Angel Investors Vs. Venture Capitalists: What Is the Difference?

Last Updated: By TRUiC Team

Creating a startup company from scratch is a challenging yet rewarding endeavor and often requires founders to take on additional investment from outside of their startup in order to grow as rapidly and efficiently as possible.

While most individuals would have heard about angel investing and venture capital (VC), what exactly is the difference between them? Should your startup look for angel investors, venture capitalists, or both?

In this guide, we will walk through the differences and similarities between angel investing and venture capital and explore what type of investor is more suitable for your startup.

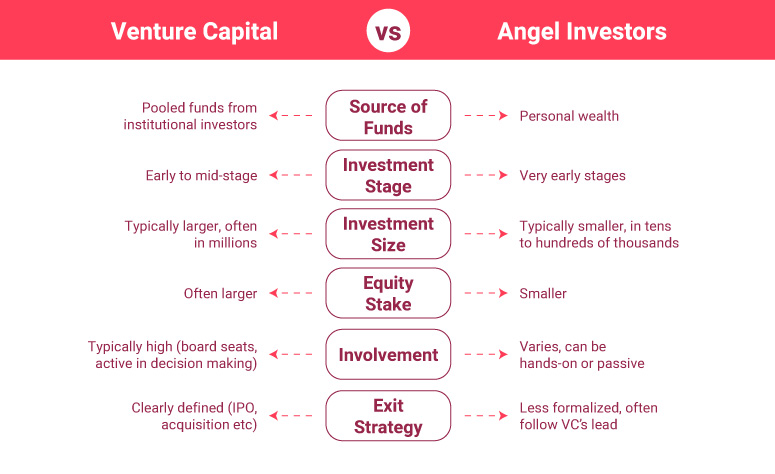

Venture Capital vs. Angel Investors

Venture capitalists and angel investors are both interested in putting their capital to use in new companies with innovative ideas, but there are slight differences in the way they operate.

Depending on whether you want a single investor who believes in your startup idea and is willing to guide you with their business experience or if you’re looking for a larger sum of investment capital up front, you’ll have to consider the pros and cons of each investment type carefully.

Angel Investing and Venture Capital: The Key Differences

When launching a startup, securing funding is one of the most significant steps. Knowing the difference between angel investors and venture capitalists can help you make informed decisions about your business's future. Here are the key differences between these two types of investors:

Source of Funds

Angel Investors: Typically affluent individuals who often have a great deal of business and startup experience themselves. They possess a wealth of knowledge that they’re willing to share with the startups they invest in.

Venture Capitalists: Manage pooled funds from different investors. They usually work for venture capital firms that manage these funds.

Investment Size

Angel Investors: Usually invest smaller amounts, generally ranging from $25,000 to $100,000 per investment.

Venture Capitalists: Make larger investments, often in the millions. Their aim is to accelerate high-growth startups.

Level of Involvement

Angel Investors: Usually take a less formal role in operational control, often serving as mentors or advisors rather than direct managers.

Venture Capitalists: Typically have a more formal relationship and may take a board seat. They often provide strategic direction and help secure further funding.

Risk Appetite

Angel Investors: Generally have a higher tolerance for risk, as they invest in early-stage startups that may lack a proven track record.

Venture Capitalists: Typically prefer less risky investments, often favoring startups with demonstrated potential for significant growth. This reduces (but does not eliminate) the risk.

Decision-Making Process

Angel Investors: The decision-making process is often quicker with angel investors since they are the sole decision-makers.

Venture Capitalists: VCs often have a more complex, structured decision-making process involving stricter due diligence and board approvals.

Return on Investment Expectations

Angel Investors: Usually seek a good return but are often more patient and flexible about when this return is realized.

Venture Capitalists: Aim for a high return on investment and typically expect significant growth within a specific timeframe, often 5-10 years.

Exit Strategy

Angel Investors: Angel investors may not have a set exit strategy. The exit often happens when the company is acquired or goes public, but the timeline can be flexible.

Venture Capitalists: Generally look for a clear exit strategy, such as an acquisition or IPO, typically within a defined timeframe.

Venture Capital vs. Angel Investing: Case Studies

It's always useful to explore real-life examples to understand concepts better. There are several examples from the tech industry that illustrate the distinction between these two types of investments.

An example of a famous angel investment is when Peter Thiel, co-founder of PayPal, invested $500,000 into Facebook in 2004. This was Facebook's first infusion of capital, which came at a time when the company was just a year old and had yet to become profitable. Thiel's initial investment eventually turned into billions when Facebook went public.

Another example is when Amazon founder Jeff Bezos made an angel investment in Google in 1998 before it was a household name. The exact amount Bezos invested has not been disclosed, but considering that Google is now one of the largest companies in the world, it's safe to say that this was a highly successful investment.

A good example of venture capital investing is when Lightspeed Venture Partners invested $485,000 in Snapchat in 2012. Snapchat has since grown to become a major player in the social media and communication app space.

Uber is another company that greatly benefited from venture capital. In 2011, Benchmark Capital invested $11 million into the ride-sharing company. The company has since grown to a multi-billion dollar valuation.

How to Choose the Right Investor Type for Your Startup

Choosing between angel investors and venture capital firms can be a tough decision, but it may be one of the most important decisions you make as a startup founder.

If you’re looking for more autonomy and want to be in control of all of your startup’s business decisions, going with an angel investor is likely the better decision.

Similarly, if you want a mentor who likely has a great deal of industry experience, has gone through the startup process in the past, or already has a successful business in your space, you’re much more likely to find an angel investor who meets all of these criteria.

When it comes to venture capital firms, this may be a great choice if your startup needs a larger capital investment upfront. VCs often invest much larger sums of money in order to give your startup the capital it needs to grow rapidly.

Then comes the question of operational control – how much control do you want to retain over your startup, and are you willing to “give the reins” of your company to a venture capital firm, allowing them to weigh in on all decisions? If you don’t mind working with a VC firm and don’t mind giving up control of your startup in favor of a larger capital investment, this may be the right choice for you. Keep in mind that venture capital firms will favor rapid growth and will often push your startup to make choices that facilitate growth in the short term.

All in all, it’s up to you and your team to decide which type of investment best fits into your vision and goals. Depending on how rapidly you want to grow and how much involvement you want from your investor, the decision of an angel investor or venture capitalist will have to be made with all of these factors in mind.

Final Thoughts

Angel investors and venture capitalists both offer valuable resources for startup companies, but they serve different roles and are better suited to different stages of business development.

Angel investors typically provide smaller amounts of funding, valuable advice, and networking opportunities, usually at the seed stage. Venture capitalists, on the other hand, invest larger sums, typically in later stages of business development, and offer more structured support, often taking an active role in company management.

Understanding the differences between these two types of investors is crucial for entrepreneurs seeking funding, as it helps them to identify which source of capital is most appropriate for their particular stage of growth and their specific business needs.

Frequently Asked Questions

Do you have to pay back venture capital?

No, you don’t have to “pay back” venture capital in a technical sense, but they do expect a return on their investment within your company. Usually, VC firms invest in startups that expect an exit, where they are sold to a larger business, and the VCs are repaid on their initial investment.

Who uses venture capital?

Venture capital investments are used by investors who’d like to earn large returns, entrepreneurs who need funding for their startups and businesses, and venture capitalists who make money for themselves by being the “market maker” between investors and entrepreneurs.

What percentage do angel investors want?

Angel investors will likely expect to receive a share of 20% to 50% of your startup company in return for their investment. Since these investors are taking on substantial risk with the startup they choose to place their capital in, they will likely structure the deal in a way that most aligns with the valuation of your startup.

Are angel investors a good idea?

If your startup is looking for investment capital as well as a potential “mentor” who can pass on their past experience to your startup, angel investors may be a good idea for your company. Additionally, if you still want operational control of your startup, angel investors are often passive investors, meaning they want you to run the day-to-day operations, occasionally weighing in with advice.