It’s the classic dilemma: old reliable vs. the modern machine. In this FreshBooks vs. QuickBooks comparative review, we’ll put two leaders of the small business accounting industry head to head to find out which one’s best for you.

We’ll show you their common features, along with their differences, compare pricing and look through customer feedback to help you develop a wider perspective. Without further adieu, let’s get started!

FreshBooks & QuickBooks Commonalities

Because these two are big standard-setting names in the accounting software industry, they have a ton in common. For example, both platforms offer tools suitable for all types/sizes of businesses and professionals. They’re also easy to use, reliable and secure. We’ve broken down some of their other similarities into two categories below:

Access

One of the major reasons they have such huge communities is because both are optimized, compatible with mobile devices, and it’s simple to get started. But, that’s just the beginning.

- Free Trial: You can try either program for free for the first 30 days to get a feel for how each works, how much you’ll need to learn, and whether it’s a good fit!

- Cloud Storage: Data automatically syncs, allowing you to store your data across all devices. This way, if your laptop or desktop dies you won’t lose anything.

- Mobile Apps: Their mobile apps are easy to download and available on a variety of devices so you can keep up with your business on the go.

- Bank Integration: QuickBooks and FreshBooks both have a bank reconciliation feature that allows you to automatically sync with your bank and credit card information.

Functionalities

The five features below are only the proverbial tip of the iceberg. Both FreshBooks & QuickBooks have much more to offer, but these are some of the popular functionalities they share in common.

- Automatic Financial Reports: Both generate a number of different reports, from balance sheets to customer demographics to help maintain financial health.

- Customizable Invoicing: Adjust the format of your invoices by uploading your logo, changing the color and adding in pertinent information.

- Monitoring Tools: There are a host of tracking tools available to keep you on top of your income and expenses.

- Time Tracking: Keep track of your billable hours easily with their time tracking tool.

- Estimates: Unlike many other accounting software companies, FreshBooks and QuickBooks offer customizable estimates you can send to clients for future jobs.

Where Freshbooks & QuickBooks Differ

As you can see, they have a fair amount of great features in common, so we’re starting off strong. But this wouldn’t be a proper comparison if we didn’t get into the nitty gritty. Here’s the important ways they differ.

FreshBooks

- One surprisingly uncommon feature is their payment history which allows you and your clients to look back through any past transactions or payments. This helps you keep track of previous work, and clients can request a copy of this document from Freshbooks if they so desire.

- If you’re really interested in planning tools, FreshBooks forecasting and budgeting features arguably can’t be beat.

- Freshbooks also has a late payment reminder feature that Quickbooks doesn’t.

- FreshBooks charges based on active clients as opposed to features, so you can get all the components of the software regardless of your subscription selection.

QuickBooks

- Depending on which plan you select, you can have a number of different users (1-5), which makes this platform super-accessible and great for startup collaboration.

- If you want the fullest version of QuickBooks, there’s a downloadable desktop version if that’s more your style.

- Get a 50% discount if you use a payroll app alongside their accounting software!

- Although QuickBooks doesn’t currently receive the best reviews, their inventory management is capable of much more than FreshBooks.

Pricing & Packages

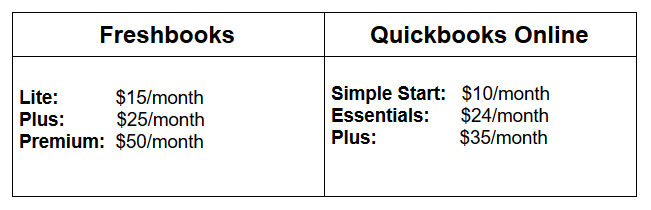

QuickBooks and FreshBooks both use a monthly subscription system. You can pay one flat fee for a full year or a month to month subscription fee. But their pricing and packages can vary. Simply put, their packaging offerings are as follows:

At first glance, QuickBooks is the most cost-effective choice, but that’s not exactly the case. For the first 6 months, you can receive 30% off your monthly subscription fee, but after that time has expired, their prices jump up to be almost identical to FreshBooks ($15, $24 and $50, respectively).

From here, there are a number of smaller distinctions that can be made:

- Freshbooks charges based on the number of clients that you bill. Their tiered packages range from 5 active clients to 500, so you can pick the package that fits the size of your business. If you’re a smaller business that still wants all of the amazing features, you’ll end up paying significantly less for FreshBooks.

- Quickbooks on the other hand charges based on the number of features you use. Basic features like invoices, application integration, tracking tools and cloud storage are all included in their Simple Start package. But, for things like bill pay, hour tracking, and tax forms, you’ll need to purchase their Essentials or Plus Package.

- Both companies have handy video tutorials on how to use key features within each package, making it super-easy to transition to their accounting software.

Customer Reviews

Truth be told, QuickBooks and FreshBooks are two of the most well-known companies, but, in terms of reviews they’re on opposite sides of the coin. Both companies have about the same rating (7.5-8.0) on TrustRadius, but FreshBooks has 77 reviews while QuickBooks has over 270.

While FreshBooks has maintained a TrustRadius Score of 8.0, and received high marks in most of their ratings summary, they don’t have the volume yet of companies like QuickBooks. Although as a newer company that’s a handful of years, this makes sense in comparison to Intuit’s (QuickBooks parent company) multiple decades in the industry.

At the end of the day, reviewers seem quick to comment on the ease of use, tracking tools and responsive customer service. We’ve included their Rating Summary as well to give you a feel for how they hold up in various categories.

QuickBooks has FreshBooks beat in terms of sheer volume, but they’re pretty much neck-in-neck for ratings. Unfortunately, we did encounter a few more negative reviews when exploring their Trust Radius page. Most centered around data input, which some users find confusing and time consuming.

Otherwise ratings are extremely positive. Many reviewers praise QuickBooks software for their ease of use, customization, and ability for collaboration between users.

Which Should You Choose?

Honestly, you really can’t go wrong with either. There’s a reason why they’ve been at the top of our list for so long. Millions of users trust them.

To get started exploring modern accounting software today, or continue exploring your options, use the handy links below. Cheers!

Try FreshBooks Free or Try QuickBooks Free

Try either accounting software for 30 days free