QuickBooks Online Review 2024

Is It Worth It? (Pros, Cons, & More)

Last Updated: By TRUiC Team

Facing the complexities of business accounting and looking for some help?

Thankfully, small business accounting software exists to make everything much smoother and more manageable!

In this QuickBooks Online review, we’ll be taking a look at some of their basic pros and cons, briefly comparing them to others in the industry, feature options, pricing, and more to give you a good idea of what QuickBooks brings to the table. Are they the best business accounting software for you? We’re about to find out!

Recommended: Hiring an accountant can save your company thousands of dollars in taxes each year. Get a free tax consultation with 1-800Accountant.

Pros & Cons of QuickBooks

Pros of QuickBooks

- The QuickBooks bank reconciliation tool allows you to download, categorize, and sync your bank/credit transactions so you don’t have to deal with manual entries from multiple accounts.

- Easily monitor business expenses through the QuickBooks tracking tool; create and customize invoices and send them to clients in one click.

- QuickBooks has a mobile app for iPhone, iPad, and Android phones/tablets for convenient access. I like that you don’t have to pay separately for this because it’s included in your QuickBooks Online subscription.

- Want to upgrade your QuickBooks subscription to get more of the goods? No problem, you can do so without additionals fees (they brag about their “no contract or annual commitment” approach).

- Connect multiple third-party apps with your account and sync, link, and import their data, which can be easy and accessible because of the QuickBooks user-friendly interface.

- You can add up to five users, plus customize their permissions so that you only give the right access to the right people.

- Check on the status of your finances at any time – profit and loss statements, balance sheets, reports, and plenty more.

Cons of QuickBooks

- No internet connection = no QuickBooks Online. Some users report that the software has occasional downtime and server maintenance, which may affect your work.

- QuickBooks’ mobile app doesn’t have all the features that you would expect to see on their Online web version, and we should mention that QuickBooks doesn’t have late payment reminders either (yet).

- The software is only limited to one kind of invoice, unlike FreshBooks, which allows you to customize and create different types of invoices.

- If you want the downloadable version of QuickBooks, QuickBooks Online is not for you. It has no ability to forecast your sales and expenses.

QuickBooks Alternative

Xero has a number of impressive capabilities, and their cloud-based software is extremely easy to use. Read Review

QuickBooks Pricing & Features

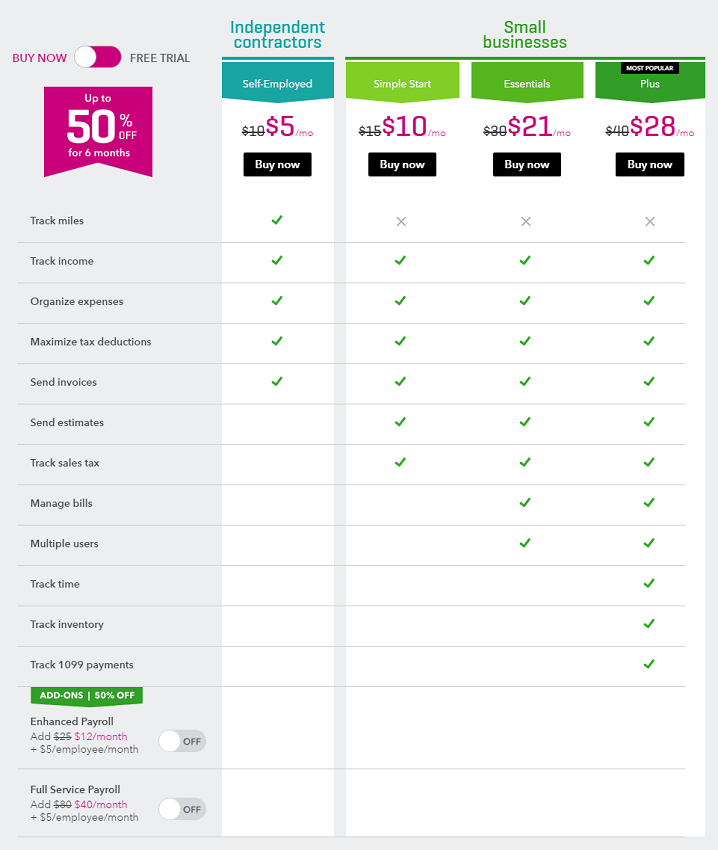

QuickBooks Online has four plans: Self-Employed, Simple Start, Essentials, and Plus.

The most affordable plan is obviously Simple Start, which is priced at $10/mo if you choose their 50% off discount for the first 6 months, as opposed to a 30 day free trial.

Self-Employed

$10/mo ($5 for 1st 6 months)

Their introductory package, as I mentioned, is definitely one of the cheapest on the market, especially if you opt for their 50% off discount for the first 6 months. In this package, you’ll find all of the necessary features you would need as a solo entrepreneur or independent contractor, including:

- Mileage Tracking

- Income & Expense Organization

- Tax Deductions

- Send Invoices

As the title would suggest, we definitely recommend this package for independent contractors or solo freelancers. It gives you all the features you would need, while still keeping costs down.

Simple Start

$15/mo ($10 for 1st 6 months)

Moving on to their second intro package, simple start is ideal for small operations who want a little bit more than what the Self-Employed package has to offer. In this plan, you’ll find everything from the previous package, along with features like:

- Creating & Sending Estimates

- Sales Tax

Looking at this plan in comparison to their Self-Employed package, we think this package is best suited for established solo contractors who need a little bit more flexibility than the self-employed plan allows for.

Essentials

$30/mo ($21 for 1st 6 months)

From here, QuickBooks packaging starts to shift to small business accounting, as opposed to independent contractor bookkeeping. You’ll still have all the features from the first two packages, but they’ve added in additional capabilities like:

- Bill management

- Multi-user setup

Having a multi-user feature is a pretty big ticket item for a lot of folks, especially if you would like to assign responsibilities to additional team members. For this reason, we recommend the Essentials package to small businesses who would like some room to grow and expand over time.

Plus

$40/mo ($28 for 1st 6 months)

Finally, we have QuickBooks most robust package. Here you’ll find everything you need and then some. The Plus package offers a couple key features for small business accounting, including:

- Time tracking capabilities

- Tracking Inventory

- 1099 Payments

Because they offer these additional services, we recommend this package to well established small businesses or even slightly larger organizations depending on what your needs are. This is also the ideal package for those in the e-commerce business because of their inventory tracking tools.

Additional Features

The two big add-ons that QuickBooks offers are centered around Payroll. You can choose between enhanced and full service payroll, and integrate either into your existing plan. The difference between these two similar payroll options are as follows:

- Enhanced Payroll (Additional $20/mo): Consider this the DIY version of payroll. With Enhanced Payroll, you’re in control of your payroll management and can pay employees with free direct deposit, and manage state and federal payroll taxes. The initial setup is $20 a month for enhanced payroll, plus an additional $5 for each employee.

- Full Service Payroll (Additional $40/mo): With full service payroll, you’ll have all of the capabilities that enhanced payroll offers, but it takes a little bit of that weight of your shoulders. Instead of personally handling payroll for your employees, you’ll have trained experts who can help you get setup, transfer any existing payroll data, and file your taxes in a timely manner.

Recommended Package

Because QuickBooks has a clear distinction between its packaging I’d recommend two different packages based on your current situation. If you’re a solo entrepreneur, or an independent contractor, Self-Employed is a great place to start. And when you start to grow a bit too big for this package, you can upgrade at anytime.

For small businesses on the other hand, I’d highly recommend the Essentials package. It offers a little bit of everything and can serve as a great aid for service-based businesses.

QuickBooks Customer Reviews

So, here’s the deal: you can Google “QuickBooks reviews” and gain access to over 1,000 on the first page in just seconds.

As you’ll see overall, QuickBooks comes highly rated from users…unless you head on over to the Consumer Affairs website which is where everyone with a gripe seems to go. I’ve included reviews from a bunch of different websites, including Consumer Affairs, so you can get a quick look for yourself what the general consensus is.

Customer Reviews as of: August 23, 2017

- G2Crowd: 6.3/10, 508 reviews

- Consumer Affairs: 1.2/5 reviews

- Software Advice: 4/5, 818 reviews

- FitSmallBusiness: 3/5, 62 reviews

- TrustPilot: 7.4/10, 169 reviews

Millions of people have used or currently use QuickBooks, so it’s unthinkable that at least a portion of their users wouldn’t think they’re heavenly.

For example, not everyone has a great customer service experience, or appreciates their UI, or feels their suite of features in certain packages is worth the price, etc. And there’s really no way to know if you’ll be happy or disgruntled until you give it a shot, right? Or, at least some similar software so you get the gist.

Long story short, you can get a free 30-day trial of any plan, so you can give it a test drive before committing long-term. You may find that certain features prove especially helpful, or that you have a different experience from previous reviewers who had a less-than-stellar go at it.

How QuickBooks Online Compares

QuickBooks is definitely one of the titans of the bookkeeping software world, no doubt about it. As of 2017, they’re still responsible for the vast majority of small-business accounting-software sales.

They’re the most popular, partly because over time they’ve developed such a comprehensive suite of solutions and versions to fit just about any business.

That being said, because they’re the titan, many competitors like FreshBooks and Xero have been coming up to challenge the dominance of QuickBooks. These competitors boast sleek, user-friendly interfaces and easy-to-understand functionality, as well as robust customer support and customizable reports, invoices, and tools specific to small businesses.

Here, I’ve put QuickBooks head to head with one of our top picks: Xero. We’ll see how they stack up in terms of pricing, customer support, features and more so you can see exactly how well QuickBooks stands up against the competition.

Pricing: In terms of the overall pricing range, Xero and QuickBooks are about equal, but when we dig a little deeper that changes a little bit. Xero offers things like payroll as a part of their initial packages, so you can save a significant chunk each monthly by opting for one of their more robust plans. Their introductory packages however, are extremely similar and are almost the exact same price, so it really comes down to personal preference there.

Features: Quickbooks has been in the business for over 30 years, so they’ve had plenty of time to create and refine their features. When it comes to tax help specific QuickBooks has some great tools available to help in preparation. That being said, there are some features that Xero offers that QuickBooks just don’t have yet like asset management and advisor tools.

Customer Support: Both companies are pretty committed to serving their customers by providing support when needed. Unfortunately, though, we have seen a number of customers who’ve had a very hard time getting a clear answer from QuickBooks customer support.

Xero, on the other hand, has been the winner of the Canstar Customer Satisfaction Award two years in a row, so if you’re a big fan of personalized support, Xero may be the better bet.

Businesses Served So Far: This is where QuickBooks has a considerable edge over Xero. Because they’ve had over 30 years in the industry, and served the majority of small businesses for several years, QuickBooks has well over 3.7 million users. To compare, Xero has been in the industry for a little over 10 years, and has over 1 million current users.

HERE'S A QUICK VISUAL

Xero

Pricing Starts at $9/month

1 million+ users so far

Perfect for: Anyone needing affordable, comprehensive & flexible accounting software

QuickBooks Online

Pricing Starts at $10/month

3.7 million+ users so far

Perfect for: Anyone wanting the original & most recognized accounting software available

Frequently Asked Questions

Do I even need accounting software?

In general, we highly recommend that every small business invest in accounting software that scales with you as you grow. Having a process in place that lets you keep track of expenses, invoice clients, and more will streamline your operations and ensure that you’re recording everything you need in one place. You’ll thank yourself later!

Are there any hidden fees?

With QuickBooks, you pay for the base plan you choose per month, but if you commit to six months or more, you’ll also get a discount. You can also choose to upgrade your plan or cancel at any time without any penalty or fee, and the Simple Start, Essentials, and Plus plans also include a 60-day money-back guarantee. You’ll have to chip in extra if you want advanced payroll tools, but it’s easy to build those in up-front so you always know your total cost. Also, if you’re accepting card payments, QuickBooks will take out a small fee for each transaction.

Does QuickBooks replace my need for an accountant?

QuickBooks doesn’t necessarily replace your need for an accountant, but it gives you the option of taking control of your finances while minimizing the risk of missing any legal hoops or incorrect reporting. And if you already work with an accountant, you can give them access to your software so they can jump in where you left off, making collaboration really easy.

How secure is my information on QuickBooks?

QuickBooks guarantees to secure your info, and even provides automatic backup so you never have to worry about losing data. Adaptable permissions let you only share the information you want to share. Plus, QuickBooks always uses password-protected logins, firewall-protected servers, and advanced encryption technology for 24/7 privacy and security.

Should You Use QuickBooks?

Based on all the metrics that we’ve covered, I’d give QuickBooks a solid 4.4/5. They offer a platform that has had decades to perfect their features and available plans. That being said, if this doesn’t sound like your perfect fit, check out our Business Accounting Software review. Cheers!