an S corporation by filing Form 2553, (b) the IRS accepted the election, and (c) the election remains in effect.”

S corp shareholders who receive a Schedule K-1 must use the information it provides to file their personal income tax return. If you receive a Schedule K-1 for any investments you have in partnerships, S corps, etc., you don’t need to submit that information to the IRS because the IRS will already have a corresponding copy on file.

How to File a K1 Tax Form for an S Corp

Your S corporation, or accounting professional, will need to fill out and file a Schedule K-1 (Form 1120S) for each shareholder.

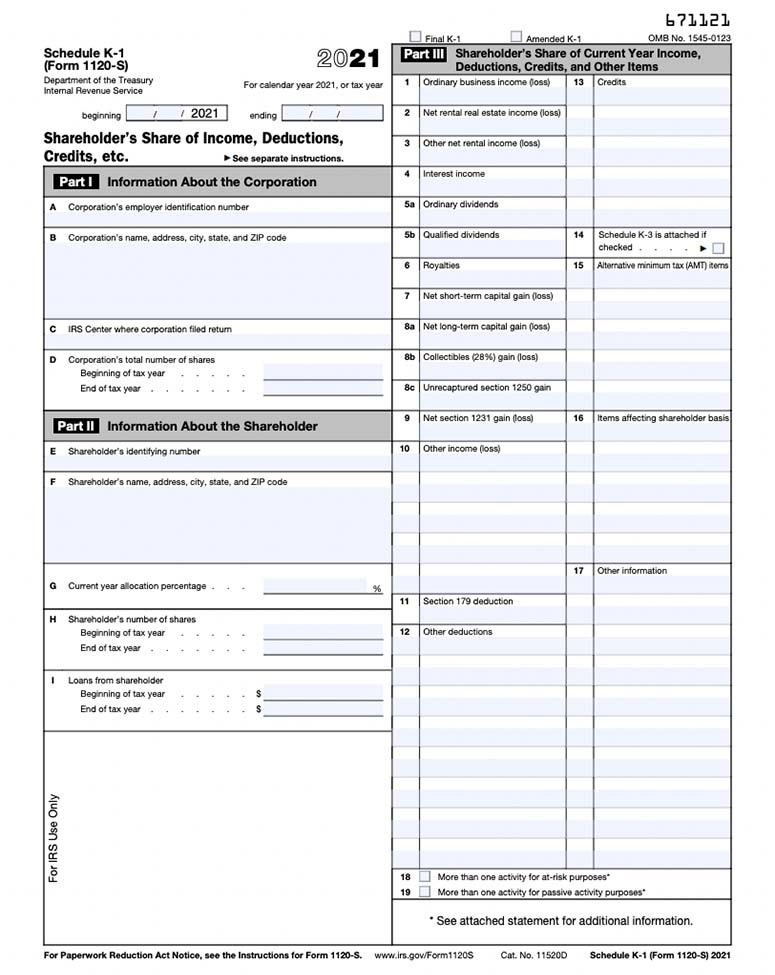

Schedule K-1 for S corporations has three parts:

- Part I: Information About the Corporation

- Part II: Information About the Shareholder

- Part III: Shareholder’s Share of Current Year Income, Deductions, Credits and Other Items

Part I asks for the corporation’s identifying information, including its name, address, and Employer Identification Number (EIN). It also asks for the S corp’s total number of shares at the beginning and the end of the year.

Part II asks for information about the shareholder, including their name, Social Security number, and equity in the S corp throughout the year.

Part III is where an S corp outlines a shareholder’s allocation of income, deductions, and credits for the IRS and each shareholder. It includes lines where an S corp can provide details on business income, rental real estate income, interest income, dividends, royalties, capital gains, collectibles gains, and other income.

Who Receives Schedule K-1?

The IRS requires S corps to send a Schedule K-1 to every one of their shareholders. S corporations must then file a corresponding copy for each shareholder with the IRS along with Form 1120S (an S corp’s federal income tax return).

This means the IRS will know how the business allocated it profits and losses among its owners. It’ll then look for that information to appear on each owner’s personal tax return.

Again, each shareholder must receive a copy of Schedule K-1, detailing their ownership interest and allocation of the company's income, deductions, credits, etc. — even if the S corp had no income or expenses for the year.

What Do Shareholders Do With Schedule K-1?

If you’re a partner or shareholder for a pass-through entity, you should receive Schedule K-1 for each company in which you have an ownership interest. You’ll then use the information on your Schedule K-1(s) to complete your personal income tax return.

Because pass-through entities like S corps don’t pay tax at the company level, the owners (or shareholders) are responsible for paying the tax on the business’s profits — even if they don’t take any distributions.

While most pass-through entities treat most business income as self-employment income, S corps treat their business income differently. Specifically, S corps pay their members a salary or wages for their work within the company. Those members must then pay tax on their salaries and wages, accordingly.

It can seem complicated and confusing to determine how to report income, deductions, and credits from Schedule K-1 (Form 1120S) on your personal tax return. For S corp shareholders, this form will break out their income into ordinary business income, rental real estate income, interest income, dividends, royalties, capital gains, collectibles gains, and other income (or losses).

Depending on the types of income a company receives, you may need to report income from your Schedule K-1 on Schedule B, Schedule D, Schedule E, or a number of other forms and schedules.

Important Dates for Filing Schedule K-1

S corporations must file Schedule K-1 along with their federal tax return (Form 1120S) by the 15th day of the third month following the end of the company’s fiscal year. This due date typically is March 15 for S corporations that follow the calendar year — unless March 15 falls on a weekend or holiday.

S corps that need more time to file Form 1120S and their Schedule K-1s must submit both an extension request and any anticipated tax payments by the tax return’s original due date — usually March 15.

By requesting an extension, an S corporation can delay filing its Form 1120S and Schedule K-1s for six months. However, it’s important to remember that shareholders need this information to file their personal tax returns so they’ll also need to file extensions.

Recommended: Most S corporations engage an accountant or other tax professional to help them complete their Schedule K-1s and federal income tax returns. 1-800Accountant offers a free consultation that can help you ensure you correctly prepare and file your tax forms.