Xero Review 2024

Is It the Best Business Accounting Software?

Last Updated: By TRUiC Team

If you own a small business, you have more important things to spend your time on than complicated tax documents, tracking expenses, and sending invoices to customers.

A reliable small business accounting software like Xero can alleviate the stresses of accounting and simplify your life significantly.

In this Xero review we’ll cover their most popular features, peek inside the platform, and get to the bottom of everything to see if it’s actually the best tool for you. If you'd like to dive in and try Xero yourself, they offer a 30 day free trial where you have full access to the business accounting software. No credit card required.

Recommended: Hiring an accountant can save your company thousands of dollars in taxes each year. Get a free tax consultation with 1-800Accountant.

Pros & Cons of Xero

Pros of Xero

- From freelancers and small business owners galore, to startups and corporations of various shapes and sizes…Xero fits.

- Xero offers free QuickBooks conversion, which allows you to transfer your data and pick up where you left off without having to switch between platforms.

- You can integrate more than 500 third-party business apps for just about anything you can think of, including Google, Square, Shopify, and even PayPal.

- You can manage bills and payments through expense schedules to watch cash flow (one of our favorites), plus create professional invoices and receive automatic updates when they’re viewed.

- Have savvy and easy-on-the-eyes financial reports with 24/7 premier-level customer support should you need a little help, and Goldman Sachs–level security to ensure your data stays under wraps.

- Their cloud-based software is accessible anytime, anywhere, on nearly any device, so you can pick up where you left off…from wherever you are. (Their smartphone apps are also very well designed)

- From their reconciliation tool that allows you to transfer and categorize banking, credit card, and PayPal transactions, to their baked-in time sheets to monitor employee hours which are automatically calculated, to the fact you can inventory items, quickening the process of invoicing while monitoring sales and purchases…wow!

Cons of Xero

- No internet connection = no Xero, which can honestly be a pain for people in some places and situations. Just keep it in mind and plan accordingly.

- Some users feel Xero’s multi-currency function could be stronger, which could affect businesses operating internationally.

- It lacks a stock-control feature, which Xero recently acknowledged and assured is coming soon.

- Finally, we should point out that although Xero boasts of its user-friendly interface, many users complain the software’s too complex. For instance, one user said the basic task of adding expenses becomes too complicated, unlike FreshBooks, which is a lot easier to use.

After looking through all of Xero’s features, plans and pricing we’d give them a solid 4.6/5. They’ve got a number of impressive capabilities, and their cloud-based software is extremely easy to use. If you’d like to learn more about what Xero has to offer, or would like to check out some of the other companies in our Top 7 Online Accounting Companies lineup, click either of the links below. Cheers!

Xero Pricing & Features

By that glimmer in your eyes, you may be falling in love. But don’t jump the gun, because you haven’t seen their pricing yet. Xero is one of the most affordable small-business accounting software tools alongside QuickBooks. With each plan, you get a variety of practical features that help manage the numbers driving your brand.

Available Software Plans

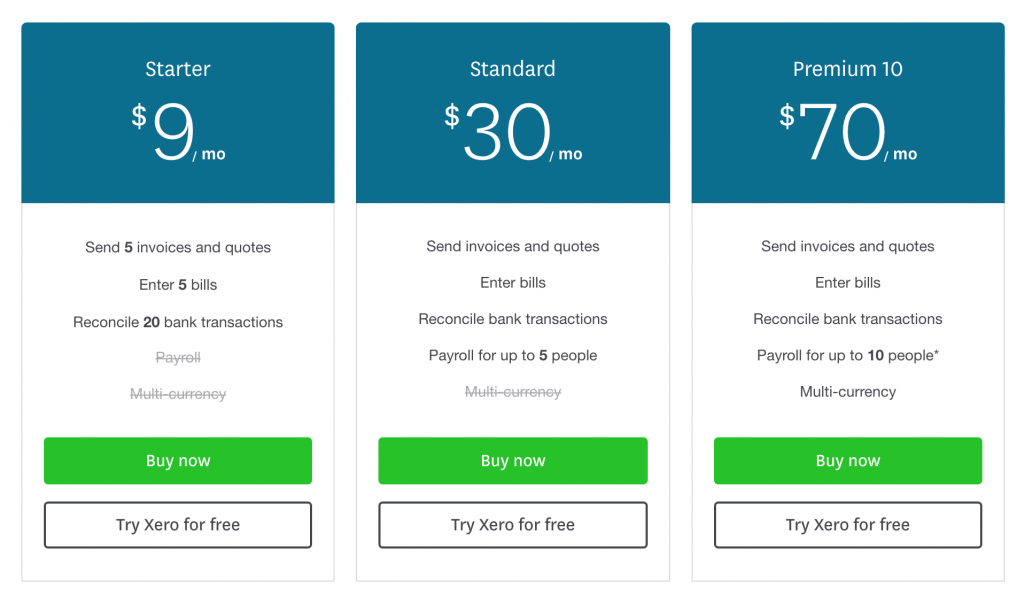

Xero has three straightforward plans: Starter, Standard, and Premium. The screenshot below lays them out in all their glory. Look at those prices. For everything we’ve covered and more, for let’s be honest, a really good price.

Starter = $9/mo.

Xero’s intro package is a great place to start. They offer one of the cheapest options for introductory level accounting software, that still offers a lot of bang for your buck. Within this package, you have access to a number of features including:

- Send 5 invoices or quotes a month

- Enter 5 bills per month

- Reconcile 20 transactions per month

We recommend this package for solo entrepreneurs or those who are just getting started. This package is a great first step, so that when you’re ready, it’s easy to upgrade.

Standard = $30/mo.

Moving on to their Standard package, Xero takes the features that are already available in the Starter package and adds to it. With this package, you can:

- Send unlimited invoices and quotes

- Enter bills

- Reconcile bank transactions

- Enable payroll for up to 5 team members

This package is a great fit for established smaller businesses, because it allows you all the flexibility and features you could possibly need, plus some additional wiggle room for growth in the future.

Premium 10 = $70/mo.

Finally in their Premium 10 package, you have all the features from the previous two packages, as well as some extra goodies. Here, you’ll find useful features like:

- Payroll for up to 10 people

- Multi-currency support

We think that this top tier package is best suited for established businesses who’ve been experiencing growth in the last couple years, and need a little help managing a slightly larger operation. Although these three packages are best suited for small businesses, this plan is definitely the largest and most robust of all.

Optional Services

All of the features that Xero has listed on their website in including within these first three packages, however, there are some additional packages available for businesses that need a more heavy duty set up.

Premium 20 and Premium 100 operate in the same manner that Premium 10 does, but instead of limiting you to processing payroll for only 10 employees, you can process payroll for up to 20, or even up to 100 people, depending on which plan works best for you.

These two packages start at $90 and $180 a month respectively, and still contain all the useful features you’d expect with Starter, Standard and Premium 10.

Recommended Package

For most users, especially solo entrepreneurs, we’d recommend you start out with the Starter package. At times it can be a bit limiting, simply because of the low number of transactions you’re allowed to process, but if you find that it’s not enough for your business, you can upgrade to their Standard package at any time, which completely removes that threshold.

Xero Customer Reviews

Does Xero have legions of positive reviews? Yes. Not as many as some, but enough to know that it’s legit software. However, it’s not for everyone.

Some people have negative experiences, just like every other software in existence. It’s best-suited for small businesses, including retail, e-commerce, startups, and global businesses. Most of the review sites we’ve found had more positive reviews than not.

Customer Reviews as of 8-20-17:

- GetApp: 4.5/5, 616 reviews

- TrustRadius: 8/7/10, 118 reviews

- G2 Crowd: 8.6/10, 103 reviews

- Software Advice: 4.5/5, 614 reviews

Some say it’s the best, while others run into inexplicable and ultra-rare issues and have a horrible time. Some people couldn’t imagine business without it while others end up on calls for hours trying to figure out what went wrong. Odds are you’ll be fine and in six months be ready add to your own stellar testimonial.

How They Compare

Xero’s Starter plan is designed for beginners, entrepreneurs, and for professionals who aren’t trained accountants or super-experienced with modern accounting technology. On the flip side, through their apps and upgraded features as you move through each plan, the software can become as complex as you need it to be.

Xero is ideal for small businesses with a minimal accounting background. It’s also the best option for payroll tools: no need to use a third-party platform for time sheets and PTO requests. Although these payroll tools aren’t yet available in all states, Xero notes on their website that they’re working to include missing states and include electronic payroll tools across the board.

For a more detailed comparison though, we’ve brought in another heavy hitter in this industry to show you how Xero stacks up. FreshBooks has been in the industry for slightly longer than Xero, but the two share quite a bit in common with one another.

Pricing: In terms of pricing, Xero definitely offers a cheaper introductory package, starting at $9 a month. But, as you get into the higher tiered packages, the savings start to dwindle a bit. FreshBooks offers their mid-range and top tier packages for less than what Xero offers.

Features: As I mentioned, Xero has one of the largest selection of features and third party add-ons in the industry. Their payroll and inventory management features offer you the option to sort and add items in your inventory, record time sheets and assign users to approve time off. In addition they’ve got features like asset management, advisor tools and purchase orders, which aren’t offered anywhere else.

Customer Support: My team and I have been in touch with both FreshBooks and Xero recently and overall, I’m pretty impressed. Both companies replied within 24 hours with responses to our questions. The only downside to Xero is that only support via email, so if you’re a fan of getting the answer from a live person over the phone, there may be better options available for you.

Business Served So Far: FreshBooks has been around for a few years more than Xero, and with that comes a jump in total number of subscribers. FreshBooks currently has over 10 million, and Xero has over 1 million. Neither of these numbers aren’t small by any means, but if you’re looking at sheer magnitude, FreshBooks wins out.

HERE'S A QUICK VISUAL

Xero

Pricing Starts at $9/month

In business since 2006

Perfect for: Anyone needing affordable, comprehensive & flexible accounting software

FreshBooks

Pricing Starts at $15/month

In Business Since 2002

Perfect for: Anyone needing an accounting software with a stronger focus on services, invoicing & billing

Frequently Asked Questions

Do I really need an Accounting Service?

It’s relative to how well you can handle your own accounting, and even if you can, how much time could be saved and how much more productive you could become by leveraging modern software. Or hey, if your friend’s doing the books just fine, then sure. But for those that need some help and need to make bookkeeping more efficient, a small business accounting software is a stellar option.

Any Hidden Fees?

There are no hidden fees within Xero. You can cancel your plan at any time with one month’s notice. Xero’s standard and premium plans also include payroll tools in select states (with more coming soon), so you’re not adding on features for another fee.

Does Xero Replace My Need for an Accountant?

No, but it helps you not only limit the amount of work you need to outsource, but also makes communication with your accountant easier. With handy advisor tools, you can grant tailored permissions to your accountant so they have all the info they need at their fingertips. This protects your valuable time and eliminates back-and-forth confusion. Their website also offers a well-rounded library of resources for your accountant or bookkeeper.

How Secure is Xero?

Xero is committed to protecting your data through many layers of security. You can control user access and even opt for double-authentication for extra peace of mind. All of your data is encrypted when it goes between you and Xero, and their team is continuously monitoring activity in the system to prevent any potential threats. Pretty impressive actually.

Should You Use Xero?

After looking through all of Xero’s features, plans and pricing we’d give them a solid 4.6/5. They’ve got a number of impressive capabilities, and their cloud-based software is extremely easy to use. If you’d like to learn more about what Xero has to offer, or would like to check out some of the other companies in our Top 7 Online Accounting Companies lineup, click either of the links. Cheers!