S Corp vs. C Corp vs. LLC

Last Updated: By TRUiC Team

When starting a business, most entrepreneurs will need to decide on a formal business structure. The main options include a limited liability company (LLC) and a C corporation (C corp) — and some owners of LLCs or C corps may even elect to be taxed as an S corporation (S corp). While LLCs and C corps are formal business structures, an S corp is a tax designation that may offer tax benefits for business owners looking to withdraw additional money from their companies.

Ready to form your business now? We recommend using a business formation service to save yourself the hassle and get your LLC, S Corp, or C corp up and running.

Choosing a Formal Business Structure

A formal business structure dictates how you can legally organize your business as well as the regulations and taxes it’ll face. It also can offer personal liability protection, tax benefits, greater opportunities for growth, and increased credibility.

The two main types of formal business structures include:

- Limited Liability Companies (LLCs): Owned by its members, an LLC is the simplest way of structuring your business to protect your personal assets in the event your business suffers a loss. LLCs also offer unique tax benefits.

- Corporations (C corps): Owned by its shareholders, a corporation also offers personal liability protection. But, it’s more complex to maintain than an LLC. Setting up a corporation is often best when you need to attract outside investors.

While informal business structures also exist (e.g., sole proprietorships and general partnerships), LLCs and corporations benefit from the distinct advantages of having a formal, legal business structure.

An S corp, unlike an LLC or C corp, is a tax designation — not a formal business structure. Existing LLCs and C corps may elect to have S corp status. Skip ahead to S corps.

Advantages of Having a Formal Business Structure

Organizing your business with a formal business structure comes with multiple benefits, including:

- Personal Liability Protection: Formal business structures like LLCs and corporations provide personal liability protection. This safeguards your personal assets (e.g., your car, house, and bank account) in the event someone sues your business or it defaults on a debt.

- Tax Benefits: Formal business structures have options to customize their tax structure, allowing businesses to use the best tax strategy for their circumstances.

- Credibility and Consumer Trust: LLCs and corporations generally earn more trust from both banks and consumers than informal business structures like sole proprietorships. This can not only impact a business's ability to secure loans, but also affect its marketability.

- Growth Potential: Formal business structures tend to have more opportunities for growth due to the advantages offered by their personal liability protection, tax benefits, and increased credibility.

Choosing Between an LLC and a Corporation

While both LLCs and C corps offer the benefits of a formal business structure, they differ in several ways. LLCs typically are easier to form, simpler to operate, require less paperwork, and don’t need as much administrative overhead. While a corporation is more complex, it’s the preferred structure if you plan to seek investors and venture capital funding. In general, business owners can always change their business structure at a later stage. But, the adaptability and simplicity of forming an LLC makes it an ideal choice for a new small business.

When to Form an LLC

Many businesses start as an LLC, and it’s likely the best structure for your business if:

- You’d benefit most from an easy-to-maintain business structure.

- You don’t need to attract investors.

- You plan on investing most of your profits back into your business each year.

Benefits of an LLC

In addition to personal liability protection, tax benefits, greater opportunities for growth, and increased credibility, LLCs also offer some unique benefits over corporations.

- LLCs are easy to start and maintain. LLCs have a simple business structure that requires less paperwork and administrative overhead than a corporation.

- LLCs enjoy pass-through taxation. LLCs don’t pay taxes directly. Instead, the business’s net income (its profit minus its expenses) passes through to the LLC owners’ individual tax returns. LLC owners (also called members) then use their individual tax returns to pay the income tax and self-employment payroll tax — Federal Insurance Contributions Act (FICA) and Medicare — on the LLC’s profits. This means paying taxes for an LLC requires less paperwork and time than for a corporation.

Pass-through taxation also ensures a business’s profits are taxed only once at the owners’ personal tax rate. In contrast, corporate profits are taxed first at the corporate tax rate and then again at shareholders’ personal rate when distributed to them as a dividend — a process known as “double taxation.”

To learn more about taxation, read our LLC vs. Corporation Taxes guide.

Ready to form your LLC? Our How to Start an LLC guide will walk you through the LLC formation process. Or, you can save yourself the hassle and use an LLC formation service to get your LLC up and running quickly.

When to Form a Corporation

A corporate business structure may work best for you if:

- You plan on seeking investors and venture capital funding

- You need to carry significant profits over from one tax year to the next

Benefits of a Corporation

Beyond personal liability protection, tax benefits, greater opportunities for growth, and increased credibility, corporations offer some distinct benefits vs. LLCs.

- Corporations are more attractive to investors. If your business plans to seek external funding, most investors and venture capital firms will require you to be a corporation. Why? Investors in corporations only pay taxes on the dividends they receive while investors in LLCs must pay taxes every year — even if they don’t receive a distribution — due to the nature of pass-through taxation. As a result, investors prefer C corps to ensure they only pay taxes on money they get back from their investments.

- Corporate profits carry over from tax year to tax year. While corporations may pay more taxes than LLCs, they have advantages if you plan to carry money over from one year to the next. Profits not reinvested into the business and carried over into the next year are taxed at the corporate tax rate of 15%. Given pass-through taxation, an LLC member’s tax burden would be greater than 15% because they must pay FICA taxes as well as federal and state income taxes.

If a business owner anticipates needing to carry a significant amount of profit into the next tax year, they should consider the financial benefits offered by a corporation.

If you’re ready to form your corporation, check out our step-by-step guide on How to Start a Corporation. Or, we recommend using a business formation service to make the process quick and easy.

S Corp Tax Designation

Unlike LLCs and C corps, an S corp is not a formal business structure. An S corp is a tax designation that alters how the Internal Revenue Service (IRS) taxes your business entity. An LLC or C corp can elect to be taxed as an S corp, which could potentially save business owners money if they plan to take additional distributions to pay themselves vs. reinvesting profits back into the business.

The IRS classifies S corp business owners as employees for tax purposes. As such, S corps must pay their owner(s) “reasonable compensation” based on IRS guidelines and current industry standards and, as a result, run payroll.

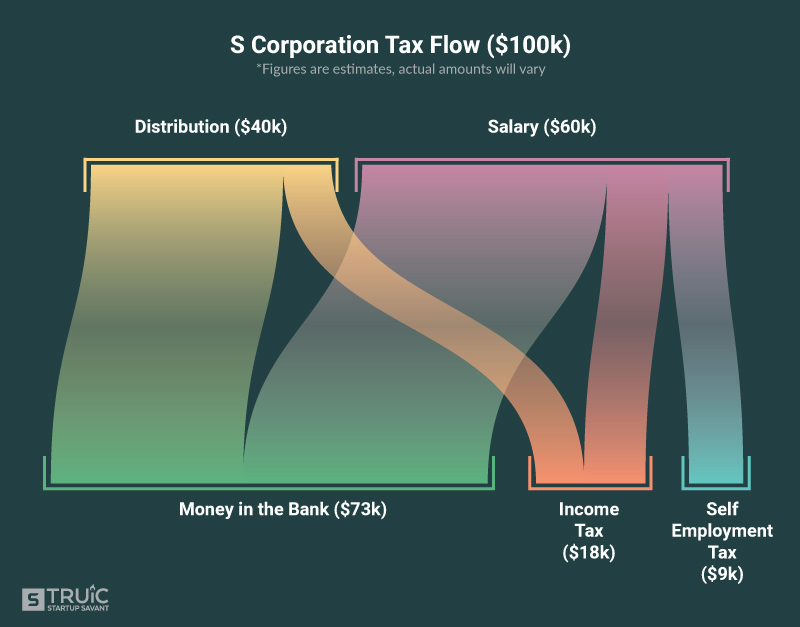

S corp owners receive money from a combination of their “reasonable salary” and distributions from the company. While they must pay both income taxes and self-employment payroll taxes on their reasonable salary, S corp members don’t have to pay self-employment taxes on distributions. This can potentially save S corp owners money on their taxes.

Tax Advantages of an S Corp

Like an LLC, S corp owners benefit from pass-through taxation. This means the business’s income, profits, credit, and losses are taxed at an individual level on the shareholder’s personal income tax return. As a result, S corps avoid the double taxation associated with C corps.

S corp owners also benefit from not having to pay self-employment taxes on distributions. To better understand this, it’s important to understand how default LLC and S corp taxes differ.

- Default LLC Taxes: Due to pass-through taxation, LLC owners pay income taxes and self-employment payroll taxes (i.e., FICA and Medicare taxes) on the company’s net profit and any distributions that pass through to their individual tax returns. This means LLC owners must pay the following taxes on their individual tax returns:

-

- Self-employment taxes

- Income tax

- S Corp Taxes: S corp owners also enjoy pass-through taxation, but, unlike LLC owners, they receive a salary — subject to both self-employment and income taxes. However, any distributions S corp owners receive (i.e., additional money drawn from the business’s earnings or net profits) are subject only to income tax. Therefore, S corp owners must pay taxes on the following:

-

- Their reasonable salary (self-employment and income taxes)

- Their distributions (income tax)

When Is It Best to Choose LLC Default Taxation Status?

Many businesses may choose to stick with the LLC default taxation status. If you don’t currently run payroll or want to keep investing most of the profits back into your business, then the LLC default status is probably your best option.

- If you plan to reinvest profits back into the business: Only an LLC’s net income (its profits minus its expenses) qualifies for pass-through taxation. That means the net income passing through to an owner’s personal tax return may be fairly small if an LLC invests most of its profits back into the business. If an owner doesn’t take large distributions and wants to reinvest most of the profits back into the business, the LLC default status is likely best. Why? Because the main advantage of electing S corp status is paying less tax on distributions, which is money taken out of the business for personal use. If you don’t take much money out of the business for personal use, then you lose out on the benefits of an S corporation.

- If you don’t want to run payroll: Because the IRS considers S corp owners as employees who must receive a reasonable salary, an S corp has to run payroll. If a single-member LLC doesn’t already do this and has no need to hire additional employees, the added expense of running payroll may not be worth the benefit of electing S corp status. In this case, LLC default status would again be the best option.

When Is It Best to Elect S Corp Status?

In order to reap the tax benefits of S corp status, a business must:

- Earn enough in net profits to pay its owners a “reasonable salary” while also taking out $10,000 in annual distributions.

- Ensure the additional payroll and accounting costs don’t outweigh the tax advantages.

- Meet S corp requirements and restrictions.

Net Profit, Reasonable Salary, and Distributions

To benefit from S corp tax status, a business must have enough profit left over (i.e., net profit) to pay its owner(s):

- A reasonable salary

- At least $10,000 in distributions

A reasonable salary is any salary you’d pay someone to do the same job. Glassdoor and the US Bureau of Labor Statistics are a good place to start researching current salaries for specific jobs.

Because an S corp owner’s salary is taxed at a higher rate than their distributions, it may seem tempting to pay them less in salary and have them receive large distributions. But, the IRS closely scrutinizes S corps and stipulates that owners’ salaries must be “reasonable” so it’s important for their duties to align with their salaries.

In addition to their reasonable salary, S corp owners can generally only achieve the tax benefits offered by this tax designation if they can take out $10,000 a year in distributions. If a business owner chooses to reinvest almost all of the profits back into the business or can’t afford to take $10,000 of distributions in addition to their reasonable salary, then it’s likely not worth electing S corp status.

S corp taxation can be complex. We recommend speaking with an accountant to learn whether or not S corp status can benefit you.

Payroll and Accounting Costs

Because the IRS considers S corp owners as employees, an S corp must run payroll. If a single-member LLC doesn’t currently run payroll and wants to elect S corp status, the owner must first determine if the tax benefits will outweigh the additional administrative costs.

Maintaining proper accounting and payroll for an S corp is best left to a professional, and these yearly expenses may, in some cases, cancel out the potential tax savings for a small business.

Recommended: Having a reliable and easy-to-use payroll service can save your S corp time and money. Fill out this form below to get started with Paychex’s payroll service.

S Corp Requirements and Restrictions

To elect S corp tax status, the IRS requires legal business entities to:

- Operate as a domestic corporation or LLC

- Have no more than 100 shareholders – all of whom must be US citizens or permanent resident aliens

- Issue only one class of stock

- Restrict their ownership to private individuals, certain trusts, and estates (S corp owners can’t include business entities like partnerships, LLCs, corporations, or some trusts.)

- Secure agreement from all shareholders to elect S corp status

- Record their minute meetings

Unlike LLCs, but similar to C corps, S corps may issue stock. However, they can issue only one class of stock to their shareholders.

Ready to form your S corp today?

Use a formation service to get your S corp up and running in no time.

Which Is Best: LLC, C Corp, or S Corp?

The best strategy for any business will depend on the situation. We recommend small business owners choose a formal business structure (e.g., an LLC or a C corp) in order to benefit from limited liability risk protection, tax advantages, enhanced credibility, and increased growth opportunities. If your business doesn’t need to attract investors or venture capital funding, then an LLC might be the best option because it’s easier and cheaper to form. An LLC also tends to offer more tax advantages than a corporation due to its pass-through taxation.

Because an S corp is a tax designation — not a business structure — business owners must form an LLC or C corp before electing S corp status. S corps benefit from pass-through taxation, but don’t have to pay self-employment taxes on distributions paid to their owners. This could potentially save a business owner a significant amount in taxes.

Still not sure if an S corp is best for you? Check out our S corp calculator to find out how much you could potentially save by switching your business to an S corp.