What Is Venture Capital (VC) and How Does It Work?

Last Updated: By Reyna Hurand

Venture capital (VC) plays a pivotal role in the startup ecosystem, providing vital financial support to promising businesses with high growth potential. It refers to a form of private equity financing that is typically provided by high-net-worth individuals, institutional investors, or specialized firms, known as venture capital firms.

Throughout this guide, we’ll explore the basics of venture capital funds, including how VC firms operate, the different stages of funding, and the process of securing investment. Whether you're an entrepreneur seeking funding or an investor looking for promising ventures, this guide will equip you with the knowledge and strategies necessary for success.

Check out our comprehensive list of the top venture capital firms.

Venture Capital 101

Venture capital has a rich history that dates back to the mid-20th century. Initially emerging in the United States, venture capital gained traction as a way to fund and support innovative startups with high growth potential. Early pioneers like Georges Doriot and Arthur Rock paved the way for a new model of investing, injecting capital into promising ventures in exchange for equity ownership.

Over the decades, the venture capital industry evolved and expanded globally, playing a pivotal role in fueling technological advancements and driving economic growth. The industry witnessed significant milestones, such as the establishment of iconic venture capital firms like Kleiner Perkins and Sequoia Capital, which funded revolutionary companies like Apple, Google, and Amazon.

Let’s delve into the world of venture capital, exploring its fundamentals, key players, investment strategies, and the lifecycle of a typical venture capital deal.

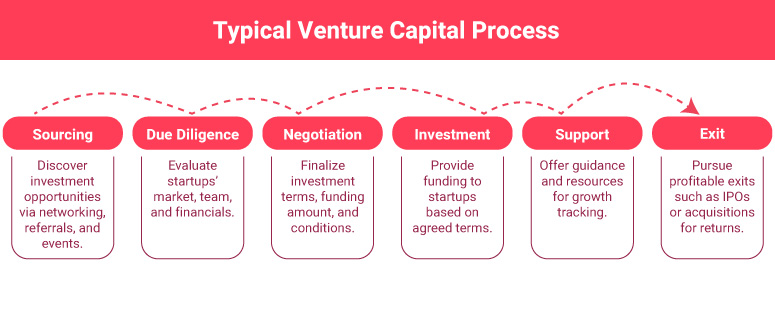

How Does Venture Capital Work?

Venture capitalists are individuals or firms who provide venture capital financing, but it's not a gift or a loan. They're actually buying a piece of your company. Here's how it works:

Identifying Promising Startups & Initial Screening

VCs actively search for promising companies with high growth potential. They often specialize in specific industries or sectors and have a keen eye for innovation and market trends.

VCs may find potential investment opportunities through various channels, such as networking events, industry conferences, referrals from trusted sources, or even online platforms.

Once a VC identifies a potential startup, they initiate an evaluation process to assess its viability and growth prospects. This evaluation typically involves a thorough examination of the startup's business model, market potential, team capabilities, and competitive landscape.

VCs also consider the level of risk associated with the investment and how it aligns with their investment strategy and portfolio companies.

Pitching & Due Diligence

If the startup passes the initial screening, the entrepreneur gets an opportunity to pitch their business idea and present their growth plans to the VC. This pitch is crucial as it allows the entrepreneur to showcase the unique value proposition of their company.

If the venture capital partners find the pitch compelling, they move on to the due diligence stage. During due diligence, they conduct a deeper investigation into the startup's financials, market positioning, intellectual property, and legal compliance to ensure the investment is sound.

Terms & Investment

If the VC is satisfied with the due diligence results, both parties enter into negotiations to agree upon the terms of the investment. This includes determining the amount of funding the startup will receive in exchange for a percentage of equity stake or ownership in the company.

Negotiations also cover other aspects, such as investor rights, governance, and milestones that the startup must achieve to unlock additional funding rounds.

Post-Investment Support

Once the investment is made, the VC becomes an active partner, providing guidance, mentorship, and industry connections to help the startup grow.

VCs often leverage their experience, network, and resources to assist the entrepreneur in scaling their business, accessing new markets, and attracting further funding rounds if needed.

Growth & Exit

The goal is for your startup to grow and become very successful. Eventually, there might be an "exit event". This could be your company getting sold to a bigger company or going public in the capital markets through an IPO (initial public offering). When this happens, the venture capitalists sell their shares and make a profit.

Here are some hypothetical examples to make the VC process a little clearer:

Example 1

Imagine Sarah has an exciting technology startup that aims to revolutionize the transportation industry. She pitches her startup to a venture capitalist, and they invest $1 million in exchange for 20% ownership.

With this funding, Sarah can hire more engineers, conduct further research, and bring her innovative product to the market.

Her company grows and is later sold for $50 million. The VC makes $10 million (20% of $50 million) from their original $1 million investment.

Example 2

David has a promising biotech startup with a breakthrough medical device. He successfully secures a venture capital investment of $5 million in exchange for a 25% ownership stake.

With the VC's backing, he can conduct clinical trials, obtain regulatory approvals, and launch his life-saving product to make a positive impact on patients' lives.

After several years, his company is sold for $200 million. The venture capitalist receives $50 million (25% of $200 million) from their investment.

Example 3

Emma starts a new fashion brand that becomes popular. A VC gives her $2 million in return for 10% of her company. She is able to refine her product, expand her customer base, and secure partnerships with key players in the market.

Her brand takes off, and she decides to go public through an IPO. The company's value rises to $100 million. The venture capitalist can now sell their shares and make $10 million (10% of $100 million).

In all these cases, the venture firm takes a risk by investing in a startup, but the potential rewards are very high. Your startup gets the money it needs to grow, and the venture capitalist has a chance to make a big profit if your company succeeds.

Venture Capital Pros

Venture capital investments can provide significant advantages to entrepreneurs looking to grow their startup companies. Here are some key benefits:

- Large Funding Amounts: A venture capital firm is usually able to provide large amounts of funding. This can help your company grow quickly and allow you to tackle larger projects and goals.

- Expert Advice & Mentoring: Venture capitalists often have experience in the industry and can provide valuable advice and guidance. They might have insights that can help you avoid common business pitfalls and make smarter decisions.

- Validation & Credibility: When a reputable VC firm invests in a startup, it adds a level of validation and credibility to the business. This endorsement can boost the startup's reputation in the eyes of other investors, customers, and potential partners.

- Long-Term Partnership: VCs have a vested interest in the success of the startup and are committed to helping it reach its full potential. This long-term partnership can provide stability and support as the business navigates various growth stages.

- Network Access: Venture capitalists often have extensive networks in the business world. They can introduce you to potential clients, partners, and even other investors.

Venture Capital Cons

While venture capital funds can provide a lot of benefits, it's not without its drawbacks. It's important to understand the potential downsides before deciding to pursue this type of funding. Here are some of the main cons:

- Loss of Control: When you accept venture capital funds, you're giving up a portion of your company's ownership. This can result in less control over your business decisions, as the investors may want a say in how the company is run.

- Pressure to Perform: A venture capital firm will often push for rapid growth and possibly an eventual sale of the company. This can put a lot of pressure on you and your team and might not align with your personal business goals.

- Equity Dilution: To get the money, you have to give up a part of your business, or "equity." This means when your business makes money, you have to share more of it. If your business becomes very successful, you could end up with a smaller piece of a big pie.

- Possible Loss of Privacy: Your company's finances and strategies may become more transparent to outsiders. Investors will likely want regular updates and reports on your business's progress, which means sharing more information than you might be comfortable with.

Stages of Venture Capital Investing

The VC funding process typically consists of several stages, each with its own characteristics and requirements. Let's explore these stages in further detail:

Pre-Seed - Seed

Pre-seed funding is the very first stage of the funding process. At this point, your business idea is still in its early form, and you might not even have a product yet. The funds raised during this stage are usually used to develop a prototype or conduct market research.

Pre-seed funding often comes from the founders themselves, friends and family, or angel investors—people who provide capital for a business startup, usually in exchange for convertible debt or ownership equity.

Then, seed is where you might have a prototype or a minimum viable product (MVP), but you're still testing the waters and figuring things out. The money from seed funding often goes toward market testing, hiring a small team, or fine-tuning the product or service.

Like pre-seed funding, seed funding can come from angel investors, but it may also come from an early-stage venture capital firm.

Series A - B

Series A is where a VC firm usually comes into the picture. By the time you reach this stage, your business should have a clear plan for generating revenue and a good understanding of its target market.

The funds raised in Series A are often used to improve the product or service, reach new customers, and strengthen the business model.

Then, Series B funding is all about taking the business to the next level. This usually means expanding the market and increasing the scale of operations. At this point, your business should have a steady customer base and consistent revenue.

The funds raised during Series B are often used for hiring more staff, launching more expansive marketing efforts, and potentially acquiring other businesses.

Series C and Beyond

The Series C funding stage is typically the last stage, but there can be more (Series D, E, etc.). By this point, your business is usually successful and looking to expand further, perhaps to new markets or through more acquisitions.

Series C and beyond funding often comes from private equity firms, hedge funds, and investment banks. The focus of these funding rounds is often on fueling growth, acquiring competitors, or preparing for an initial public offering (IPO).

Learn more about the VC process by reading our guide.

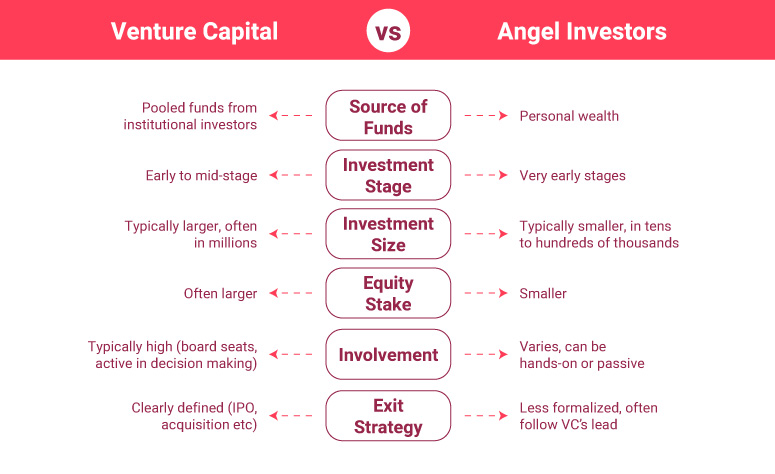

Angel Investors vs. Venture Capital

Understanding the differences between angel investors and venture capital is a key step in identifying the right funding source for your startup. Let's break down the key differences.

Source of Funds

Angel Investors: Angel investors are individuals who use their personal funds to invest in companies. They're often experienced entrepreneurs or executives who want to support new businesses. They might be someone you know, or they might be a stranger who believes in your business idea.

Venture Capitalists: VCs manage pooled funds from multiple investors. These funds often come from large entities like pension funds, insurance companies, or wealthy individuals. The goal of VCs is to make a return on investment for their fund's investors.

Amount of Investment

Angel Investors: Angels typically invest smaller amounts of money, usually ranging from a few thousand to a couple of million dollars. This makes them a good choice for startups in the early stages of development that need seed money to get started.

Venture Capitalists: VCs usually invest larger amounts, often millions of dollars. This makes them suitable for startups that are more established and are ready to scale up their operations.

Decision-making Process

Angel Investors: Decisions to invest are usually made quickly, as there are fewer parties involved. The decision is often based on the individual's belief in the entrepreneur and the business idea.

Venture Capitalists: The decision-making process is often more complex and slower. They need to convince other members of the venture capital fund that your business is a good investment.

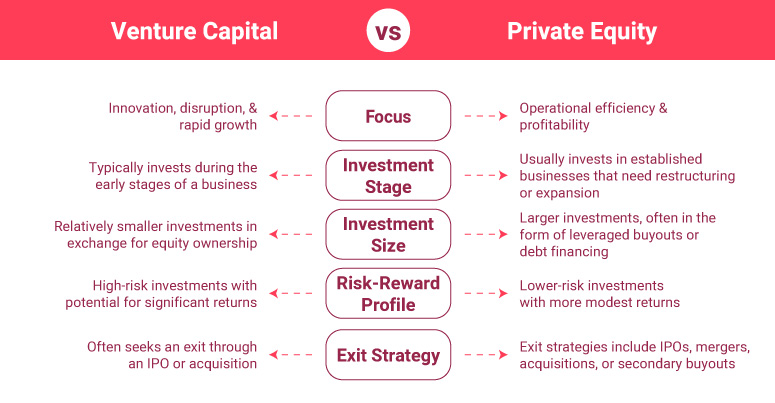

Venture Capital vs. Private Equity

Distinguishing between venture capital and private equity (PE) can be quite challenging, but it's an essential aspect in securing the right funding for your business. Here, we'll explain the main differences between these two types of investment.

Stage of Investment

Venture Capitalists: VCs typically invest in startups and young companies that are in the early stages of their operations. These businesses often have a high potential for growth but also carry a significant amount of risk due to their unproven nature.

Private Equity Firms: PE firms usually invest in mature companies that have a proven track record of stability and profitability. These companies are often in need of funds to facilitate growth, streamline operations, or for strategic acquisitions.

Investment Size

Venture Capitalists: VC investments can range widely, but they are generally smaller than PE investments. They often range from a few hundred thousand to several million dollars.

Private Equity Firms: PE investments are usually much larger, often in the hundreds of millions or even billions of dollars. This reflects the larger scale and established nature of the companies they invest in.

Exit Strategy

Venture Capitalists: VCs typically look for a return on their investment through an exit strategy such as an initial public offering (IPO) or a sale to another company.

Private Equity Firms: PE firms also aim for a return on investment through an exit strategy. This can include selling the company to another firm, a management buyout, or taking the company public through an IPO.

Is Venture Capital Right for You?

Venture capital can be a powerful tool to help grow your startup. However, it's important to evaluate if this type of funding is the right fit for you and your company. Here are some key factors to consider:

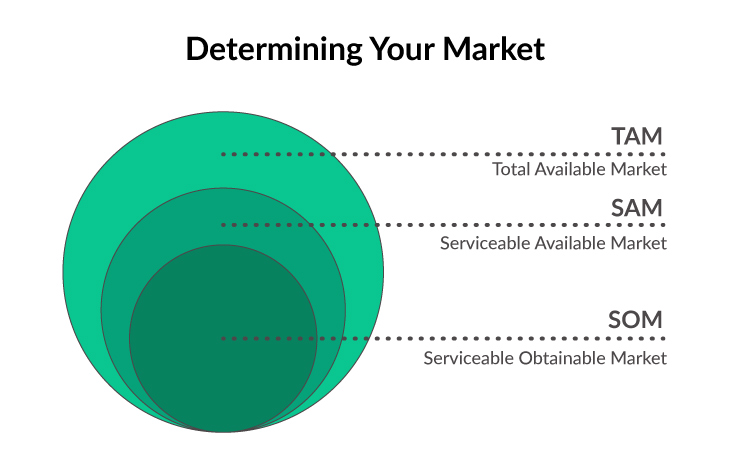

Understanding Your Market

Before seeking VC funding, ensure you have a thorough understanding of your market. This includes knowing the addressable market (everyone who might find your product useful) and the obtainable market (the customers you can realistically reach). This knowledge demonstrates to potential investors that you have a clear vision for your business's potential growth.

Pitch Deck & Product-Market Fit

Your pitch deck should effectively communicate your business idea, the problem it solves, and why your solution is unique. It should also show evidence of product-market fit, meaning there's a demand in the market for your product or service.

All of these elements should be woven together into a coherent, compelling, and cohesive story. This story should not only communicate your business idea and plans but also ignite passion in potential investors.

Technical Expertise

Having a technical founder or a key team member with a deep understanding of your product or service's technical aspects can be a significant advantage. This expertise not only reassures investors about your team's capabilities but also that you can overcome technical challenges that may arise in the future.

Use of Funds

Investors want to know specifically how you'll use their capital. Be prepared to provide a detailed breakdown of how the funds will be allocated. This could include areas like product development, marketing, hiring, and more.

Before you seek venture capital, ensure that your startup meets these criteria. VC funding involves giving up a degree of control and equity in your company, so it's important to consider whether this is the best path for you. Remember, venture capital is just one of many funding options, and it's crucial to explore all your options before making a decision. Always seek expert advice if you're unsure.