What Is an S Corporation?

Last Updated: By TRUiC Team

An S corporation (S corp) is a tax designation that formal business entities like limited liability companies (LLCs) and corporations may elect. For many businesses, S corp status provides significant tax advantages.

An S corp’s tax structure is a variation of the pass-through taxation model in which a company’s profits and losses pass through to its owners while the business remains exempt from paying corporate income taxes.

S corp owners must pay themselves a reasonable salary and then treat the remainder of the business profits as distributions from the firm. In many cases, distributions provide a significant tax advantage for S corp owners.

Keep reading to learn more about:

- S Corporation Definition - What Is an S Corporation?

- S Corp Requirements

- S Corp Taxes

- S Corp Advantages and Disadvantages

- How to Become an S Corp

- How to File S Corp Taxes

- Should I Form an S Corp?

Recommended: If your business makes at least $60,000 in net earnings and you plan to take money out of it for your own use, S corp status may offer tax benefits. We recommend using a formation service like Northwest to get started.

S Corporation Definition - What Is an S Corporation?

As a tax designation that allows a corporation or LLC to pass its profits and losses through to its shareholders, S corps are governed by the Internal Revenue Service’s (IRS’s) Subchapter S regulations. The IRS defines S corporations as “corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes.”

Because S corp status is a tax designation LLCs or C corporations (C corps) may elect, an S corp isn’t a business structure. You must form an LLC or C corp before electing S corp status.

S Corp Requirements

To elect and maintain their S corp tax designation, an LLC or corporation must adhere to certain rules, including:

Ownership Restrictions

S corps may have up to 100 shareholders — all of whom must be US citizens, resident aliens, or certain types of estates, trusts, and tax-exempt organizations. No US partnership, US corporation, or non-US entity may own any shares in an S corp. Some specific types of businesses also can’t elect S corp status, such as financial institutions, insurance companies, and international sales organizations.

In addition, companies that earn 25% or more of their revenue from passive sources don’t qualify for S corp status if they accumulate earnings and profits for three or more years in a row.

Reasonable Salary Requirements

Because the IRS considers S corp owners as employees, it requires S corps to pay reasonable compensation to their owners “in return for services that the employee provides to the corporation before non-wage distributions may be made to the shareholder-employee.”

According to the IRS, reasonable compensation equates to “the value that would ordinarily be paid for like services by like enterprises under like circumstances.”

Payroll Requirements

Because S corp owners must pay themselves a reasonable salary, an S corp needs to run payroll for its owners and any other employees.

Managing payroll involves more than simply paying owners and employees. This process also requires tracking and recording non-salaried employees’ hours, calculating employees’ gross pay, determining deductions and credits, and withholding and paying taxes. It also requires additional bookkeeping and accounting tasks as well as filing and remitting tax payments to the IRS and the state.

For more on what payroll involves and how to set it up for your business, read our hiring guide and How to Choose the Best Payroll Service for Your Business.

Recommended: Having a reliable and easy-to-use payroll service can save your S corp time and money. Fill out this form below to get started with Paychex’s payroll service.

S Corp Taxes

The main advantage of electing S corp status is the potential to save money in taxes. To determine if S corp status is right for you, it’s important to understand how S corp taxes work.

S Corp Pass-Through Taxation

Like other pass-through tax entities, an S corp’s earnings pass through to its owners (or shareholders) so that its profits aren’t taxed at the company level.

In most pass-through entities (e.g., sole proprietorships, partnerships, and LLCs), all business profits pass through to the owners as self-employment income. This means the owners must pay personal income taxes and self-employment taxes on all of the business’s profits. But, unlike other pass-through entities, S corps must pay their owners a reasonable salary and distributions.

S Corp Reasonable Salary and Distributions Taxes

S corp earnings and losses pass through to business owners (or shareholders) in two different ways — both of which have tax implications.

Reasonable Salary

Because S corps must pay their owners a reasonable salary for any work they perform within the company, those owners must then pay personal income taxes and self-employment taxes on their salaries.

To comply with this reasonable salary requirement, S corps must determine, report, withhold, and pay all employment and withholding taxes on their owners’ salaries and earnings. S corps are also responsible for filing and paying federal unemployment insurance along with any state-specific unemployment insurance or other taxes.

Distributions

After S corps pay all required salaries, they pass any remaining profits through to their owners (or shareholders) as dividends or capital gain distributions in proportion to their ownership stake in the business. These distributions are only subject to personal income taxes, so S corp owners don’t have to pay self-employment taxes on them.

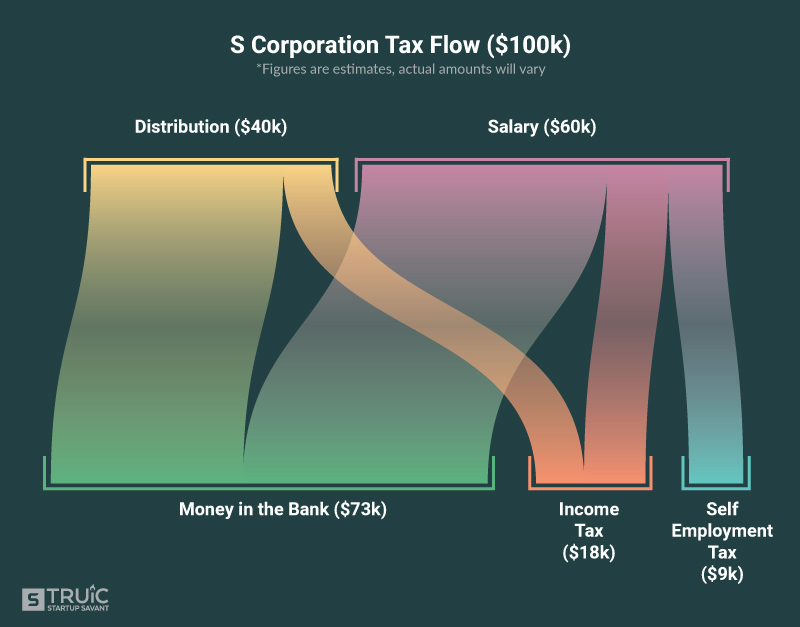

Each owner must then pay personal income tax on their own salary and distributed portion of the company’s earnings. Below is an example of S corp tax flow for an S corp with $100,000 in profits:

S Corporation Advantages and Disadvantages

For some businesses, the S corporation tax designation can prove quite advantageous. Before you decide if S corp status is right for your business, consider these benefits and drawbacks.

S Corp Advantages

For many businesses, S corp status combines the advantages of an LLC or corporation with a hybrid pass-through tax treatment. The key benefits S corp status may provide include:

- Pass-through taxation

- Profits not subject to corporate income tax

- Profits distributed and taxed as dividends or distributions

- Losses passed through to shareholders

- Potential tax savings

- Can issue stock

S Corp Disadvantages

Despite its potential benefits, S corp status comes with several drawbacks:

- Ownership Restrictions (i.e., type and number of owners)

- Can only issue one class of stock

- More complex accounting and tax reporting

- Must pay reasonable compensation and run payroll

- Must distribute profits and losses according to shareholder equity

- Greater IRS scrutiny

- Some states tax S corps as corporations

How to Become an S Corp

Forming an S corp is relatively easy if you already organized your business as an LLC or corporation. If not, you’ll need to form an LLC or corporation in order to elect S corp status. Just follow these simple steps:

1. Form a formal business entity (LLC or corporation). Because an S corp is a tax designation and not a formal business structure, the first step in becoming an S corp involves forming an LLC or corporation.

To learn more about which business structure is right for your company, read our How to Choose a Business Structure guide.

If you don’t already have a formal business structure, we recommend first forming an LLC and electing S corp status. Check out our How to Start an LLC guide or use a trusted LLC formation service to get started.

2. Obtain an EIN. Your business will need an Employer Identification Number (EIN) before it can elect S corp status. The IRS uses this nine-digit number to identify and track a company for tax purposes. Think of it as a Social Security number for your business. You’ll also need an EIN to open a business bank account, hire employees, and file taxes.

Obtaining an EIN from the IRS is fast, simple, and free when you apply online. Or, you can complete and submit an EIN application (Form SS-4) by fax, mail, or phone.

Want to obtain an EIN for free? Read our How to Get an EIN guide.

3. File Form 2553. Finally, you must complete and file Form 2553 to elect S corporation status with the IRS.

For more details, check out our How to Start an S Corp guide.

Ready to start your S corp? Many businesses turn to formation services to easily form their business and apply for an S corp tax designation. Using a formation service can help streamline the process and get your S corp ready to go quickly.

How to File S Corp Taxes

S corp taxes are more complex than filing taxes for a single-member or multi-member LLC because S corps must meet several additional tax-filing requirements.

At a minimum, an S corp is usually responsible for:

- Withholding, reporting, and paying its employees’ Social Security, Medicare, and personal income taxes as well as paying the employer’s share of Social Security and Medicare taxes quarterly using Form 941.

- Filing and paying the federal unemployment tax (FUTA) annually using Form 940.

- Reporting all salaries and wages paid during the year to both its employees and the IRS, using the corresponding copies of Form W-2.

- Completing and filing an informational return with the IRS to report income, deductions, credits, profits, and losses using Form 1120S.

- Filing (with the IRS) and reporting to each shareholder their allocation of the company’s profits and losses on Schedule K-1 (Form 1120S).

S corp owners must then report their business income and profits on their personal income tax returns, using the information provided on their Form W-2 and Schedule K-1. Specifically, S corp owners must:

- Report any wages, salary, and bonuses they received from the company (as reported on Form W-2) on their personal tax return (Form 1040).

- Report and pay personal income tax on any dividends or capital gains distributions allocated to them (as indicated on their Schedule K-1) on Schedule E of their personal income tax return.

Should I Form an S Corp?

Choosing to form an S Corp will depend on several factors, including your eligibility to do so and if the benefits outweigh the costs.

For many LLCs and corporations, electing S corp status can prove beneficial because the owners avoid paying self-employment taxes on their distributions while the pass-through taxation model prevents the double taxation faced by corporations.

However, S corps have limitations on the amount and type of shares they can issue and who can hold those shares. They also have more complex legal and tax reporting procedures as well as typically higher accounting, legal, and payroll costs.

So, the optimal time to elect S corp status is when the financial benefits are sufficient to warrant bearing the burden of the added expenses involved in establishing and operating an S corp.

It’s usually advantageous for solo entrepreneurs to elect S corp status when they anticipate $60,000 to $100,000 in annual profits because the tax savings typically justify the added costs.

If you still have questions about whether the S corp tax designation makes sense for you, consult with an accountant and/or tax professional about how it’ll impact you and your business.