TaxAct Business Review

Is It The Best Software To Use?

Last Updated: By TRUiC Team

Are you looking for business tax software for your company, but you’re not sure if TaxAct Business is the best program for you? There’s quite a few companies offering business tax software solutions, and it’s crucial to make sure you’re using the one that best fits your company’s needs.

To complement your own research, my team and I looked into the details of each popular business tax software product. By sharing this info with you, I hope to make your decision a little easier.

This TaxAct Business review focuses on their pros and cons, pricing and features, customer feedback and much more. Is TaxAct the ideal choice for your business?

Pros & Cons of TaxAct

Pros of TaxAct

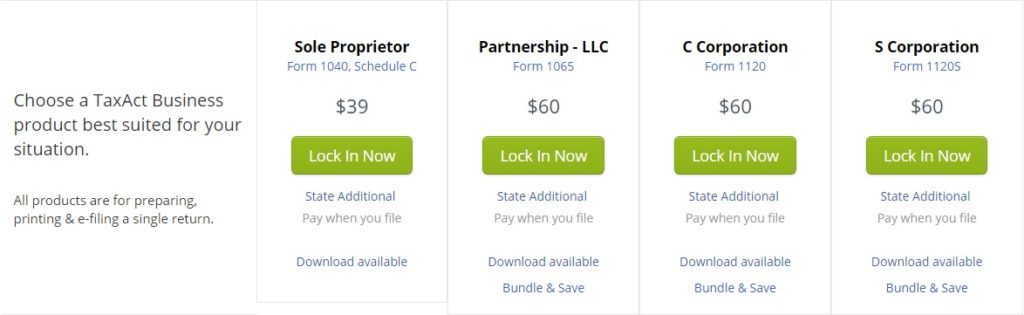

- My favorite part of TaxAct Business is their pricing, as they’re essentially the cheapest option outside of taking the DIY approach to your business taxes. For a sole proprietorship, federal returns cost $39, and for other business types it’s still just $60. When it comes to state returns, TaxAct charges $37 for any entity.

- TaxAct Business is covered by a 100% satisfaction guarantee. If you’re less than entirely pleased with your purchase, simply ask for a refund and they’ll pay back your service fees.

Cons of TaxAct

- If you need to file taxes for multiple businesses, you’ll need to buy multiple copies of TaxAct Business. Unlike some competitors like TurboTax Business, TaxAct only allows for one entity per purchase of their business software.

- TaxAct Business does not provide audit support, which is really not surprising to me considering their low price points. Still, it’s advisable that anyone using this product makes extra certain to complete each step correctly.

TaxAct Alternative

We really like how TurboTax allows you to file taxes for multiple businesses with one software purchase, and their customer feedback is quite strong for this industry. Read Review

TaxAct Business Pricing & Features

With TaxAct Business, you’ll pay either $39 or $60 for your federal return filing, and $37 for a state return. Take a look at how they advertise this software on their website, then we’ll explore the details.

TaxAct Business offers solutions to any entrepreneur looking to save lots of time, but without spending the hundreds of dollars it costs to hire a tax attorney to file your returns for you. TaxAct has many features that business owners really like, so let’s quickly run them down.

- Federal e-file included

- Import accounting records in CSV format

- Products backed by 3 powerful guarantees

- Accuracy guarantee

- Satisfaction guarantee

- Best-price guarantee

- Unlimited customer support via email or phone

I should note before we move on that TaxAct does not offer audit support, beyond a brief FAQ section on their website. Also, because TaxAct doesn’t offer automatic data imports from accounting programs, you’ll need to manually double-check anything you transfer from your accounting software.

In short, while you do sacrifice some features with TaxAct Business compared to some of their competitors, not all entrepreneurs really need comprehensive audit support or automatic data importing. If you’re okay with doing without these features, TaxAct’s money-saving price point is awfully appealing.

Customer Reviews

In my experience, I’ve found that business tax software doesn’t tend to get the best reviews. Many customers get fed up with the complexity of filing taxes, and get upset when the software they purchase doesn’t handle every single step for them.

This seems to be the case with most of the negative reviews for TaxAct Business. Additionally, there really aren’t that many critical reviews for TaxAct in the first place, as most of their customers seem quite pleased.

The main points I see in their positive reviews are customers thanking them for their low prices, as well as commenting on the software’s convenience.

Customer Reviews Section Last Updated 11-21-17

- Bizrate: 3.9/5, 103 reviews

Conclusion: While 3.9 out of 5 may not seem like a super-high score, it’s actually pretty good for business tax software. TaxAct Business doesn’t receive universally positive feedback, but they do get mostly favorable reviews. In my opinion, customer reviews are a net positive for TaxAct.

How TaxAct Business Compares

Considering how much time I’ve invested in business tax software research, I’ve developed some personal favorites along the way.

TaxAct Business is strong business tax software, but no one product is the right answer for every single entrepreneur. That said, let’s see how it compares to a top competitor, TurboTax Business.

Pricing: TurboTax Business charges $159.99 for your federal returns, and $49.99 for state. That’s obviously more expensive than the TaxAct Business rates of $39-60 for federal and $37 for state.

Features: With TurboTax Business, you’ll get a few features that TaxAct lacks, starting with audit protection. TurboTax Business also allows users to file taxes for multiple businesses, even if they are different business types, whereas TaxAct requires you to purchase their software for each separate entity.

Also, TurboTax is owned by the same company that makes QuickBooks, so there are some really convenient features that allow you to automatically import income and expense info. However, TurboTax doesn’t offer a 100% satisfaction guarantee like TaxAct does.

Customer Support: For the most part, these companies offer similar support networks, as they both provide unlimited phone and email support. One difference is that TurboTax has a forum on their website that actually gets regular use from customers, and you can often find answers to your questions there, without having to ever pick up the phone.

Experience: Both of these software solutions have been around for a while. TurboTax started offering business tax software in the mid-1980s, and TaxAct Business has been available since 1998.

Here's A Quick Visual

TaxAct

Pricing Starts at $39

In Business Since 1998

Perfect for: Anyone looking for personalized experience and software built to grow with them as they evolve

TurboTax

Pricing Starts at $159.99

In Business Since 1980's

Perfect for: Anyone looking for the most comprehensive business tax software for multiple businesses

Frequently Asked Questions

Do They Provide Audit Support?

No, not really. TaxAct Business does have a section of their website FAQ dedicated to audit questions, but that is the extent of their audit support.

How Secure is Their Service?

TaxAct has some welcome security features, like multiple-device authentication, trusted device verification, etc. Additionally, you can set your own security settings on their website.

Can I Import Data from Previous Returns or Accounting Programs?

You can directly import data from a previous TaxAct return, but if you haven’t used this software before you’ll need to transfer some of the data manually. It’s kind of a similar story with accounting records, where you can save your trial balance reports in CSV format and transfer them over, but you’ll need to double-check to make sure everything transfers correctly.

Should You Use TaxAct Business?

TaxAct Business is worth a score of 4.4/5 in my book. Their prices are great and they also have a 100% satisfaction guarantee covering their products. That being said, if this doesn’t sound like you perfect fit, check out our Best Tax Software for Small Business. Cheers!