Addressing the Market Gap

Existing limited partners (LPs) accounted for the majority of the funding raised, although the company also welcomed a number of new LPs. Some of the leading global endowment funds, several top universities, foundations, and family offices participated in the funding round. 137 Ventures Fund IV, the previous fund launched by the VC fund, was closed at $250 million.

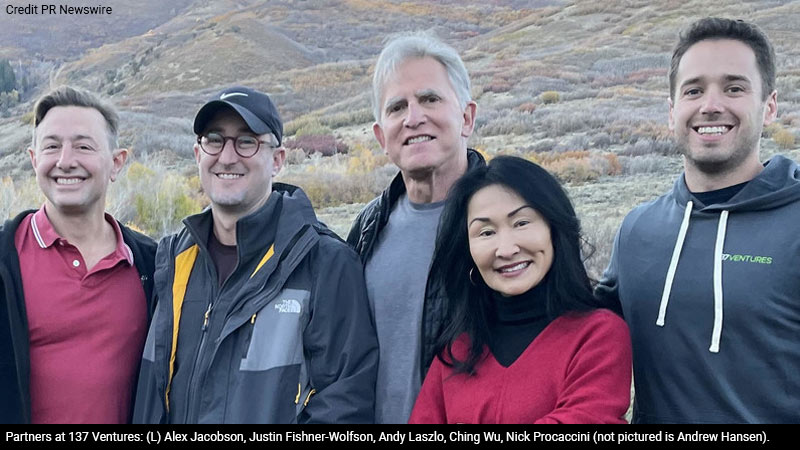

“Our limited partners support our approach to venture investing, for which we are very grateful. We have spent the last ten years proving the effectiveness of our model and developing a track record that we are proud of. The decades ahead will be focused on scaling the team and continually innovating liquidity solutions for visionary founders and company leaders,” said Justin Fishner-Wolfson, managing partner at the VC business.

Through the fifth fund, the VC company plans to continue leveraging the same investment approach. This business model is based on providing custom funding solutions to entrepreneurs, startup founders, executives, and large shareholders of private, high-growth tech companies. The VC business also plans to provide funding to startup companies by deploying smaller investments in primary funding rounds.

Since it was founded ten years ago, the VC business has provided funding to more than 75 startup companies, of which 13 have gone public to date.

"Our team is happy to have helped founders by providing them hundreds of millions of dollars in liquidity over the years. By doing so, we have been able to invest directly with founders and other large shareholders in some of the industry's most sought-after companies,” Fishner-Wolfson added.

SpaceX, Gusto, Workrise, Curology, and Flexport, among others, are some of the most profitable startup investments the VC business has made to date. Since it closed Fund IV two years ago, 137 Ventures’s largest investments included Anduril, Workrise, Wonolo, and Lattice.

David Sacks, co-founder and general partner at Craft Ventures, said the VC company helps entrepreneurs, startup founders, and executives “to more comfortably play the long game.” As a result, the VC business now has a well-established reputation among startup founders.

137 Ventures was co-founded in 2010 by Alexander Jacobson and Justin Fishner-Wolfson, who met each other at the Founders Fund. At the time, Fishner-Wolfson saw an opportunity in the market after a group of his friends who were employed at Facebook asked him to help them obtain liquidity using their private Facebook shares.

His friends were in possession of high-value Facebook shares but had no cash to meet their life needs like repaying student loans or purchasing a house. As a result, Fishner-Wolfson recognized a gap in the market, and he and Jacobson left Founders Fund to start the VC business.

A year later, the VC company closed its first fund. After that, it closed four more flagship funds and multiple co-investment vehicles.

Summary

VC company 137 Ventures announced today the closing of its fifth flagship fund and the largest in the company’s 10-year history. The closing of Fund V brings 137 Ventures’s total AUM to approximately $2 billion.

About the Author

An analyst of global affairs, Adriaan has an MSC from Oxford, with diverse interests in the digital economy, entertainment, and business. He is a specialist trainer in advanced analytics and media.