Incorporating your startup means establishing your business as a formal legal entity, separate from its founders or owners. When you incorporate your business, you register your startup with your state, and it becomes its own legal entity.

In this guide, we will cover the ins and outs of incorporating and walk you through the startup incorporation process step-by-step.

Recommended: Firstbase offers the tools you need to launch and grow your company — all in one platform. Incorporate your startup with Firstbase ($399 one-time fee).

Startup Incorporation Guide

Incorporating a startup may seem complex and scary; however, it is a necessary step in founding a startup, especially a startup with high growth aspirations or that is seeking funding from venture capitalists.

In this guide, we break down the process step-by-step and help you navigate the resources and tools you may need to incorporate a startup.

Continue reading, or simply have a professional service incorporate your startup for you:

Firstbase ($399 one-time fee)

Note that forming a corporation is recommended for startups, especially those seeking outside investors, while forming a limited liability company (LLC) is recommended for small businesses that do not plan to raise outside investment. You can learn more about which legal structure is right for you by reading our guide, Should I Form an LLC or Corporation for My Startup?

Here are the six steps to incorporating a startup:

Step 1: Choose a Business Entity

Step 2: Select a Tax Structure

Step 3: Choose a Location

Step 4: Create a Founders' Agreement

Step 5: Form Your Business

Step 6: Maintain Your Corporate Veil

Step 1: Choose a Business Entity

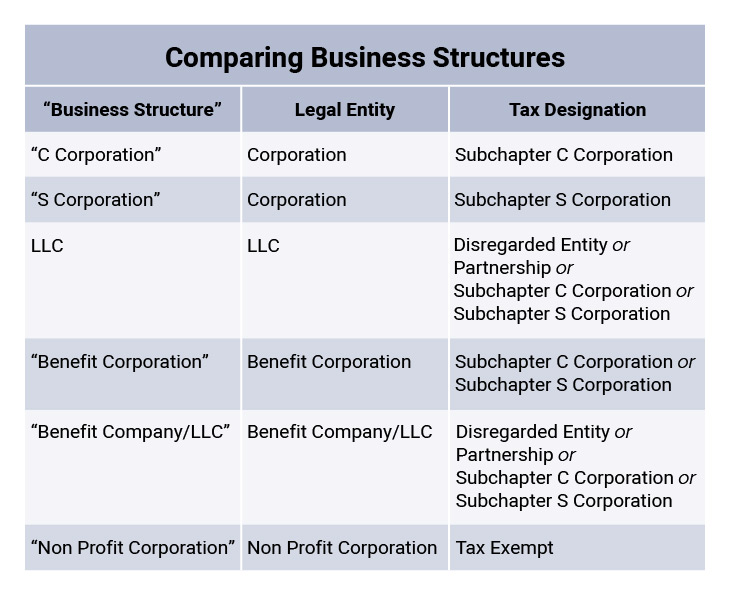

One of the first and most important decisions you will need to make when incorporating a startup as a formal legal entity is to decide your business structure.

This is actually a series of two distinct yet related decisions — choosing the type of legal entity you will operate under (i.e., the legal form of your startup) and selecting a tax designation. Because the type of tax structure available to you depends on the type of legal entity you choose, these decisions are closely intertwined.

There are several types of formal legal structures for startup ventures:

- Limited liability companies (LLCs)

- Corporations

- Benefit Company/LLC

- Benefit Corporations

- Nonprofit Corporations

Read our full guide on How to Choose a Business Structure.

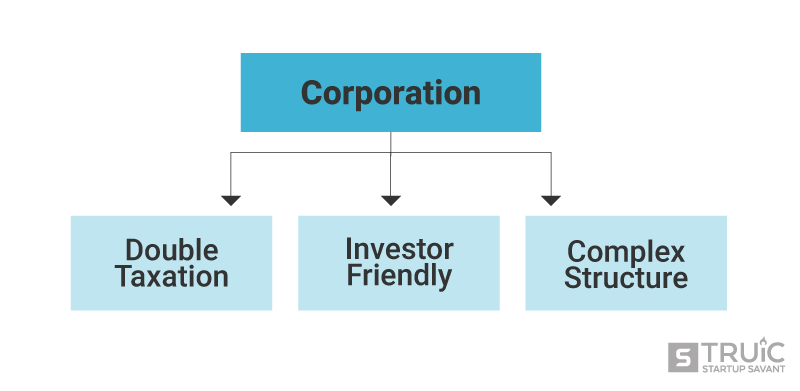

Corporation (C Corporation)

A corporation is a legal business entity that is owned by shareholders, run by a board of directors, and created through registration with the state. Corporations are more formal, less flexible legal entities, and they are required to follow more complex operating procedures than LLCs.

Although corporations get a bad rap for double taxation, corporations can choose among several tax treatments and often provide tax benefits for its shareholders.

Corporations also make it easy to issue and transfer ownership and are the only type of organization that can go public and issue an initial public offering (IPO).

For all of these reasons, corporations are the preferred — and often only acceptable — method of organization for investors.

Pros

- Personal liability protection

- Choice on taxation (corporate taxation by default)

- Unlimited number and types of stockholders (C corp only)

- Funds, trusts, and organizations can invest (C corp only)

- Earnings can be retained in the corporation

Cons

- More complex and require more paperwork

- Less management/ownership flexibility

- Profits may be subject to double taxation

Choose C Corp If:

- You want to retain and reinvest profits

- You plan to build a large company with outside investors

- You are looking to raise institutional or venture capital

- You plan to take the company public

Limited Liability Company (LLC)

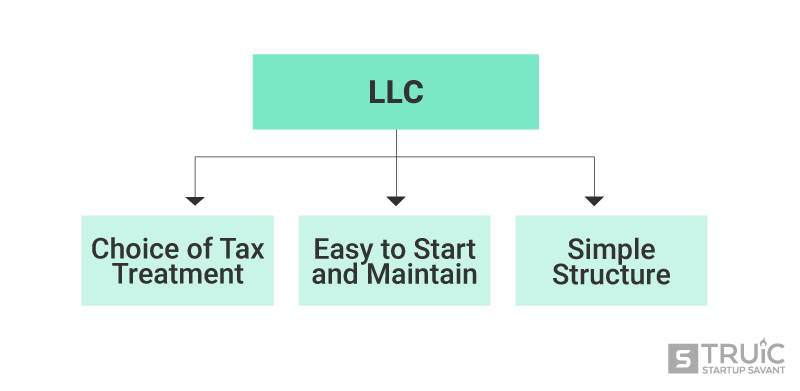

LLC stands for limited liability company. LLCs are simple business structures that provide liability protection for business owners and their personal assets.

LLCs are easy to start and maintain, offer management and ownership flexibility, and have several options for how they choose to be taxed, making them a popular choice for a wide variety of business types and sizes.

For more information on LLC taxation, read our LLC Tax Guide.

If you are ready to form your LLC, start today with the help of our free Form an LLC guide or with one of these trusted LLC formation services.

Pros

- Personal liability/asset protection

- Simple and easy to start

- Management/ownership flexibility

- Choice of taxation (pass-through taxation by default)

- Losses can be passed through to owners

Cons

- Difficult to raise capital

- Can only accept investments from individuals, not funds, trusts, or organizations

- Must pay taxes on pass-through income even if there are no disbursements

Choose an LLC If:

- You plan to start a small owner-managed business

- You desire flexibility in designating ownership in the business

- You are not seeking angel or venture capital investments

Benefit Companies and Benefit Corporations

If your startup has a social mission, the newest alternative legal structures that may be available to you are the LLC benefit company and the benefit corporation (B corp).

Benefit LLCs and benefit corporations are essentially the same as LLCs and C corps. They are still for-profit entities with members or shareholders. However, benefit LLCs and B corps have special provisions in their operating agreements or Articles of Incorporation that specify a purpose for the business outside of maximizing shareholder value.

Best Incorporation Services

Recommended: Hiring a professional service will help simplify the incorporation process for you. Check out our review of the best online incorporation services for startups by clicking below!

Step 2: Select a Tax Structure

There are four primary tax structures available to limited liability companies and corporations.

Disregarded Entity

Like a sole proprietorship, single-member LLCs can elect to be taxed as a disregarded entity. In fact, this is the default tax structure for LLCs with only one owner. The disregarded entity tax structure is a pass-through tax structure where the profits pass directly to the owner and are reported as self-employment income on his or her personal tax return.

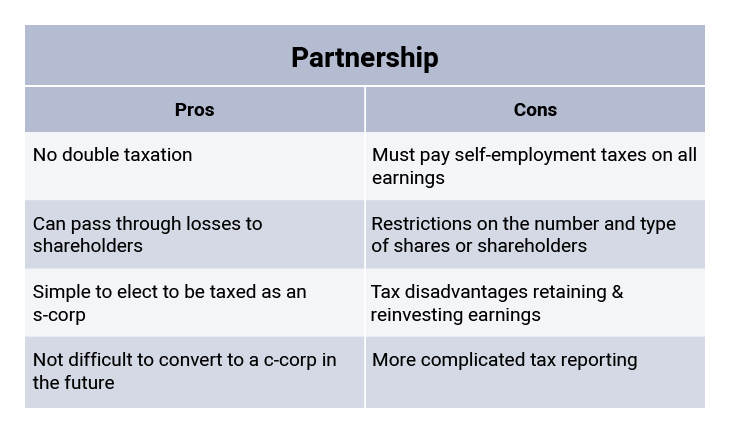

Partnership

Multi-member LLCs default tax structure is the partnership tax structure. The partnership tax structure is a pass-through tax structure for partnerships and multi-member LLCs where the profits pass directly to the owners and are reported as self-employment income on each member's personal tax return.

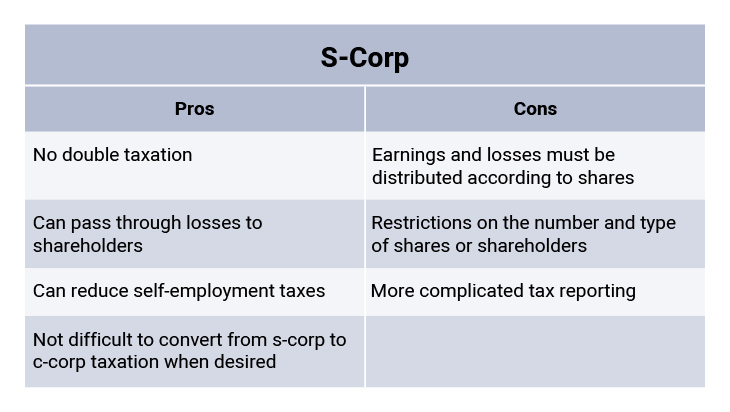

S Corp

The S corp tax structure is a hybrid pass-through tax structure where an LLC or corporation's income or losses are passed-through to its shareholders for tax purposes. This means an LLC and C corp that elects to be taxed as an S corp do not pay corporate income tax. Rather, income to S corporation owners is divided and taxed in two parts — salary and distributions.

If any of the owners of an S corporation also manage or are employees of the organization, S corp tax designation requires that they must pay themselves a fair salary (and the appropriate taxes be withheld) through the corporation.

Unlike a partnership’s passthrough taxation, any profits of an S corporation over and above the owners’ salary are treated as a distribution rather than as self-employment. Thus shareholders pay tax on the capital gains that are passed through to them but do not pay self-employment tax on the distribution portion of the proceeds.

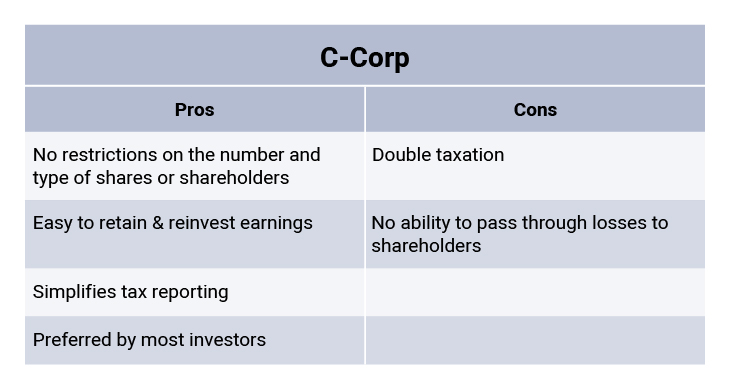

C Corp

The C corporation tax structure taxes the corporation on their profits less any deductions, credits, or losses. The current top corporate tax rate is 21%. The owners or shareholders of the C corp then only pay income tax on any dividends issued by the corporation at the preferred capital gains tax rate.

C corporation tax designations simplify tax reporting for the company and shareholders alike. They also make it easy to retain and reinvest earnings in the company, as shareholders only pay taxes on dividends distributed by the corporation. It is clear from these reasons alone why investors prefer to invest in C corporations.

Putting It All Together

Choosing the right type of legal entity and tax designation depends on the unique characteristics and needs of your business, and these may even change over time. Take the time to assess your current and future needs and which structure suits your company best.

Step 3: Choose a Location

Once you have chosen among the legal entities and tax structures, you will need to decide where to incorporate. Most startups incorporate in one of three states: their home state, their investors' or venture capitalists' state, or Delaware.

One of the principal reasons companies incorporate in Delaware is its exceptional court system and well-defined corporate law. Corporate law cases in Delaware are decided by a special court for corporations known as the Court of Chancery. The Court of Chancery handles only corporate cases, and cases are decided by a judge who is an expert on corporate law, not a jury. The special Court of Chancery and the judges’ expertise on corporate law has led to well-defined corporate law with a long history of decisions and legal precedence.

Another reason that entrepreneurs and investors prefer to incorporate in Delaware is the flexibility in corporate structure. Corporations in Delaware can include just one person who serves as officer, director, and shareholder. Directors, officers, and shareholders also do not have to be residents of Delaware and do not have to be reported to the state, meaning that they can remain anonymous if they wish.

Entrepreneurs and investors also often prefer to incorporate in Delaware because of its tax laws. There is no corporate income tax in Delaware (although there is a franchise tax on the value of shares), and shareholders who do not live in Delaware do not have to pay tax on shares in the state.

However, there are a number of drawbacks to incorporating in Delaware. First, filing fees to incorporate in Delaware are higher than many states. Also, although Delaware has no corporate income tax you, will have to pay a franchise tax in Delaware and may have to file and pay income taxes and franchise taxes in the states you do operate in. This means that many businesses will see no real tax benefit and may even end up paying more in taxes.

Step 4: Create your Founders’ Agreement

If your startup has multiple founders, a founders’ agreement should be drafted in the earliest days. The founders’ agreement lays out the roles, responsibilities, liabilities, ownership, and vesting schedules among the co-founders.

Founders’ agreements should address any possible issues that may arise concerning ownership, contribution, and decision-making power of the founders. The ideal founders’ agreement should lay out:

- Equity

- Vesting

- IP Ownership

- Founders’ Roles

- Decision Making

- Capital

- Issuance of Shares

- Non-Competes

- Non-Disclosure

- Founders’ Exits

When going through the formal steps to incorporate a startup, the framework laid out in your founders’ agreement is further defined and expanded upon in your LLC or corporation formation documents.

Consider hiring a lawyer to help draft or review your founders’ agreement. Read our guide on how to find a startup lawyer for information on finding the right attorney for your startup.

Step 5: Form Your Business

Once you have chosen a legal entity, tax structure, and location, you are now ready to form your business. Many of these steps are the same whether you are forming an LLC or a corporation. For example, no matter your legal entity type, you will need to name your business, appoint a registered agent, file formation documents, and get an employer identification number (EIN) from the Internal Revenue Service (IRS).

Read on to find out all of the steps you need to take to form a corporation or form an LLC.

Form a Corporation

Here are the steps to form a C corporation:

- Name Your Corporation

- Choose a Registered Agent

- Choose Initial Directors and Share Structure

- File Formation Documents

- Get an EIN

Read our full guide on how to start a C corporation or hire a professional service.

Form an LLC

Here are the steps to start an LLC:

- Name Your LLC

- Choose a Registered Agent or Registered Agent Services

- File LLC Formation Documents

- Create an LLC Operating Agreement

- Get an EIN

Read our full guide on how to form an LLC or hire a professional service.

Step 6: Maintain Your Corporate Veil

A corporate veil is a legal concept that the C corporation is a separate legal entity from its members or shareholders. This is the aspect of a corporation that provides personal liability protection for the members or shareholders of the corporation.

To establish and retain liability protection, the business and its owners must maintain a corporate veil. This means registering your business correctly and filing the right documents, maintaining separation between the corporation and its owners, keeping your corporate records updated, and filing required documents and quarterly, biennial, and annual reports on time.

Separate Business and Personal Assets

The first thing you need to do to establish and maintain a corporate veil is to separate business and personal assets. This includes opening separate business bank accounts, business credit cards, and building business credit.

Business Bank Account

A business bank account helps you separate your business and personal finances, adds professionalism and legitimacy to your new venture, and helps prevent piercing the corporate veil.

The first accounts you will need to open are a business checking account and a business savings account. This is the first step in separating your business and personal finances.

Read our review of the best bank accounts for startups and entrepreneurs to help you choose the right business bank account for your company.

Business Credit Cards

If you find yourself relying on credit cards as a source of funding or to provide that extra financial flexibility, you will need to open a business credit card rather than relying on your personal cards in order to keep your business and personal accounts separated.

Business credit cards are an important source of funding for startups and small businesses and can provide some financial flexibility in between funding cycles, during slow periods, or for unexpected expenses.

Read our guide to the best business credit cards to find the right business credit card.

Building Business Credit

Building business credit involves establishing your business’s fundability, getting listed with business credit bureaus like Dun & Bradstreet, and establishing credit lines while keeping them in good standing.

Maintaining Corporate Records and Filing Reports

To establish and retain your corporate veil, you will also need to maintain accurate corporate records. This involves setting up and managing your accounting and producing and submitting accurate financial statements and reports.

There are a number of options for managing your accounting, such as hiring a bookkeeper or accountant or using small business accounting software.

Maintaining the legal status and corporate veil of your LLC or corporation will also require you to file the required financial documents and reports. In some states, you will be required to file an annual report or reports with your state. You may also be required to file quarterly, biennial, or annual reports with taxing agencies or with your owners or shareholders.

Take Action

There are several startup incorporation options available depending on your needs:

DIY

Many founders form their LLC or corporation on their own. Incorporating yourself saves money, which is always a concern for cash-strapped startups.

While LLCs are relatively easy to form yourself online, corporations are a little more complex but can still be accomplished by resourceful startup founders.

The formation requirements for LLCs and corporations vary by state, so you will need to check with your state’s Secretary of State (or other appropriate agency) for the correct formation documents, procedures, and filing fees for incorporating a startup.

Read our state-by-state guide on how to form an LLC or how to form a corporation for more information on incorporating in your state.

Use a Startup Incorporation Service

Third-party, online incorporation services can help you complete your formation documents or can handle the entire business formation process, saving you time and money and allowing you to focus on running your business.

Each incorporation service has its own sets of affordable features (e.g., EIN and registered agent services) and pricing for your business structure (e.g., corporation, single-member LLC, multi-member LLC, etc.).

We reviewed and ranked the top incorporation services. To find out which is right for your business, read our guide on the best incorporation services.

Hire a Lawyer

While it is possible to incorporate without a lawyer (especially if you choose to form an LLC), it is recommended to at least consult a lawyer when incorporating your startup. Startup lawyers can help you understand the complexity surrounding incorporating, business structure options, choosing your tax treatment, choosing where to incorporate, and making sure all of the legal documents are in order.

About the Author