Wave Accounting Review 2024

Is It Right For You? (Pros, Cons, & More)

Last Updated: By TRUiC Team

Interested in small business accounting software but unsure which is the best option for you and your company?

There’s so many, and each is a little different, who’s the ideal option? With their free app and “pay for what you need” pricing, Wave is worth consideration.

In this Wave Accounting review, we’ll be going over some of their pros and cons, important features, pricing, and customer feedback so you can see exactly how they stack up in the industry. Without further adieu, let’s see if they’re the right small business accounting software for you!

Recommended: Hiring an accountant can save your company thousands of dollars in taxes each year. Get a free tax consultation with 1-800Accountant.

Pros & Cons of Wave

Pros of Wave

- Free: Their introductory package is totally free. Accounting and reports, sending invoices, receipt scanning and email support are included too.

- Lightweight: Their mobile app is easy to navigate and their software is quite compact in comparison to other, more involved platforms.

- Instantly Sync: All of your data, from invoices to payroll, syncs instantly to their platform.

- Financials: Wave allows you to hook up all your business credit cards, PayPal and more so you don’t have to manually input every charge.

- Multi-Currency: They currently serve over 180 countries, have multi-currency capabilities, and are equipped to handle regional sales tax/VAT.

- Automated Reports: Wave generates automatic balance sheets, sales tax reports and more so you can stay on top of your finances with ease.

- Guides: Brand-new to accounting software? No problem. Their “Get Started Guide” is easy to follow and walks you through all Wave’s features.

- Expense Tracking: See exactly where your money is going and when, and set helpful reminders throughout each month.

- Small & Personal: Wave is designed for smaller operations. They’ve simplified complex jargon and put together a platform ideal for businesses with under 10 employees.

- OnDeck Partnership: Few companies within this industry have money lending capabilities. Recently, Wave has partnered with OnDeck to allow you to apply and receive funding for your startup in as little as 24 hours.

Cons of Wave

- Credit Notes Feature: They don’t yet have a credit notes feature available yet, but you can still keep track of debts against invoices to stay on top of negative income.

- Capability: Additionally, there’s a number of other features that we would love to see in an accounting software like Wave that aren’t available, like time tracking and audit history.

Wave Alternative

Xero has a number of impressive capabilities, and their cloud-based software is extremely easy to use. Read Review

Wave Pricing & Features

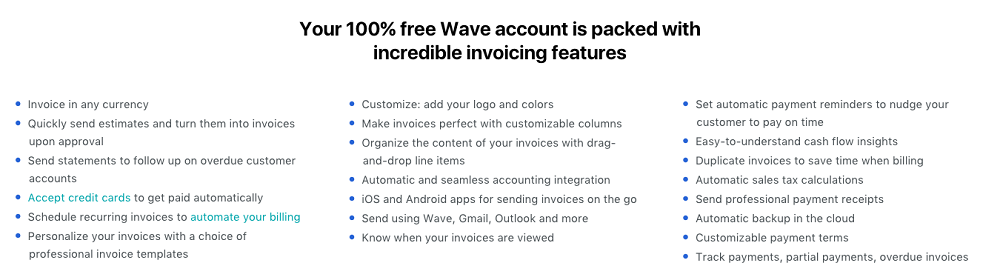

Wave’s pricing scale has much more versatility in terms of pricing, their mobile app is completely free, and they’re very transparent with their software capabilities. Here’s a great “feature wall” screenshot to checkout:

Standard Package = Free + Additional Paid Features

Any of your accounting software invoicing or receipts are free with Wave, so the only exceptions are when you get into credit card processing and payroll. We’ll talk more about this below, but these are the primary categories they cover.

- Accounting

- Payroll

- Invoices

- Lending

- Receipts

- Payments

- Recurring billing

I recommend this package for users who need a place to get started. Because they allow you to start for free and use all of these services without any monthly subscription fees, you can get your business’ finances even during the early stages when you’re just starting out.

Additional Features

For those of us in the U.S., the two big ticket items are credit card processing and payroll services. This services are considered premium so there are some small charges that you can expect to pay for monthly if you so choose. This include things like bill pay and online payments, for small charges for individual transactions.

- Per transaction Wave charges 2.9% + 30 cents, so if you’re not making too many transactions throughout the month their plan is extremely cost effective.

Additionally, they charge for payroll services.

- The base fee is $15 + $4 for the first 10 employees. After that, they charge $2 per employee. And, if you’re a resident of New York, California, Florida or Texas, you can add full payroll tax services for an additional $10.

Wave Customer Reviews

They do moderately well when stacked up against some of the bigger accounting software companies. Wave doesn’t yet have the hundreds or thousands of customer reviews, but what they do have are positive.

Customer reviews as of 8-27-2017:

- Software Advice: 4/5, 201 reviews

- FitSmallBusiness: 4, 73 reviews

- GetApp: 4.2/5, 201 reviews

- G2Crowd: 8.9/10, 59 reviews

- Capterra: 4/5, 200 reviews

For a smaller company (for now), they get some pretty great reviews. Users are impressed with their features, and even more impressed that they continue to be offered for free, even after several successful years in the business.

That being said, they’re not the best option for larger organizations. Customers with large volumes of transactions have reported issues processes those transactions in a timely matter. But smaller operations and solo entrepreneurs love the flexibility that their features allow for.

How Does Wave Compare?

There’s two things to keep in mind when comparing an accounting software: Pricing & Features. The folks behind Wave’s accounting software are clearly trying to disrupt the usual payment plans that other companies offer.

In addition to packaging, pricing and available tools, we’ll be comparing Wave’s customer support and number of users to one of the most well known companies in the industry. Xero’s been around for a little under 10 years and have made quite a name for themselves as one of the most robust platforms available.

Pricing: You can’t beat free, right? Wave offers most of their features for free, and the ones they do charge for are definitely considered to be premium features in this industry.

Xero on the other hand is still pretty cost effective, since their intro package starts at only $9, but you are still paying between $9-$70 a month depending on what you need. The thing that really sets the two apart though, is the amount of features you receive through either subscription.

Features: Xero has cornered the market when it comes to the sheer number of features that their platform offers. While Wave hasn’t quite hit that same threshold, they’re working diligently to keep rolling out new features and capabilities as quickly as possible for users.

Customer Support: We’ve reached out to both companies in order to give you the most up-to-date information on their support options. Both companies concentrate their efforts in email and online support, which is a growing trend in many industries.

We received almost immediate response to our emails, letting us know that they would aim to get to our questions as quickly as possible, but that window differs between the two. Xero tries to answer all support emails within 24 hours, while Wave’s range from 24 hours to 3 days depending on the request.

Number of Businesses Served: Both companies are climbing pretty quickly, but Wave wins out in the end. Xero has over 1 million users, and Wave has just about 2.7 million. Neither is small by any means, but it’s clear by the numbers that users love being able to join Wave for free and get started right away.

Here's a Quick Visual

Wave

Pricing Starts at Free

2.7 million+ users so far

Perfect for: Anyone looking for 100% free fully functional accounting/invoicing software

Xero

Pricing Starts at $9/month

1 million+ users so far

Perfect for: Anyone needing affordable, comprehensive & flexible accounting software

Frequently Asked Questions

Do I really need accounting software?

This depends on how confident you are in your accounting skills. It’s possible to handle basic financial management on your own but it’s incredibly time consuming. For the basics, you can use some of Wave’s key services without paying a cent.

Do I still need an accountant?

No, but if you’re a larger company that needs a custom approach to financial management, an accountant is the way to go. If you’re just getting started and don’t quite have the budget for an accountant yet, Wave packs incredible value.

Any hidden fees?

Nope, but their payment plan is different than the typical flat monthly charge. Depending on your business and the features you use, you’ll pay a different amount. Wave is upfront and transparent about charges though, so no surprises.

How secure is Wave?

Wave is committed to working with privacy consultants and international experts so they can create the most secure platform possible. They use encryption and security controls, as well as third party sources like TRUSTe to stay up to date with privacy certification.

Should You Try Wave?

After looking at all of the most important bits of information, I’d give Wave a solid 4.2/5. I love that they offer their introductory services for free and that their customers are so pleased. That being said, if this doesn’t sound like you perfect fit, check out our Top 7 Business Accounting Software Tools for Startups. Cheers!