Wells Fargo Business Checking Review

Is It Reliable?

Last Updated: By TRUiC Team

Do you require a business bank account, but you’re not sure who has the convenience and features you need? So many financial institutions offer business checking and savings accounts that it’s tough to figure out which one’s the best for you.

To complement your own research, my team and I spent many hours studying the top banks for business. Our goal is to give you the info you need to pick the right bank for your company.

In this Wells Fargo business banking review, I’ll walk you through some pros and cons, pricing and features, customer feedback and much more. Let’s find out if they’re a good fit for your business!

Pros & Cons of Wells Fargo

Pros of Wells Fargo

- With 13,000 ATMs and over 8,700 branches nationwide, you’re never far away from a Wells Fargo banking location.

- They offer 4 different checking accounts for businesses of various shapes and sizes. Whether you’re a sole proprietorship or a large company, they have a business checking product for you.

- Although their business checking does technically come with monthly fees, you’ll rarely if ever pay them. Wells Fargo offers business customers several different ways to get their monthly fees waived, including maintaining a minimum balance and through debit card purchases.

- If you link one of their business credit cards to your checking account you get some great perks, like cash back on all purchases, travel rewards and more.

Cons of Wells Fargo

- The rates for their interest checking and savings accounts are low. At 0.03-0.06% APY, there isn’t much incentive to maintain a high balance in these accounts.

- While their Android apps work well, their iOS integration isn’t great. iPhone customers report lots of issues with Wells Fargo business apps.

Wells Fargo Alternative

Capital One's lack of fees, minimums, and their digital banking platform make it quite convenient. Read Review

Wells Fargo Pricing & Features

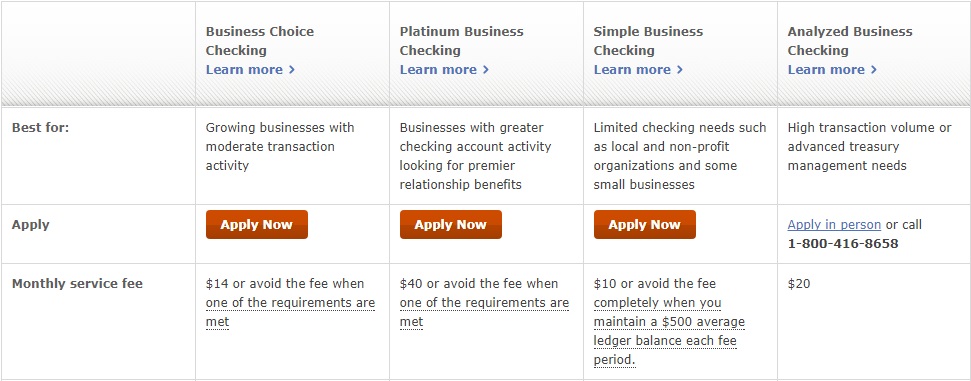

Wells Fargo offers customers 4 options for business checking accounts: Simple, Business, Platinum and Analyzed. Check out the basics, then I’ll break down each package for you.

Simple

What It Includes: 50 monthly transactions, $10 monthly fee waived with $500 minimum balance, $3,000 monthly cash deposits.

Who It’s Right For: If you have an entity that doesn’t transact much business — certain types of sole proprietorships, small nonprofits, etc. — you could probably get by with the Simple package.

Choice

What It Includes: 200 monthly transactions, $14 monthly fee with 6 ways to waive (including $7,500 average balance, 10+ debit card purchases and more), $7,500 monthly cash deposits.

Who It’s Right For: Small to mid-sized businesses that perform 10 or fewer transactions per business day will enjoy the relaxed limitations and easy-to-avoid fees.

Platinum

What It Includes: 500 monthly transactions, $40 monthly fee waived with $25,000 average checking balance or $40,000 combined balances between checking/savings, $20,000 monthly cash deposits, interest-bearing (currently 0.03%).

Who It’s Right For: Larger companies with steady customer volume will appreciate the way this package is structured, as it leaves room for growth with its high limits.

Analyzed

What It Includes: Earnings credits offset transaction fees, $20 monthly fee, treasury management services, interest-bearing (currently 0.03%).

Who It’s RIght For: Big businesses that ring up a large volume of transactions on a regular basis should be interested in this package.

Recommended Package

Obviously, there isn’t a “one size fits all” solution here, but I really like the Choice checking account for small businesses. It’s not too terribly restrictive and has some room for growth, while also being a manageable option for any budget.

Keep in mind that if you also get a business credit card from Wells Fargo, you can take advantage of their rewards program which includes cash back, airline tickets, hotels, car rentals and more.

Savings Accounts

Wells Fargo doesn’t have the worst savings interest rates in the industry, but they’re far from the best. They offer two business savings accounts, Market Rate and Platinum.

- Market Rate: 0.03% interest rate, $6 monthly fee waived with $500 average balance or $25 monthly transfer from business checking account.

- Platinum: 0.05-0.06% interest rate, $15 monthly fee waived with $10,000 minimum balance.

Customer Reviews

In my experience, it seems like the biggest collections of honest customer feedback for big banks like Wells Fargo are in their mobile app reviews.

In Wells Fargo’s case, it seems that customers are generally pleased with the lack of significant fees and the convenience of having so many branch locations. The most prevalent complaint was about the iOS app itself, which customers say has frustrating load times.

Customer Reviews Last Updated 8-17-17

- Google Play: 4.3/5 out of 191,514 reviews

- iTunes: 2.9/5 out of 44,226 reviews

Conclusion: While performance of their apps can be a bit inconsistent, it’s a good sign that we didn’t identify any other trends in their critical reviews, aside from some customer service issues which come with the territory when you’re a company as big as they are.

How Wells Fargo Compares

In all the hours I spent poring over the details of the best banks for business, I’ve determined that some of them objectively offer better business solutions than others. Still, the goal here is to figure out which one hits the sweet spot of features and convenience for your company.

Wells Fargo is a good choice for business banking due to their easily avoidable fees and their 8,700+ physical branches. It’s always a good idea to know what the competition has to offer though, so let’s also take a look at my personal favorite, Spark Business by Capital One.

Pricing: With Spark Business, there are no fees or minimums for any of their business bank accounts.

Features: You have access to 40,000+ ATMs with Spark Business, compared to 13,000 for Wells Fargo. However, Spark Business is a fully digital product with no branch locations, whereas Wells Fargo has 8,700 branches nationwide. When it comes to savings accounts, the 0.40-1.00% APY with Spark Business is a massive improvement over Wells Fargo’s 0.03-0.06% interest rate.

Customer Support: These are both huge financial institutions with extensive customer service networks. With any company of this size, support agents will vary in quality and some unsatisfied customers are inevitable. The good thing is that neither company has any alarming trends in customer support feedback, and I’ve personally had good experiences with both Spark Business and Wells Fargo agents.

Experience: Wells Fargo is the 3rd biggest bank in the US, and has been around since 1852. Capital One is the 8th largest American bank and opened in 1988.

HERE’S A QUICK VISUAL

Capital One

Service Fee Starts at $0

In Business Since 1988

Perfect for: Anyone looking for a startup-friendly, cost-effective business checking account

Wells Fargo

Service Fee Starts at $10/month

In Business Since 1852

Perfect for: Anyone looking for business banking for small businesses with limited checking needs

Frequently Asked Questions

How Easy Is It to Get Set Up?

You can quickly and easily apply online or at any Wells Fargo branch near you. All the info you need for the application is your address, phone number, EIN and other basic company info.

What Perks Come with Checking Accounts?

Both the Platinum and Analyzed accounts are interest bearing, albeit with low rates. If you choose to add them, their business credit cards have excellent cash-back and travel rewards.

How Are Deposits Made?

You can make deposits on the CEO Mobile app, at any Wells Fargo ATM, or you can go to the nearest branch location.

Should You Use Wells Fargo?

Wells Fargo scores a 3.9/5 in my book. Their few fees are easy to avoid and they have a ton of physical branch locations across the country. That being said, if this doesn’t sound like you perfect fit, check out our Best Business Bank Accounts. Cheers!