Startup Exit Strategies

Last Updated: By TRUiC Team

Exiting may not be the first thing on the mind of startup founders, but startup exits play an important role in strategic decision-making. That’s why it is important to understand what an exit strategy is and the types of exit strategies available for startups.

This article looks at what “exit strategy” means for startups as well as some common forms of exit strategies.

Skip Ahead:

What Is an Exit Strategy?

A startup exit strategy is a startup’s strategic plan to sell or make liquid stakeholders’ ownership in the company. While not every entrepreneur starts a business with the goal of selling it, when startups take on investors, they need to have a plan to allow founders and investors to exit the business when the time comes.

Everyone wants to cash in on their investments. Thus exit strategies are plans to exit the business or make the business liquid (take it public) to allow for founders, investors, and other stakeholders to exit.

In addition to selling a business or taking it public, other exits, planned and unplanned, may include mergers, family succession, and in some adverse cases, liquidation or bankruptcy.

Should Startups Have an Exit Strategy?

Should startup founders have an exit strategy? The answer is a resounding yes. Even if you have no intention of selling your company anytime soon, having an exit strategy is important for making strategic decisions.

When launching a startup, it may seem counterintuitive to begin to think about exiting the business already. However, an exit strategy doesn’t mean that a founder sells or even leaves the business. Some startup exits provide liquidity not just for the founder but also for their investors, who will at some point expect a way to recoup their investment.

For example, a startup founder could lead their startup to an IPO to raise a large round of capital to fund the next phase of growth without leaving their role in the company or selling any of their shares. Rather, in many cases, an exit strategy puts a mechanism in place where founders, investors, employees, and other stakeholders can sell their shares and cash in on their investment if and when they choose.

On top of that, any number of personal or economic reasons may arise that require you to step back from or sell your business. Health issues, a family crisis, an economic recession, or another pandemic may disrupt many founders' plans for their businesses. Having an exit strategy in place assures you that you are more prepared should such a situation arise.

How Do You Value a Startup for Exit?

Determining how much a startup is worth can be a complex process, and startup valuation can be as much subjective as it is objective.

In a mature business, there are a number of factors that are commonly used to determine valuation. These include the company’s assets, revenues, cash flows, and earnings.

However, many startups have limited physical assets and little to no revenues, cash flows, or earnings. Thus, startup valuation often relies on projected future earnings, market comparisons, or other criteria important to investors and the market.

The type of valuation you use will often depend on the industry, the stage of your startup, and the preference of the type of investors you are seeking. In many cases, a combination of valuation methods will be used to estimate a startup’s value more accurately.

Although you can perform many startup valuations yourself, if you are planning on raising capital or selling your business you may want to speak with a professional business appraiser for the most accurate value or for professional use.

Recommended: Read our guide on How to Value a Startup to learn more about startup valuation and how you can assess the value of your startup.

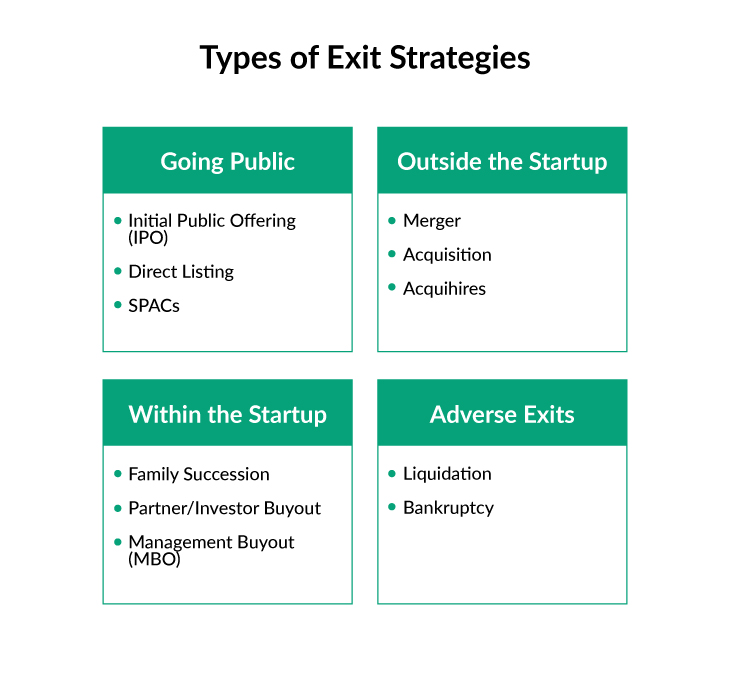

Types of Exit Strategies

Every startup founder will need to consider exiting their business at some point or another. In order to assess all of your alternatives, you will need to understand the various startup exit strategies your startup could take. Here are the primary types of startup exits available to startup founders:

Initial Public Offering (IPO)

An initial public offering, or IPO for short, is the process of taking the company public by selling shares on the publicly traded market. The IPO is the first (or initial) sale of a company’s shares on the public market.

While IPOs are not the right fit for every startup, they were the long-standing gold standard in startup exits. The popularity of IPOs has somewhat declined in lieu of alternative startup exits; however, as seen with numerous unicorn IPOs in 2021, such as ByteDance, SpaceX, and Stripe, they can also be extremely lucrative.

The IPO process is long and complex. Your startup will need to work with attorneys and investment bankers to make regulatory filings with the SEC, decide how many shares you will sell for your IPO, at what price they will be sold, and who to sell them to. The shares are then sold to a group of investors at the predetermined price, and, prior to the IPO, an auction is held to determine the initial listing price.

Once shares go on sale and begin trading publicly, founders and other shareholders can then sell their shares on the market, effectively exiting (or at least ending their ownership of) a startup. However, it is important to note that in many cases, there is usually a lock-out period where management and employees cannot sell their shares for a certain amount of time (usually 90 to 180 days).

Pros

- Usually produces the highest return

- Raises significant capital for the startup

- Reduces the cost of future capital

- Increased reputation and recognition

- Can use stock to attract talent and compensate employees

Cons

- Long and complex process

- High underwriter and attorney costs

- Regulatory, filing, and reporting requirements

- Mandatory transparency of finances

- Scrutiny from regulators and shareholders

- Small number of IPOs succeed

- Lock-out period restricts when founders and employees can sell stock or options

Direct Listing

Another way startups can go public is through a direct listing. A direct listing is similar to an IPO in that it is a first offering of the shares to the public; however, in a direct listing, there are no predetermined initial prices. Rather, there is an opening public auction in which the initial share price is set by the market.

Several notable companies have gone public via direct listing, including Coinbase, Roblox, and Spotify. In most cases, direct listings do not have a lock-out period; thus, founders, employees, and other stakeholders are not restricted on when they can sell their shares.

Pros

- Market participates in setting the starting price

- Raises capital for the startup

- Reduces the cost of future capital

- Less fees paid to attorneys and investment bankers

- Can use stock to attract talent and compensate employees

- No lock-out period

Cons

- Regulatory, filing, and reporting requirements

- Mandatory transparency of finances

- Scrutiny from regulators and shareholders

SPACs

Another recent popular vehicle for startup exits are special purpose acquisition companies (SPACs). SPACs are companies created with the purpose of finding a company to buy and bring public.

SPACs are currently one of the hottest trends on Wall Street and have become an increasingly common startup exit vehicle. More than 200 SPACs were launched in 2020. Well-known companies that have recently gone public through SPACs include DraftKings, Nikola Corporation, and Virgin Galactic.

In a SPAC deal, SPACs themselves launch an IPO to raise funds in order to buy a startup or other company. Once they have gone public and launched an IPO, SPACs then find a target company and work with that company to acquire it, effectively merging the startup with the SPAC and providing the startup with the SPACs public listing.

SPAC deals typically include a lock-out period, in many cases longer than those of an IPO.

Pros

- Quicker and simpler than an IPO

- Existing shares and options convert $ for $ into the publicly-traded company

- Reduces the cost of future capital

- Ability to use growth and financial projections to attract investors

- Can use stock to attract talent and compensate employees

Cons

- Regulatory, filing, and reporting requirements

- Mandatory transparency of finances

- Scrutiny from regulators and shareholders

- No new infusion of capital

- Lock-out period restricts when founders and employees can sell stock or options

Mergers and Acquisitions

Mergers and acquisitions (M&A) are two other common types of startup exit. Although they are usually lumped together, mergers and acquisitions are two distinct exit events. In an acquisition, one company is acquired (or purchased) by another. In a merger, the two companies converge into one.

Mergers

In a merger, both parties will still control a share of the ownership. There is usually not an infusion of capital, and a startup may or may not become more liquid for its founders and investors.

Startups usually explore mergers because both parties stand to benefit. Mergers may occur when two or more companies believe they can streamline operations, reduce costs, create economies of scale, or build some other competitive advantage.

When a merger occurs, the two companies are usually combined into and operated as a single new entity. Neither company will continue to exist or operate in its previous form. A new business model and new management are often put in place.

Although there are many mergers that do not work out in the end, mergers do have the capability of allowing startups to find greater success and ultimately earn a profit for their founders and investors.

Pros

- A strong exit strategy for some startups

- Often a win-win

- Startups have bargaining power to negotiate their own terms

- Can streamline operations, reduce costs, and/or create economies of scale

- May create a liquidity event for founders and investors

Cons

- Merger processes can require considerable time and resources

- Usually the end of the original business/legacy

- Transition process is not always smooth

- Many mergers fail

Acquisitions

Another common form of startup exit are acquisitions. Acquisitions are when another company acquires (or purchases) your startup.

When an acquisition occurs your startup may continue operating as is or it may be dissolved into the acquiring company. Some founders take their earnings and walk away. Other founders and stakeholders negotiate a role and are hired by the acquiring company to continue in their present position. In fact, cashing out or remaining with the company may even be a condition of the deal and end up being required for founders to vest all of their shares.

Acquisitions can occur in cash, equity in the acquiring company, or a mix of the two. For example. when Facebook acquired Instagram in 2012 and WhatsApp in 2014, they completed the transactions in a mix of cash and stock. However, when Uber acquired Postmates in 2020, they did so in all stock.

When a startup is purchased via cash, stock, or options in a publicly-traded company, it creates a liquidity event where founders and investors can cash out on their investments. If your startup is bought by a private company, however, the stock and stock options may not allow the same flexibility to sell and exit the startup.

Pros

- Another strong exit strategy for some startups

- Often a win-win

- Startups have bargaining power to negotiate their own terms

- Can streamline operations, reduce costs, and/or create economies of scale

- May create a liquidity event for founders and investors

Cons

- Acquisition process can require considerable time and resources

- Usually the end of the original business/legacy

- Transition process is not always smooth

- Founders and investors may be required to (a) cash out or (b) stay with the company as a part of the deal

Acquihires

Acquihires are a less common exit in which another company acquires a business purely for the skills and talent of the startup’s employees. The acquiring company will usually not produce the product or service that your company was working on but rather will likely dissolve the startup and re-assign your team within its own organization.

Although an acquihire exit may produce a high return for talent-based startups, it can be difficult to find a buyer. However, if you can produce a return and find a home for your skilled employees, seeking an acquihire buyer may be a win-win situation for everyone involved.

Pros

- May produce a high return for talent based startups

- Can be a profitable way to exit a struggling startup

- Employees will have job and career continuity

- May create a liquidity event for founders and investors

Cons

- Difficulty finding an interested buyer

- Usually the end of the business/legacy

- Some of your team/employees may be left without positions in the acquiring company

Sale to Third-Party Buyer

Another option for founders looking to sell a company is to sell to a third party, either on your own or through a business broker. Selling to a third party creates an instant successor to the business, and finding an ambitious buyer may continue and grow the legacy of the business.

One major complication of finding a third-party buyer is that it can be difficult and take a significant amount of time to find an interested buyer. This is why one of the most common ways to sell a business is through a business broker. Business brokers are intermediaries between the seller and potential buyers. They market your business, find and vet potential buyers, and help manage the sales process.

In exchange for their services, brokers are typically paid a commission on the sale which generally ranges near 10%.

To sell your business through a broker, you will need to find a reputable broker that will work hard for you. One place to start is the International Business Brokers Association, the largest association of professional business brokers.

Pros

- A strong exit strategy for some startups

- Potential continuity of business/legacy

- An ambitious new owner may continue to try to grow the business

- Creates a liquidity event for founders and investors

Cons

- May be difficult to find a buyer

- High cost to use a business broker

- Buyers may have difficulty obtaining financing/require owner financing

- Transition process is not always smooth

Family Succession

Family succession, also known as a legacy exit, is the process of turning your business over to your children.

Family succession usually involves “selling” the business to your children. It is recommended that you consult your accountant and/or attorney for more information on the tax and legal implications of “gifting” vs. “selling” your business.

While family succession is a popular exit strategy among small business owners, it is typically not an exit strategy for larger businesses or high-growth startups as family succession does not usually provide a liquidity event for investors and other stakeholders to cash out of the company.

For founders who wish to pass their business on to their children, planning is still important. In a lot of cases not all children are interested in or capable of stepping into and running the family business, and business and relationships do not always mix well.

Pros

- Family members are likely to know the business intimately

- Minimal disruption

- Simpler process and transition

- The succession and transition process can be eased out over years

- Founders maintain a close relationship with the company they built

- Continuity of the business/legacy

Cons

- Does not provide a liquidity event

- No infusion of capital

- Children may not be interested in running the family business

- Mixing business and personal relationships can be complicated

Partner/Investor Buyout

Partner and investor buyouts are another exit event that some startup founders pursue. In many instances, when a startup has multiple co-founders or investors and a founder wants to leave the company, partners and investors are the first options.

In private companies, the other partners and investors may even have the first opportunity to buy out a co-founder. These clauses are often written into partnership agreements in order to give the other partners an opportunity to purchase back the exiting partner’s equity.

Pros

- Partners know the business intimately

- Easier to agree on value and price

- Continuity of the business/legacy

- Simpler process and transition

- Minimal disruption

- Creates a liquidity event for one co-founder

Cons

- Does not provide a liquidity event for investors

- No infusion of capital

- Partners or investors may not be interested

- Less negotiating power over terms and price

Manager/Employee Buyout

Similar to a partner or investor buyout, in some cases management or employees may also be interested in purchasing a company. These are known as management buyouts (MBOs).

There are several benefits to management buyouts. Managers and employees are already familiar with the business, limiting disruptions and making the transition process simpler and smoother. It is also easier to agree on a valuation and price, as both parties are more familiar with the businesses operations, finances, and potential.

When an MBO occurs, in many cases, management and other leaders within the company will move into the exiting executives’ roles, taking on the ownership aspects of the business.

Pros

- Management and employees likely to be very familiar with the business

- Easier to agree on value and price

- Minimal disruption

- Simpler process and transition

- Sometimes owner financed over years

- Continuity of the business/legacy

- May create a liquidity event for founders and investors

Cons

- Does not provide a liquidity event for investors

- No infusion of capital

- Difficulty finding management or employees interested

- Difficulty for management or employees to find financing

Liquidation

There aren’t that many startups that launch with a liquidation exit strategy; however, it is the reality for some. Many companies, new and old alike, choose liquidation as an exit strategy at the end of a business’s life cycle.

When a business never, or no longer, makes a profit, many owners are forced to liquidate- to close down and sell any remaining assets. The assets would then be used to pay any creditors, and the remaining proceeds would be divided among the company’s owners or shareholders.

Liquidation is typically a much quicker exit option than most other exit strategies, but it is likely to net you the least in return. You can liquidate as quickly as you can sell your business’s assets. However, when you liquidate, you lose the value of most of your intangible assets, such as your customer base, reputation, and relationships you and your startup have worked hard to build.

Pros

- Simpler and quicker than most business exits

- Salvage some value from the business’s assets

Cons

- Usually a low-value exit

- Must sell startup assets

- Usually the end of the business/legacy

- Team/employees may be left without jobs

- May affect your business reputation in the future

Bankruptcy

The least attractive (but sometimes necessary) exit strategy is bankruptcy. Although this isn’t an outcome you would hope or plan for from the outset of your startup, the harsh reality is that many startups fail, and their founders are forced to file for bankruptcy protection. You will likely have to relinquish any business assets, and it will likely affect your credit rating, but it will relieve you of the startup’s debts and financial responsibilities.

Pros

- Relieved of startup’s debts and financial responsibilities

Cons

- Relinquish startup assets

- May affect your credit and ability to borrow

- May affect your business reputation in the future