Top 5 States Where New Businesses Are Being Formed

Business starts are up. Across the nation, new businesses are being formed at a rapid pace. Five states — California, Florida, Georgia, New York, and Texas — appear to have profited most from this entrepreneurial fever. They lead the nation in terms of the volume and rate of business formation. A benign business environment, tax incentives, and access to capital and expertise are some of the factors that may have stimulated this rise in business development. Some of these states have undoubtedly benefited from their low cost of living and rapid population growth. Our brief examines why these five states are leading the way in new business formation.

Business Starts Are Up

The pandemic may have ravaged the economy and devastated lives, but it appears, strangely, to have restored America’s entrepreneurial mojo. In 2020, as the economy wobbled, Americans donned their entrepreneurial hats at an unprecedented rate. Business starts in 2020 jumped 24% over 2019, to reach the highest level — 4.35 million — in a decade, as estimated from the applications for a new Employer Identification Number (EIN).

The five states that benefited the most from this entrepreneurial enthusiasm were California, Florida, Georgia, New York, and Texas. These are states with large populations: California with 39.5 million, Texas (29.1 million), Florida (21.5 million), and New York (20.2 million) are the four largest states in the nation. Georgia, with 10.6 million residents, is at number eight. Perhaps, therefore, their positions at the top of the business formation league may be due partly to larger numbers. But excluding New York, those states also have high rates of business formation, using a metric that compares the number of new jobs to 1 million residents.

Florida

In 2020, business starts in Florida were the highest in the nation. At 495,480, this total was 27% higher than the number of business starts in 2019 (390,960). The state also ranked 4th when new businesses were compared to population, adding about 22,802 new businesses per one million residents during 2020. Part of the reason may be its growing population. The Sunshine State recorded a 14.6% increase in population between 2010 and 2020, which means that its consumer market added 2.7 million more shoppers over that decade. A growing population bodes well for startups, as it drives demand for goods and services. Florida’s total population is now 21.5 million. For this lucky lot, a dollar is a dollar. The state’s cost of living is about average for the entire U.S.

Florida holds itself out as a good place to do business. Nonetheless, most of its entrepreneurs are homebred. The state’s Division of Corporations registered just a little under 18,000 foreign entities, less than 4% of the new businesses added in 2020. Almost overwhelmingly (~ 83%), entrepreneurs chose to set up their businesses as limited liability companies (LLCs).

Florida has a low corporate income/ franchise tax rate (2021: 4.458%) and offers a string of tax breaks to encourage investment. The private investment community has responded by deploying $47 billion in 2019. Support for businesses is available through dozens of business incubators, accelerators, and assistance centers. To sweeten the pot, there is no personal income tax.

LLC Advantages

The LLC is fast becoming the form of legal entity most chosen by new business owners, and some old ones as well, because of its many advantages. Between 2005 and 2015, LLC formation rose by around 72%. By comparison, C corporation formation declined by 18%.

The main advantages of an LLC are:

- Owners (members) enjoy limited liability. Their personal assets are protected from business creditors.

- The legal requirements in setting up and running an LLC are fewer than for a corporation.

- Members can choose to have the LLC treated as a taxable entity or as a pass-through (non-taxable) entity.

Georgia

Business starts in Georgia soared by 57% over the 2019 figure (171,700) to reach 269,100 in 2020. The state’s fairly low corporate tax rate of 5.75% may be partly responsible, and so too may be the method of computation. Georgia’s corporate tax is calculated on a “single-factor apportionment” (i.e., just the sales made in Georgia). There is no “throwback rule” for Georgia corporations. Sales in other states are not included in the corporate income tax calculation.

But Georgia imposes a highly unusual net worth tax on corporations with a net worth higher than $100,000. Corporations with a net worth of $1 million to $2 million would pay $750 annually. The maximum tax is $5,000, applicable to corporations with a net worth of $22 million or more.

Another factor that may have prompted Georgia’s rise in business starts is the larger market. The state has experienced healthy population growth (10.6%) between 2010 and 2020.

Georgia offers a number of tax incentives to encourage investment and job creation., including the Job Tax Credit and the Quality Jobs Tax Credit. Additionally, in 2019, the state attracted $22 billion in private equity capital, placing it ninth on the American Investment Council’s Top 20 States Receiving Private Equity Investment in 2019. A vibrant support network appears to be in place. The digital incubation platform, Idea Gist, lists about three dozen startup accelerators, incubators, and venture capital firms in Georgia.

Personal income tax is also quite low and looks to be on a downward trend. For the 2019 tax year, the top rate was reduced from 6% to 5.75%, and in March 2020, the state legislature authorized a further decrease. There is now a flat rate of 5.375%.

Compared to the rest of the country, the cost of living in Georgia is low. One study estimates that spending $100 in Georgia will give you $107.53 worth of goods.

Texas

In 2020, business starts in Texas jumped 26% over 2019 to reach 384,350. The state has made headlines by attracting high-profile companies to relocate or invest there. Apple’s new billion-dollar campus in Austin is set to open in 2022. Tesla is presently building a new gigafactory near Austin, and Oracle has moved its headquarters to Austin.

The Lone Star State has some obvious attractions. There is no corporate income tax; instead, there is a gross receipts tax capped at 1%. There is also no personal income tax, and the cost of living is lower than the national average. In Texas, $100 will get you $103.31 worth of goods and services. Texas is also adding people at a fast pace. Between 2010 and 2020, its population increased by 15.8% (3,999,944) to reach 29,145,505 residents. No other state added as many residents. Utah (18.4%) and Idaho (17.3%) grew faster, but together, the population of these small states went up by just 779,255 residents.

Texas provides a variety of tax incentives and credits. Businesses that gross less than $1 million in revenue are exempted from the corporate franchise tax. Businesses with greater receipts will only pay tax on the amount over this threshold. A business designated as an “enterprise project” will be eligible for refunds of sales and use tax. Local government bodies are allowed to extend financial assistance to private businesses. Thus, a municipality may provide loans and grants of city funds, as well as the use of city staff, city facilities or city services, at no charge or a minimal cost.

In 2019, private equity investment in Texas, at $75 billion, was second only to California and a great deal more than Florida ($47 billion) and New York ($41 billion). Some 529 companies received PE funding. Around 703,000 people work in Texas’ PE industry. Here again, Texas was second to California, which employs over 1 million.

California

In 2020, the number of new businesses in California rose 20% over the 2019 figure to reach 436,980 — a record eclipsed only in Florida. However, the state’s population growth between 2010 and 2020 was sluggish. The total number of residents rose just 6.1%, less than the national average of 7.4%. The estimated net loss from domestic migration — people moving to and from other states — for the decade was about 900,000 residents. California’s population only increased because of foreign immigrants. The result of these population trends is that California’s share of the total national population has declined, and so, for the very first time, the state will lose a US congressional seat.

The exodus from California has been partly attributed to the fall of the aerospace industry, and more recently, to the state’s high cost of living and housing prices. California’s cost of living is among the highest in the nation. In the Golden State, one hundred dollars is worth just $86.66, according to the Tax Foundation, and the median home price in the state ($554,886) is the third highest in the nation, exceeded only by Washington D.C. and Hawaii.

The general corporate tax rate in California is 8.84%. For banks and financial firms, it is 10.84%. Unlike at the federal level and in most other states, California taxes S corporations at the entity level. The rate is presently 1.5% for non-financial corporations and 3.5% for banks and financial firms. The minimum tax is $800. California also taxes limited liability companies (LLCs). There are two levies: an annual tax and an LLC fee. The annual tax is a flat $800 per annum. The LLC fee depends on income.

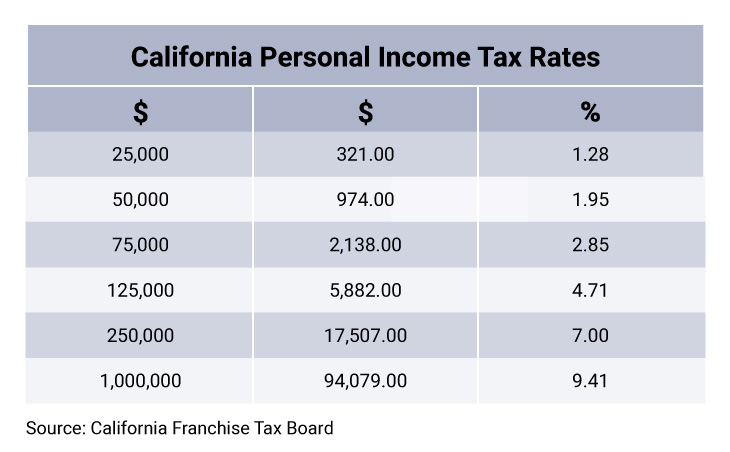

The personal income tax rate is steeply progressive. A taxpayer with $25,000 income would pay a rate of 1.28%; one who earned $1 million would pay almost 10%. The median household income in 2019 was $75,235.

But California has an allure that few other states have. It is home to Hollywood and many of the tech industry’s best-known companies and, in economic terms, really packs a punch. California has, by far, the largest state economy in the nation. In 2020, its contribution to GDP reached $3.2 trillion of the overall GDP of $21.5 trillion (around 15%.)

Almost 13% of private capital deployed nationally finds its way to the Golden State. In 2019, that figure was $90 billion. Much of this has gone to companies using advanced digital technologies to improve business processes. The large infusion of capital has helped a number of startups, among them Aurora, Chime, Instacart, Robinhood, and Stripe, achieve decacorn status. Companies born in California, such as Facebook and Google, have refashioned global society, or like Apple, Intel and Tesla provide the products and services that do so. Indeed, perhaps nowhere else in the world is there such an intensity and wealth of innovation and investment activity. In many ways, California is the Golden State.

New York

Despite the economic devastation and human suffering the pandemic brought to New York, the state recorded its highest number of business starts (253,540) — an 11% increase over the 2019 figure. This was surprising given that the population grew by a paltry amount (4.2%), a growth that resulted from an influx of foreign immigrants. Without such foreign migration, the state would have lost 1.4 million residents between 2010 and 2019. Like California, New York will lose one congressional seat, starting in 2022.

The high cost of living and burdensome taxes has been blamed. The Tax Foundation estimates that, in the state, $100 would buy only $85.91 worth of goods and services. In 2021, New York’s corporate franchise tax rate went up, from 6.5% to 7.25%. The new rate applies to tax years “beginning on or after January 1, 2021 and before January 1, 2024 for taxpayers with a business income base greater than $5 million.” The personal income tax rate was also raised. For incomes up to $5 million, the top rate is now 9.65%; previously, it was 8.82%. Incomes between $5 million and $25 million will be taxed at 10.3%, and income over $25 million will be taxed at 10.9%.

The same law that raised the corporate tax rate also provided a measure of relief to LLC owners by providing for an optional pass-through entity tax. Opting for the tax will reduce federal taxable income since the $10,000 cap on deductible state and local taxes imposed by the Tax Cut and Jobs Act (TCJA) will not apply to the deduction for federal tax purposes. In effect, an LLC that is being treated as a partnership or an S corporation can elect to be taxed at the entity level and deduct the state taxes paid to arrive at its federally taxable income. The optional pass-through entity tax rates range from 6.85% to 10.9%.

Less Tax Bite in the Big Apple

New York is now offering a new “Restaurant Return-to-Work-Tax Credit.” This is a credit of $5,000, up to a total of $50,000, that is available for each full-time employee added to the total workforce. (Credits are applied to, and reduce, the amount of tax owed.) Restaurants that have suffered at least a 40% decrease in gross receipts and/or average full-time employment due to the pandemic are eligible. In addition, a provision has been included in the 2021-22 Budget bill that allows businesses to count remote workers in order to claim tax credits and incentives requiring a minimum number of employees if the work was performed “on location” before the pandemic.

The state provides dozens of credits to promote business activity of certain kinds and in certain areas. These include credits for producing alcoholic beverages, setting up alternative fuels and electric vehicle recharging facilities, using clean heating fuel, producing commercials, films, musicals, and works for the stage, creating jobs, and hiring security guards. There is also a START-UP NY program under which employees of startups that join incubators sponsored by a New York college or university get a 10-year exemption from state income taxes.

In 2019, New York attracted $41 billion in private equity capital, according to an American Investment Council report. Although the state ranked fourth after California, Texas, and Florida, district NY-12 received the most PE investment — $19 million — of any congressional district. NY-12 also came out on top for the number of companies (123) that received PE funding.

Setting up business in any of these five states seems like a good idea. They all have something going for them. The fast-growing populations of Florida, Georgia, and Texas hold the promise of an expanding consumer base, while California and New York have an enchantment that perennially beckons the most innovative and spirited souls. Nevertheless, there’s a good reason to start a business in any state. Indeed, finding it could give your business a decided competitive edge. Good luck!

Learn how to start a business by following our comprehensive state guides. You can also follow Startup Savant on Google News to keep up with the latest startup and small business trends!

About the Author

Anthony is the owner of Kip Art Gifts, an ecommerce store that specializes in art-inspired jewelry, fashion accessories, and other objects. Previously, he worked as an accountant and financial analyst. He enjoys writing on small business, financial intermediation, and economics. Anthony was educated at Wilson’s School and the London School of Economics and Political Science.

Startup Resources

- Learn more about Startups

- Visit the TRUiC Business Name Generator

- Check out the TRUiC Logo Maker

- Read our Business Formation Services Review

- Find Startup Ideas

- Explore Business Resources

Form Your Startup

Ready to formally establish your startup? Click below to read our review of the best business formation services!

Best Business Formation Services