What Is Vesting? (+ Best Practices for Startup Founders)

Last Updated: By TRUiC Team

In the dynamic world of startups, one term that repeatedly makes an appearance is “vesting.” It's a concept crucial to the relationship between a company and its stakeholders – from founders to employees and advisors. As an entrepreneur, understanding the nuances of vesting can make the difference between a motivated, aligned team and a disengaged one.

In this article, we'll shed light on what vesting is, why it's pivotal for startups, and best practices tailored for various roles.

Startup Vesting 101

In short, vesting is the process of securing (or earning) promised equity, options, or employer contributions over time.

Launching and growing a startup often requires that you use your startup’s equity as a resource to compensate co-founders, employees, and other key stakeholders.

Think of it as a loyalty program for your startup’s stakeholders: rather than getting everything all at once, they gradually “vest” into their full entitlement based on time or performance milestones. Should a founder or key employee leave the company before their equity has fully vested, they would then lose any unvested equity.

Jump Ahead:

Why Is Vesting Important for Startups?

By aligning individual rewards with company performance, vesting helps ensure that the people driving the company forward have a vested interest (pun intended) in its success. Here's why vesting holds unparalleled significance for startups:

Retention

It's no secret that startups can be volatile. Vesting provides a structured incentive for key players to stay with the company long-term, minimizing the turbulence of frequent exits.

Alignment

As stakeholders see their future intertwined with the company's success, they are more likely to prioritize its long-term goals. Vesting ensures that everyone is rowing in the same direction, especially when faced with pivotal decisions.

Protection

Startups are a blend of ideas, risks, and potential. If a pivotal team member leaves prematurely, without vesting, they could take a substantial piece of the company with them. Vesting ensures that equity distribution is commensurate with sustained contribution.

Attracting Talent

In the competitive landscape of startups, offering equity can be a differentiator. Vesting can make these offers more appealing, as potential hires see a clear path to owning a piece of the company they're helping to build.

Investor Confidence

For external investors, seeing a vesting schedule in place signals that the key players are committed for the long haul. It reduces the risk associated with leadership changes or premature exits.

Consider the scenarios you could face without a vesting agreement. For example, let’s say you and three other people decide to launch a startup, and you each will be allocated initial equity of 25%. But after a few months, two of your co-founders get busy with other projects and stop showing up or contributing. What do you do?

If you incorporated your startup and issued shares to each co-founder immediately without a vesting schedule, your co-founders would still each own 25% of the company, and their shares would entitle them to ownership and voting rights. Without a founder’s agreement or vesting schedule in place, you and your startup cannot reclaim their equity even if they never contribute to the startup again.

With a vesting schedule, the story is different. If a founder or key employee were to leave the startup before their shares have vested, the company could then reclaim or buy back any unvested shares.

What Is a Vesting Schedule and How Does It Work?

As was previously mentioned, vesting is the process of securing one’s promised equity in a startup, usually over time. Vesting is determined by a vesting schedule, which defines the conditions of when stock (or options) will be secured by a founder or other stakeholder.

In startups, founders’ and other stakeholders’ stock and options usually vest over a number of years, as described by the startups vesting agreements. Although vesting agreements will differ, many startups follow a standard vesting schedule, which we will discuss below.

The terms of founders and early employees vesting agreements are typically defined and agreed upon by a startup's founders and approved as one of the first actions of a newly incorporated startup’s board of directors. These terms and conditions are then laid out in a vesting schedule.

For founders, startups will grant the stock to each founder. The founder then “owns” the stock and can exercise its rights and benefits, including its voting right and right to dividends. However, a founder is bound by the terms of the vesting agreement. In most cases, a founder cannot sell or transfer stock that is not fully vested. And, if a founder were to leave the startup, the company has the right to seize or buy back any equity that remains unvested at that time.

After the vesting period has passed and the terms have been met, founders and other stakeholders will then control all their vested shares. However, if they were to leave the firm before, they would only retain the shares which have already vested.

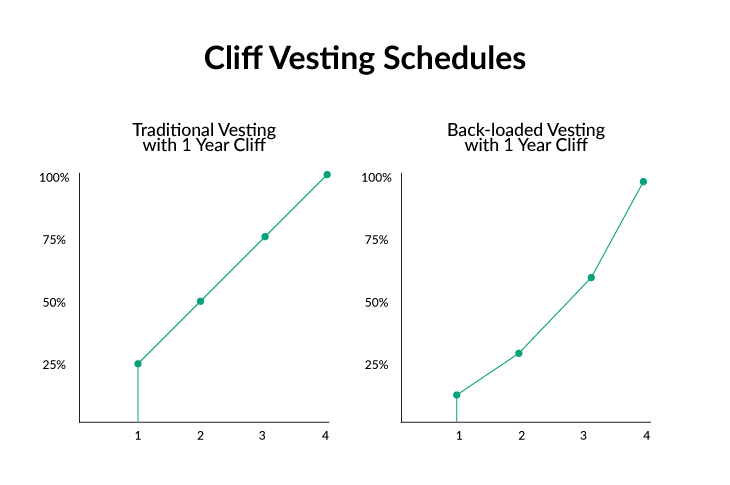

Many vesting agreements also incorporate a one-year cliff. Cliff vesting is a common time-based vesting schema that includes a clause in a vesting agreement that states that a co-founder (or an advisor, board member, employee, etc.) must stay with the company at least one year (or the time period specified) before their equity begins to vest. In this case, if the co-founder (or employee, etc.) were to leave the startup before the cliff passes, they would not be eligible for any of the equity that was allocated to them.

What Is a Standard Vesting Schedule?

While there are many types of vesting schedules, the standard vesting schedule in startups is customarily a four-year time-based vesting schedule that is ratable monthly with a one-year cliff. This means that vesting would begin after one year and would accumulate monthly for four years.

Keep reading to learn more about the types of vesting and the standard vesting schedule.

Types of Vesting Schedules

There are two primary types of vesting schedules: time-based vesting and performance-based vesting, which can be used independently or combined in a hybrid vesting schedule.

Time-Based Vesting

Time-based vesting is the acquisition of ownership over time. The three most common methods of time-based vesting are immediate vesting, graded vesting, and cliff vesting.

Immediate Vesting

The simplest form of vesting is immediate vesting. Immediate vesting is just like it sounds. All of the rights and ownership are granted (or vested) immediately. There are no waiting periods, and benefits are not granted over time. Rather, with immediate vesting, the vested party receives 100% of ownership all at once.

While immediate vesting is uncommon in most cases, it can be used at the time of incorporation to compensate founders, co-founders, and key employees that have been with a startup since the early days.

Graded Vesting

In lieu of immediate vesting, most time-based vesting is graded. In graded vesting, ownership is granted over a specific period of time. With graded vesting schedules, a percentage of ownership may be granted on a monthly, quarterly, or annual basis in either equal portions or on a back-loaded schedule.

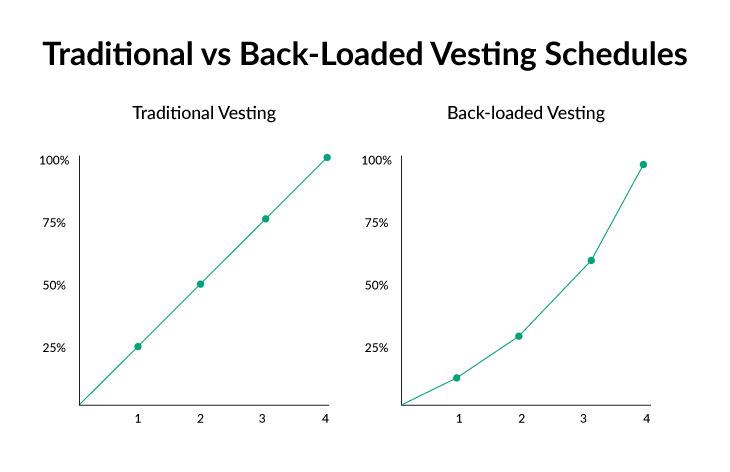

In a traditional linear vesting schedule, equal portions are granted in each period. For example, in a traditional four-year vesting schedule that vests annually, a stakeholder would receive 25% of the total ownership at the end of year one, an additional 25% at the end of year two, another 25% at the end of year three, and the remaining 25% at the end of year four.

However, many vesting schedules are back-loaded to encourage key talent to stay with a startup company longer. In a back-loaded vesting schedule, stakeholders secure less ownership at the beginning of the vesting schedule and higher portions of ownership as their vesting schedule matures.

For example, in a back-loaded vesting schedule, a stakeholder may secure 10% of the total ownership they were promised at the end of year one, 20% at the end of year two, 30% at the end of year three, and 40% at the end of year four.

In either traditional or back-loaded vesting, if a stakeholder leaves the startup before the end of the vesting period, they would only be entitled to the percentage of ownership that has vested up until that time.

Cliff Vesting

The most common vesting schedules in startups are cliff vesting schedules. Cliff vesting schedules can be immediate or graded vesting schedules that kick after a specific period of time (a cliff). In the startup world, the standard is a one-year cliff, although this can vary somewhat in different circumstances.

Once a cliff is surpassed (the period of time passes), a portion or all of the shares would vest (or, in some cases, begin vesting). However, if a founder, a key employee, or other stakeholder leaves the startup before the cliff, none of their shares would vest, and they would all be forfeited to or repurchased by the company.

Cliff vesting schemes are important for startups as the cliff serves as a trial period. If the relationship does not work out, the startup retains its equity to compensate for other talent. In fact, this is the standard vesting schedule in startups. In most startups, those promised equity or options are offered a graded four-year vesting schedule with a one-year cliff.

Performance-Based Vesting

A second major type of vesting is performance-based or milestone-based vesting. If you haven’t already guessed, performance-based vesting is based on performance — usually meeting some sort of predetermined milestones such as a target revenue or market share.

For example, the vesting schedule of a startup’s Director of Sales may stipulate that their equity will vest based on the level of annual sales revenue and will not fully vest until the company reaches $10 million in sales.

Startups frequently incentive employees with performance-based stock options. These types of options incentivize employees and others to give 100% in order to ensure the startup meets its goals and succeeds.

It is important to note that performance-based options may not be appropriate for every role. To properly incentivize employees, the performance in question must be at least somewhat under their control. For example, you wouldn’t want to fully tie the stock options of your Chief Innovation Officer to sales when the daily aspects of their job do not directly relate to sales.

In many cases, especially roles for which there are no clear key performance indicators, a hybrid approach combining time-based and performance-based vesting may be better suited.

Hybrid Vesting

Another type of vesting schedule becoming more popular among startups is hybrid vesting. Hybrid vesting combines time-based vesting and performance-based vesting, where founders, employees, and other stakeholders must both stay with the startup for a certain period of time and meet particular milestones in order to fully vest their equity and options.

Again, hybrid vesting schedules can be designed in a variety of ways. The important thing is drafting vesting agreements that protect the interests of both the startup and its stakeholders.

Vesting Acceleration

Most vesting agreements include acceleration clauses that expedite vesting in certain situations, such as a merger, acquisition, or sale of the startup. Acceleration clauses are often included in the vesting schedules of founders and other key stakeholders, allowing unvested shares to become fully vested under certain conditions.

There are two common methods of acceleration; both designed to protect founders and key talent in the event of a merger, acquisition, or sale.

Single-Trigger Acceleration

Single-trigger acceleration is a type of acceleration where shares become fully vested if the company is acquired or sold. If a single-trigger event occurs, a founder or employee’s unvested shares vest immediately, and they are free to leave the company with 100% of their equity.

Double-Trigger Acceleration

Double-trigger acceleration is another type of vesting acceleration, but with double-trigger acceleration, two events must occur to trigger the acceleration of vesting. These events are usually:

- The merger, acquisition, or sale of the company, as well as

- The termination of the founder or employee (without cause)

Double-trigger acceleration serves several purposes. For startup founders and key employees, it helps ensure that they will not lose their positions in the company that they built, or if they do, they will be compensated with their unvested equity.

For an acquiring company, it helps ensure that founders and key employees stay with the startup through the acquisition and transition phases. If founders or employees leave the company before the vesting period, they will lose their unvested shares.

Vesting for Founders and Other Stakeholders

Vesting is approached differently by founders, employees, and other stakeholders of the firm. Vesting schedules should be created for each situation to reflect the expectations of the relationship between the startup and its founders and other stakeholders.

Here are some of the vesting caveats for founders and other stakeholders of the firm:

Vesting for Founders

Founders and co-founders participate in vesting schedules just like a startup’s employees and other stakeholders. However, founders’ vesting schedules can vary greatly and may even differ among founders of the firm.

Similar to other stakeholders, founders’ equity in a startup customarily vests over a four-year period, although this can vary. Founders’ vesting schedules of three years and five years are not uncommon in the startup world.

Many times founders’ vesting schedules include a portion of stock that vests immediately. It is not uncommon for 25% or more of a founder's stock to be vested as soon as a corporation is formed. This is especially the case when intellectual property is involved. Upon the formation of a corporation, intellectual property is usually assigned to the newly formed startup company. Thus, many startups compensate founders for their intellectual property, with a portion of their equity vesting immediately.

Founders are also not typically subject to a cliff. Founders equity generally begins vesting right away on a daily, monthly, or sometimes annual vesting schedule.

Ultimately, founders are usually responsible for writing and agreeing to the startup’s own vesting schedules. However, if you plan on seeking outside capital, you should ensure that your vesting schedules will seem fair to all parties involved.

Vesting for Employees

Startups often offer stock and stock options to attract key employees. Employees' stock and options customarily vest monthly, quarterly, or annually over a period of four years.

The amount of equity allocated to key employees can vary greatly, ranging anywhere from less than 0.10% to up to 20%, 25%, and more for key executives.

Employees' stock and options are often subject to a one-year “cliff,” where their stock and options will not begin to vest until they are with the startup for one year.

Vesting for Directors

Directors are also often granted stock and stock options for their service and contribution to a startup. Similar to employees, directors' vesting schedules customarily vest monthly or annually over a period of four years.

The amount of equity compensated to directors is highly variable and typically depends on whether they are investing in or bringing investors to the startup. The typical director’s equity ranges from 0.5% to up to 3%.

In some cases, such as when a startup recruits high-profile directors, directors have the power to negotiate more favorable vesting schedules. High-profile directors may require that a portion of their equity vests immediately or that their equity vests on a shorter vesting schedule.

Directors' vesting schedules also may or may not be subject to a cliff. Again, the profile and expertise of a director will determine what concessions might be required to recruit them to your startup.

Vesting for Advisors

Advisors may also be granted stock and stock options as a form of compensation for their service and contribution to a startup. Advisors are also subject to vesting schedules similar to employees and directors.

Advisors often receive between .15% and 1% of the equity in a startup. If you grant any of your startup’s equity to advisors, you will need to incorporate a vesting schedule into your advisor agreement.

Similar to most other stakeholders, advisors’ vesting schedules also customarily vest monthly, quarterly, or annually over a period of four years, and they may or may not be subject to a cliff. However, similar to directors, high-profile advisors may have the power to leverage more favorable terms.

Vesting for Consultants

Finally, consultants may also be granted stock and stock options by a startup as a form of compensation for their service and contribution. In most cases, consultants are also subject to vesting schedules similar to other directors, advisors, and employees.

Vesting terms for consultants follow the same general format as vesting for other stakeholders. Vesting typically occurs over a period of time (usually the length of the consulting agreement) and may or may not contain a cliff.

For example, the equity compensation for a consultant that agrees to work with a startup for 24 months would normally vest monthly over 24 months and may or may not contain a cliff.