The corporate veil is another term for your company’s limited liability status. If you don’t maintain it correctly, it can be “pierced” — exposing your personal assets to creditors in potential lawsuits.

This guide will show you how a corporate veil may be pierced, how to protect your business’s corporate veil, and how far corporate veil protection extends.

What Does the Corporate Veil Protect?

The most common reason to start a limited liability company (LLC) is the protection afforded by a properly maintained corporate veil. This means that if someone sues your business, your personal liability is limited to the amount of investment you’ve made in the company. Other than that, creditors are unable to pursue your home, your car, your belongings, or your personal money.

When your LLC’s corporate veil is pierced, however, you lose your limited liability status. At this point, your personal assets become fair game for creditors — a worst-case scenario for any entrepreneur. As such, you should do everything you can to keep your corporate veil intact at all times.

How is the Corporate Veil Limited?

The corporate veil only provides personal asset protection in certain ways. It’s possible for creditors to pursue your personal assets through a few different methods even if they can’t pierce your corporate veil.

Some of these methods include:

- Taxes – Because LLC taxes pass through to the owner(s), you will claim business income or losses on your personal tax return. If you fail to pay taxes on a portion of that income, your corporate veil will offer you no protection and the Internal Revenue Service will collect that money from you however it sees fit.

- Reckless Acts – If you commit reckless acts in the course of company business, your limited liability status won’t protect you from being held responsible for your wrongdoing.

- Personal Guarantees – It’s not uncommon for creditors to ask LLC owners to personally guarantee a loan if the company doesn’t have access to enough assets to otherwise secure approval. In these situations, you essentially waive your corporate veil protection.

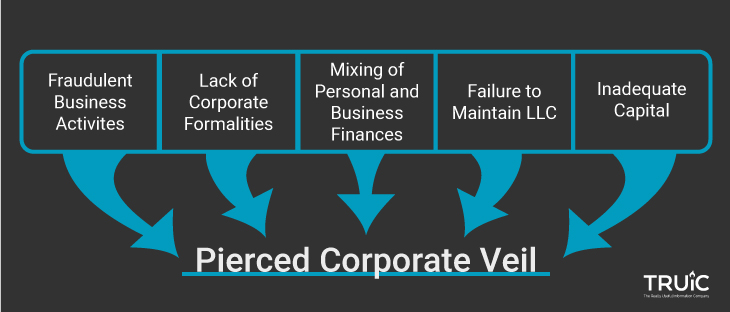

How is Your Corporate Veil Pierced?

If your LLC is examined to meet a list of certain factors, a court may choose to pierce your corporate veil.

Fraudulent Business Activities

One of the biggest red flags when it comes to piercing your corporate veil is the existence of fraud. Business-related fraud is often understood as those activities done by owners and their companies that are dishonest or illegal.

Some examples of fraudulent activities include borrowing money that the LLC cannot feasibly repay or making deals the company can’t keep. These and similar actions imply that the LLC’s ownership isn’t taking sufficient action to cover its debts.

Mixing Personal and Business Finances

The most common way LLCs get into trouble is by using company accounts to cover personal expenses.

Two examples include using your company credit card at the grocery store to buy food for yourself or writing a check from your business bank account to make a mortgage payment on your home. These actions imply that the company isn’t truly a separate entity from its owner(s).

Inadequate Capital

Businesses need a sufficient amount of money in order to operate and grow. This capital can come from places like the owners or a business loan. However, the capital must specifically be designated to the business.

If your LLC never had enough start-up capital to maintain its operations, a court could find that it never was a fully separate entity from any of its owners.

Lack of Corporate Formalities

The documentation of a business’s decisions is often known as “corporate formalities.” These “formalities” can include updating internal business rules (like in an operating agreement), signing documents correctly, and recording meeting minutes.

Failure to keep track of business decisions and maintain a paper trail for your LLC can make it look like you’re not keeping your business’s affairs separate from your own.

Failure to Maintain an LLC

A subsection of corporate formalities is the consistent maintenance of a business. For LLCs, this can include the routine filing of an annual report, filing business tax returns, and — depending on the state — paying annual business taxes.

Failure to keep your LLC compliant with state regulations can lead to the dissolution of your LLC, which means the owners will no longer have limited liability protection.

How Can You Protect Your LLC Corporate Veil?

You can do quite a bit to maintain the effectiveness of your LLC’s personal asset protection. Follow these five simple steps to protect your corporate veil:

Proper Formation

The first — and most important — step is to form your LLC properly from the start. You’ll need to correctly prepare and file your formation documents (e.g., Articles of Organization, Certificate of Formation, etc.), name an eligible registered agent, and file an initial report (if necessary).

By following your state’s guidelines properly, you can ensure your company’s corporate veil is intact from day one.

Annual Compliance

Next, you’ll need to ensure appropriate maintenance of your LLC after its formation. This means always filing your annual reports in a timely fashion and staying on top of any other maintenance requirements set forth by your state.

In addition to complying with your state’s requirements, your LLC should document any internal decisions, updates, or financial endeavors with a paper trail.

Adequate Capital

Another important step involves investing adequate capital in your LLC. If you don’t have enough money for your business to operate effectively, you can create a big problem for your corporate veil status.

An adequately funded LLC can make a much stronger case for itself when it comes to accusations that may strip it of its corporate veil.

Separate Personal and Business Accounts

You must ensure you never commingle your business assets with your personal assets. If you fail to do so, you’ll make your company vulnerable to legal action.

While this can seem more difficult for single-member LLCs, a few simple actions like setting up a separate business bank account and never using your LLC’s credit card for personal purchases can keep you protected.

You can certainly transfer funds between your own accounts and those of your business, but, if you do, you must properly document those transactions as a loan from one entity to the other.

Properly Signed Documents

You should always sign documents as a representative of your company — not merely as yourself. If you sign just your personal name, it’s harder to prove that you and the LLC are separate entities.

When signing documents for your business, make sure to sign your own name along with the company name. This will prevent any confusion.

How Does the Corporate Veil Apply to Single-Member LLCs?

Maintaining corporate veil protection as a single-member LLC can be more difficult for a few reasons. For one, piercing the corporate veil of a single-member LLC only requires that two conditions be met:

- A court deems your LLC to be an extension of you as an individual.

- A court determines that the LLC was used by its owner for fraudulent activities.

By nature, it’s more difficult for the owner of a single-member LLC to keep their business assets separate from their personal assets. It’s also more common for a single-member LLC to keep poorly detailed business records because they’re the only person involved in the business.

For these reasons, it’s critical that you treat your single-member LLC the way you would one with multiple members. Maintain separate business assets, materials, and equipment at all times. Remember to also maintain impeccable records to prove your LLC operates within state regulations should legal action ever be brought against you.

Wrapping Up

Whether you have a single-member or multi-member LLC, there’s quite a bit to keep in mind when it comes to maintaining your business’s corporate veil.

In general, keep detailed records of all your business activities and never commingle personal and business assets. If you do a good job managing these two items, the rest of the advice outlined above should fall into place.

Remember, maintaining your corporate veil is critically important to protecting yourself, your fellow LLC members, and your business from legal action.