What Makes Vint Unique and Early Business Success

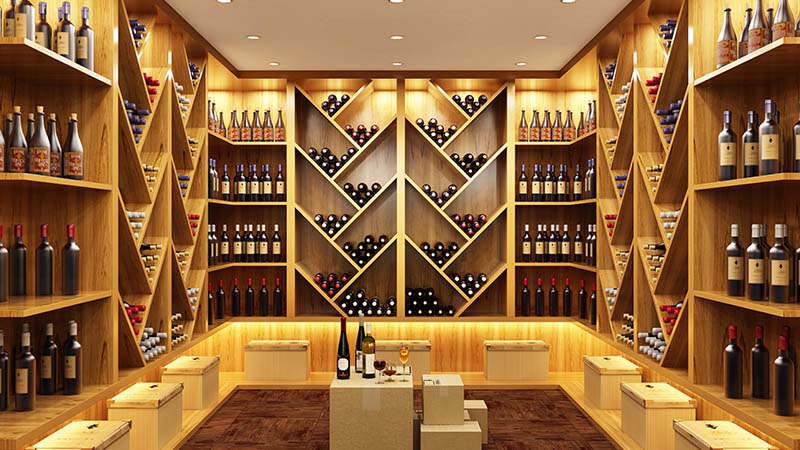

Fintech startup Vint serves as a way for investors of any level to diversify their assets away from mutual funds or traditional stocks sold on an exchange. Instead, the company has built an online exchange where wine collections are the assets. With relatively low prices per share, even for expensive collections, Vint has opened up investing in wine to a much wider group than ever before.

All wine collections traded on the Vint exchange are SEC-qualified and have a hard cap on the number of shares available to ensure that the stock is not devalued. Additionally, each collection of wine is stored in humidity-controlled facilities and fully insured by the fintech startup. This ensures that if any of the wine is lost or damaged, owners of stock in that collection will have their investment protected.

What makes Vint and wine investing on its exchange so unique in comparison to traditional stock exchanges is that the company personally owns all the wine collections. So, once the wine experts employed by the fintech startup determine the peak value of a wine collection, it will be sold with the returns automatically to be distributed to the shareholders.

Moreover, the company has seen business quickly grow as more users begin to invest through the online exchange every day. In addition, the company releases a new wine collection with at least 1,000 shares every few weeks. Each collection sells out within 48 hours. This has been the case for the fintech startup for every release of shares since 2019.

A large reason for the growing popularity of the company is that for the last 15 years, wine has actually served as a better overall business investment than traditional stocks. In fact, if someone had invested $100 in the Liv-Ex 1000 (the fine wine index) in 2006, it would have outperformed a $100 investment in the S&P 500 up to today.

Vint Funding Round and Future Business Goals

In its pre-seed funding round, Vint raised $1.7 million in capital. The funding round was led by Fintech Ventures with participation from Slow Ventures, Allied Venture Partners, irrrvntVC, Cooley, and Arrington Fund.

The funding will help the fintech startup to continue to buy its own collections and put shares of them up for sale on its online exchange. The company will also begin expanding business through public outreach to grow its user base, improve its current online user experience, and hire more employees.

When commenting on wine investing and the latest funding round, CEO and co-founder of Vint, Nick King, said, “We are excited to partner with Fintech Ventures and all our other world-class investors as we continue to disrupt the wine and spirits industry and pull back the velvet rope on a historically gated asset class. The wine and spirits industry is plagued by inefficiencies, opacity, and exclusivity, and we are transforming access to investment in these assets and democratizing an 8,000 year-old industry. We have terrific backers, an innovative business model, and a talented team ready to take on the old guard in the industry.”

About the Author

Tom Price is a writer focusing on entertainment and sports features. He has a degree from NYU in English with a minor in Creative Writing. He has been previously published for Washington Square News, Dignitas, CBR, and Numbers on the Boards.